In short, no, but the U.S. macro-backdrop is clearly improving. Earnings season has so far held up nicely with 106 of the 500 S&P 500 companies reporting and of those 106, 78 have shown positive earnings surprises for roughly a 74% positive surprise rate. Even economic data has come in more favorable over the last two weeks with the Philly Fed Regional survey the biggest surprise. What we appear to be having is a more balanced mix of bearish and bullish data, providing room for an oversold market to advance. While economic headwinds remain, long-leading economic indicators are pointing to an economic bottom in the quarters ahead.

Headwinds

One of the biggest headwinds I see ahead is a weak labor market which clearly shows signs of slipping. Two leading employment indicators are the employment indexes from the manufacturing and non-manufacturing ISM surveys. My composite weighted ISM employment indicator (70% service, 30% manufacturing) leads the annual change in payrolls by roughly three months and its sharp pullback over the last few months suggests employment could surprise to the downside in the months ahead. Given employment trends lead income which leads consumption, a weak labor market indicates the economy is not out of the woods just yet. (Click any image to enlarge)

More over, looking at 52-week new highs and lows data for the NYSE suggests that the bears are still in control. One characteristic of a bull market is that spikes in new 52-week highs are greater than spikes in 52-week lows. Just the opposite occurs in bear markets where spikes in new 52-week lows exceeds spikes in 52-week highs. This can be seen below throughout 2008 and into early 2009. Likewise, the recent spikes in new 52-week lows that came during the early August and early October market bottoms are clearly well above the prior spikes in 52-week highs that occurred during the summer. For an all-clear sign to be given for the stock market we would need to see spikes in new 52-week highs to exceed new 52-week low spikes.

My guess is that we have seen the largest spike in 52-week lows and the next short-term low will see a lower spike in new 52-week lows which would indicate bearish participation by the market is waning. This would setup a bullish divergence last seen at the 2002-2003 and 2009 market bottoms. I think as things now stand we have a more level playing field between the bulls and the bears with a broad trading range the most likely outcome ahead.

Long-Leading Economic Indicators Pointing Towards Rebound Entering 2012

Perhaps the biggest economic surprise this week was the huge jump in the Philly Fed General Business Outlook survey, which rose to 8.7 for October from a reading of -17.5 in September. To put the positive jump into perspective, it was the biggest monthly increase in 31 years and the fourth largest on record. The improvement was not a complete surprise as one leading component of the Philly Fed, the Forecasted Prices Paid Index, was hinting at a large reversal and suggests the Philly Fed stabilizes for the next few months.

As inflationary pressures have eased over the last six months, their crippling pressure on the economy has also eased and provided less of a drain on consumer and company pocket books. The Philly Fed should not be the only regional Federal Reserve survey to show improvement as all of the Prices Paid indices for the regional surveys point to a bottom in the headline indexes starting from now and going into early 2012.

