Precious metal investors have had a rough year with gold stocks down double-digits while gold is set to log another positive year. Gold stocks bottomed this summer as is their custom, but rather than rallying into the end of the year they’ve hit another rough patch and have given back much of their fall rally. However, the overbought condition in gold stocks leading into October has been worked off and it appears we may be seeing another intermediate low. The big caveat is the obvious fiscal cliff situation where politicians may drive the whole market down as they did with last year’s debt ceiling fiasco. Politics aside, we still have the setup of an intermediate low and gold stocks may begin to show signs of strength in the weeks ahead.

From Overbought to Oversold

The big fall rally that saw the NYSE Gold Bugs Index (HUI) rally nearly 40% in a span of two months produced a pretty overbought condition. Our Gold Stock indicator nearly hit an extreme overbought reading near 1.0 but has since returned back to near -1.0, a level that often marks significant intermediate lows.

Another view of the HUI is its rate of change (ROC) over various time frames. The 20 day ROC is great at finding short term lows while a 60d ROC is better at identifying intermediate lows. As seen below, both the 20d ROC and the 60d ROC are near their lower extremes, indicating that not only may a short term bottom have formed but also an intermediate one.

A look at the HUI relative to its 50 day moving average (50d MA) also shows an intermediate oversold condition. Readings 10% below the 50d MA tend to be associated with bottoms but to me even more important to the HUI being oversold was the strength exhibited prior to the selloff. The HUI rose to more than 20% above its 50 MA, an event that is fairly uncommon and typically seen as a kickoff rally to a long sustained rally. For example, the last time the HUI was more than 20% above its 50d MA was after the late 2008 lows after a nasty bear market. Similar to that situation gold stocks have been in a nasty bear market that began in 2011 and appear to have arrested that decline and are building a base from which to start another bull leg higher.

What makes the possible intermediate low interesting is that it comes at a time when investors have the opportunity to buy gold/silver stocks near valuations last seen at the major 2003 and 2008 lows as seen by the HUI’s price-to-sales ratio in the lower panel below.

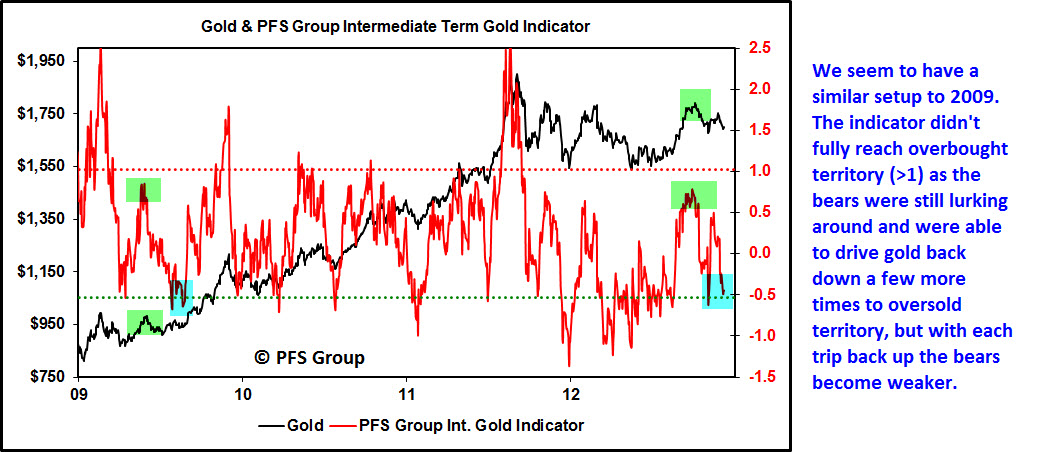

A look at gold also shows a bullish setup as gold has gradually reduced its overbought condition over the last two months and our gold technical indicator is at levels seen near intermediate lows. What’s interesting is that we have a similar setup to 2009 after gold’s bear market ended and it started to gain traction. Strong bullish moves see the indicator reach north of 1.0 and we didn’t quite get there which indicates the bears are still exerting their influence as the gold bulls haven’t achieved escape velocity. Like 2009, the bears were able to push gold prices back down after gold became overbought to reach oversold levels (blue shaded boxes) twice. It was after the second dip to oversold readings that the bears influence on gold exhausted itself and the bulls took over. A move north of gold’s December high of 54 would be the first bullish sign that a new bullish trend is occurring while a move over 00 an ounce would be the icing on the cake.

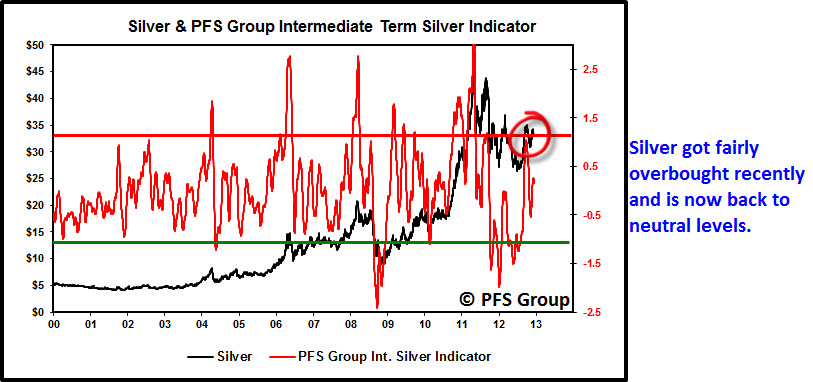

Unlike gold, our silver indicator exceeded the overbought 1.0 reading which says to me the bulls have the upper hand and are taking control, it also means silver became too extended and needed to cool off. Supporting the notion that the silver bulls are now in the driver’s seat based on a reading north of 1.0 on an advance, is that the bears were not able to drive our technical indicator to oversold readings near -1.0. In fact, the bears were just able to drive silver to neutral levels and so if silver can gain some traction silver bulls may be able to put some serious points on the score board.

Summary

We are still in the bullish seasonal period for gold and mining stocks and we appear to have put in an intermediate low. This low is significant given investors have the ability to buy miners at cheap valuations. While the current levels in gold/silver and miners may be at an intermediate low, we need to see the precious metals space start to rally and exceed prior resistance levels for confirmation.