In the FSO article Misunderstood QE Focuses on Asset Prices, Not Banks we discussed how Mr. Bernanke’s quantitative easing program is implemented via the Fed’s eighteen primary dealers, not traditional banks. Today, we will dig a little deeper into who gets the Fed's printed money.

As we are now a week away from the Fed’s much anticipated QE2 announcement, markets have already anticipated what should be months of massive money printing. According to Bloomberg:

Treasury-market inflation bets rose to a five-month high as traders wagered that bond purchases by the Federal Reserve will spur consumer-price gains. The gap between yields on U.S. 10-year notes and equivalent Treasury Inflation Protected Securities, a gauge of price expectations called the breakeven rate, widened as investors bet the Fed will succeed in sparking inflation. Mohamed A. El-Erian, chief executive officer of Pacific Investment Management Co., manager of the world’s biggest bond fund, said so-called quantitative easing will push up inflation. “When the Fed tells you inflation is too low and they want it to go higher, you have to listen,” said Jay Mueller, who manages about $3 billion of bonds at Wells Fargo Capital Management in Milwaukee. “The TIPS market is taking them seriously.”

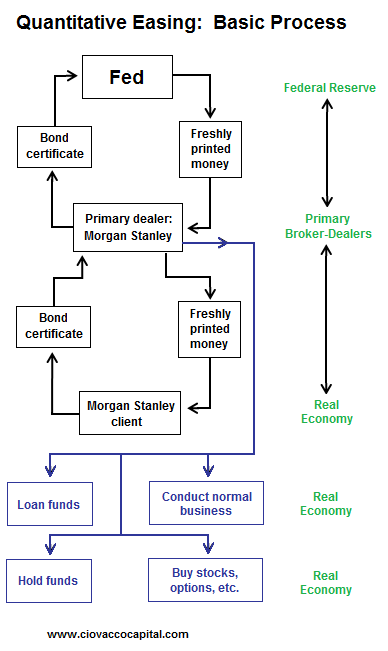

We do not know the size of the Fed’s program, nor do we know how the markets will react in the short-term. However, one thing we know with near certainty – a large quantity of newly printed money is going to flow from the Fed to the eighteen primary dealers. We also know a significant amount of the electronic greenbacks will flow from the primary dealers into the accounts of their clients.

Since the Fed encourages the primary dealers to offer client bonds in the QE competitive bidding process, it is helpful for investors to know more about the clients of the primary bond dealers. Sovereign wealth funds, who do business with numerous primary dealers, will be one of the most influential groups who may participate in QE2. A sovereign wealth fund is a state-owned investment fund, which holds a wide variety of financial assets, including stocks, bonds, commodities, currencies, precious metals, and real estate.

One of the largest sovereign wealth funds is the Norway Global Government Pension Fund, which holds somewhere in the neighborhood of $400 billion in assets. Others include the China Investment Corporation ($300 billion), Singapore Investment Corporation ($250 billion), Hong Kong Monetary Authority ($225 billion), the Russia National Welfare Fund ($140 billion), and the Australian Future Fund ($60 billion).

To give a hypothetical example of how the Fed’s newly printed money can make its way around the globe, assume the following: (a) concerned about the currency risk associated with holding too many U.S. Treasuries, the Singapore Investment Corporation (SIC) decides to sell some bonds to the Fed via the QE2 program, (b) the Fed takes the Treasuries and the SIC gets newly printed U.S. dollars in return, (c) since holding U.S. dollars also entails currency risk, the SIC decides to diversify into gold, global stocks, and emerging market bonds. This hypothetical example shows how the Fed’s printing press can, in theory, create demand for other assets and thus, help drive asset prices higher. Higher asset prices can help improve strained balanced sheets which can, in theory, spark more spending, investing, borrowing, and hiring (emphasis on in theory).

Understanding the global footprints of the primary dealers and their clients allows us to visualize the broad geographic reach of the Fed’s printing press. Understanding the buying power and investment influence of large clients of the primary dealers, like sovereign funds, helps us understand how QE2 may potentially impact a wide range of markets from currencies to commodities.

The flow chart below shows how the Fed’s newly printed cash can flow from the Fed to the primary dealer, then to the primary dealer’s clients.

With the million dollar question relative to QE2 being the magnitude of the Fed’s planned bond purchases, we can expect some volatile trading sessions for the next week or so. According to a Forbes/CNN article:

Economists at Goldman Sachs estimate the Federal Reserve may need to buy a staggering $4 trillion worth of assets such as Treasury securities to get the economy rolling again. The Goldman economists, Jan Hatzius and Sven Jari Stehn, don’t expect the Federal Reserve to go nearly that far when it resumes its asset-purchasing quantitative easing policy. Citing many officials’ unease with the prospect of adding significantly to the Fed’s already bloated balance sheet, Goldman expects the Fed to end up buying around $2 trillion worth of assets over the next few years.

Traders, money managers, and active investors may want to get some extra rest this weekend; with mid-terms and a Fed announcement coming early next week, both stress levels and market volatility will most likely be elevated.

This article contains the current opinions of the author. The opinions are subject to change without notice. This article is for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.