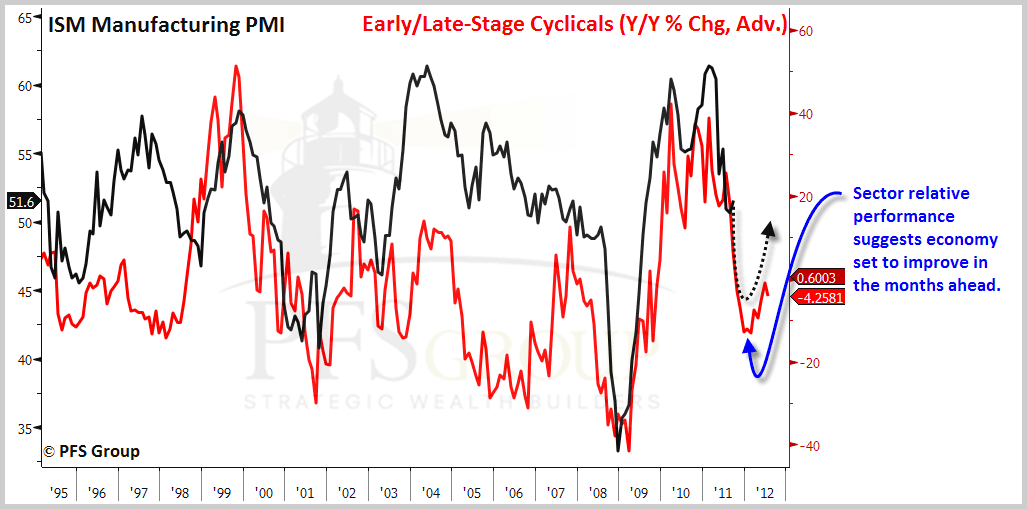

Not only are the regional ISMs set to bottom, but so too the national ISM Manufacturing Index. The inflationary headwinds faced in the spring that led to the summer/fall route have receded. The biggest tax on consumer and business wallets are oil prices as higher petroleum prices cut into discretionary spending and corporate profits. Given the decline in oil and overall import prices over the last several months we should expect a bounce in the ISM heading into 2012 as seen in the image below.

The general message of the markets also suggests an improved manufacturing picture ahead. The relative performance of early to late-stage cyclicals suggests the ISM bottoms in the next two months with a general rise going into 2012.

Risk Indicators Remain Cautious

While the general market tone over the last few weeks is improving, we still have mixed market signals. So far the credit markets have not confirmed the improvement seen in the equity markets as I highlighted last week in Equity and Credit Markets Telling Two Different Stories. The overall mixed market message can be seen below which shows the S&P 500 on top rallying and the rally confirmed by the relative performance of the Consumer Discretionary sector to the Consumer Staples sector (green line, bottom panel). The ratio between the two bottomed at the August low and failed to make a new low in October to set up a bullish divergence. Currently, what we do not see confirming overall market improvement are corporate bond spreads and the ECRI’s Weekly Leading Index (WLI), which is still falling.

While we were given a weekly BUY signal from Bloomberg’s TrendStall indicator in August (recent green arrow), we have yet to take out the weekly trailing stop (Bloomberg’s Trender indicator) as we had after the 2010 correction and so far the setup appears more like the Spring 2008 bounce. Until we get comfortably in the low 1300s on the S&P 500 the market's rally must be taken with a grain of salt.

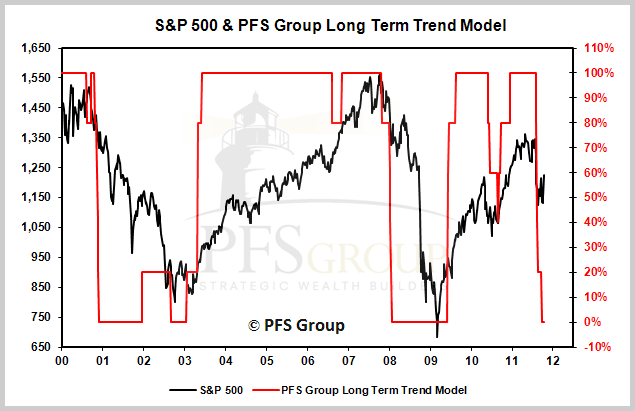

A move into the 1300s would not only exceed the bearish Bloomberg Trender trailing stop but would also turn three of our five proprietary signals on the S&P 500 to buys. Currently, 0% of our longer term indicators have turned positive (or registered buy signals) as they did in early 2009 or in the fall of 2010, as seen in the chart below:

Given the Prices Paid indexes for the various regional ISMs are forecasting a more benign manufacturing backdrop ahead, it is unlikely that the bears will gain any traction over the next few months. That said, the fact that the credit markets have not confirmed the equity markets should also temper bullish enthusiasm. Thus, it appears we are likely to see a sideways market over the next few weeks, with news out of Europe having the potential to, as usual, whip the market around as well. Given the weight of the evidence is more balanced, making large bullish or bearish bets appears unwise at this time.