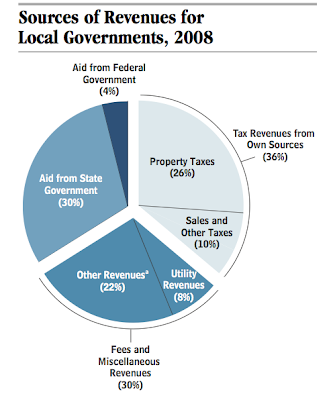

You hear a lot about the states that are facing a financial wall. California, NY and Il are on top of the list. But that is a 2010 story. The 2011 story will shift toward the nations municipalities. There are 36,000 cities, towns, villages and boroughs across the land. They all are facing problems. This chart from the CBO (pdf LINK) describes the problem:

As you can see the local munis get the lions share of their revenue from three sources; direct payments from the State (30%), local property taxes (26%) and other revenues (22%). A total of nearly 80% of the muni revenue stream is now suspect.

If you are living in a hard up municipal area (who isn’t?) you know that the fees you pay for everything has increased in the last year or so. Building permits, licensing fees, transportation fees, library cards, speeding and parking tickets, you name it have all doubled. There is a limit to this. I think it has already passed. Nickel and diming residents and having the cops turned into a revenue source is just not going to fly much longer. We are at the point where if some town wants to raise the price for garbage collection they are going to run into a wall. Don’t look for this source of revenue to bail out the munis in 2011.

Property tax revenue is also a risk. At the end of the day there is a relationship between the value of a property and the taxes that the property pays. With housing in the dumps now for two years (and with no prospect for any improvement) the tax base is falling apart. Where I live price are down about 40% from the 06 levels. One after another neighbors are petitioning the local authorities for relief based on lower values. RE agents who represent sellers tell their customers to go forward with the process before the house is listed. If the listing price is less than the value on the books, tax relief is granted. This process will accelerate. This is what the CBO had to say on the prospects of property taxes actually falling:

The decline in house prices implies that (tax) collections will probably fall in the coming years as local governments gradually update property tax assessments to reflect lower market values. On average, collections of property tax revenues lag behind changes in house prices by three years. Even small declines in collections could cause fiscal stress when the cost of providing public services is growing.

The largest contributor to Muni budgets is the states themselves. We know that the states are broke and have to cut costs, so this source of revenue has to be reduced.

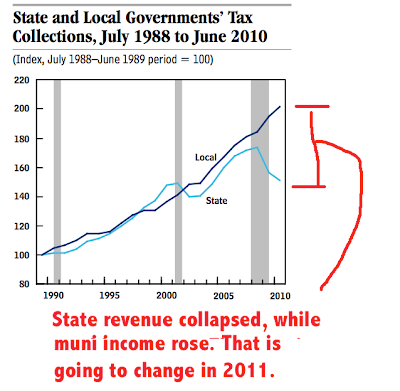

Here is a (surprising to me) chart of both state and municipal revenue for the past few years. Of no surprise is the sharp drop off of revenue at the state level. But the municipal revenue has continued to increase. Given the foregoing discussion on the sources of muni revenue it would seem certain that their income is going to decline in 2011.

A few factoids on local munis tells the importance they play in our economic picture.

-90% of all cities have cut backs in spending scheduled for 2011.

-Approximately 14 million people are employed by local munis (not state workers). That is 11% of the entire work force. Do the math. A 15% drop in employment translates to 2.2mm jobs. That would come to 175,000 per month. By itself this would add 1.7% to the unemployment rate. We would be pushing 12% UE as a result.

-Muni spending is 9% of total GDP. A 10% cutback translates into a drag on top line GDP by 1%. The estimates for growth range from 2-3%. If local governments are forced into cuts (they will) a better estimate for GDP is 1-2%.

-When looking for places to cut, munis always go to capital projects first. Roads, sewer, water hospitals, schools are not going to get built. What does this do for the private sector construction industry?

What are the options for a cash strapped muni? Unlike state borrowers, munis can go bankrupt. (more than half have laws on the books permitting a chapter filing - including key ones). The CBO report provided an excellent set of reasons for munis to default:

Benefits of Bankruptcy

-One key advantage of bankruptcy is the “automatic stay,” which is issued by a court and prevents creditors from taking action against the municipality and its officials without approval from the court.

-Another important advantage of bankruptcy is that courts can implement a restructuring plan without the consent of every creditor.

-The bankruptcy process may also allow a municipal government to reduce its labor costs by facilitating the con- sent of employee unions to changes in labor contracts.

-While a stay is in place, bondholders cannot force municipal officials to raise taxes in order to make debt-service payments.

Over the past 30 years of the 18,400 muni borrowers only 54 have defaulted on their debt. An admirable track record. One that is unlikely to be continued over the next few years. Not a pretty picture for a muni investor. To top it off BABs (the last pillar of support for munis) is gone. I wouldn’t be at all surprised if some big Muni became the Greece of America in the near future.

Disclosure: Very “underweight” in long term munis.