This week saw the third central bank step on the gas in an attempt to reflate their economy. We had the ECB and the Fed which announced open-ended QE (quantitative easing) programs, followed this week by Japan which extended its current QE program into 2013. In effect, global QE has now begun, stoking a reflationary fire as stocks, commodities, and other asset markets react to the fire being kindled by central banks around the globe.

A simple look at the aggregate debt that will be maturing across the world’s top debtor nations coupled with anemic economic growth rates made it abundantly clear global QE was coming as was highlighted earlier in the year (See Global QE is Coming: Let the Gold Mania Begin!). In that article, I pointed out that the sovereign debt maturity cycle kicks in to high gear starting this year where by the end of 2015 half of the entire outstanding debt of the world’s top ten debtor nations needs to be rolled over, which comes out to more than $15 TRILLION DOLLARS! Mind you, that is $15 Trillion in just over two years, which will absolutely overwhelm current demand for sovereign debt. Thus, in come world central banks to the rescue.

Financial markets have seen this game before and they know the drill. Risk assets outperform where emerging markets, commodities, commodity-linked currencies (AUD, CAD, NZD, BRL), and cyclical sectors outperform. The message of reflation is seen universally across multiple assets as highlighted below.

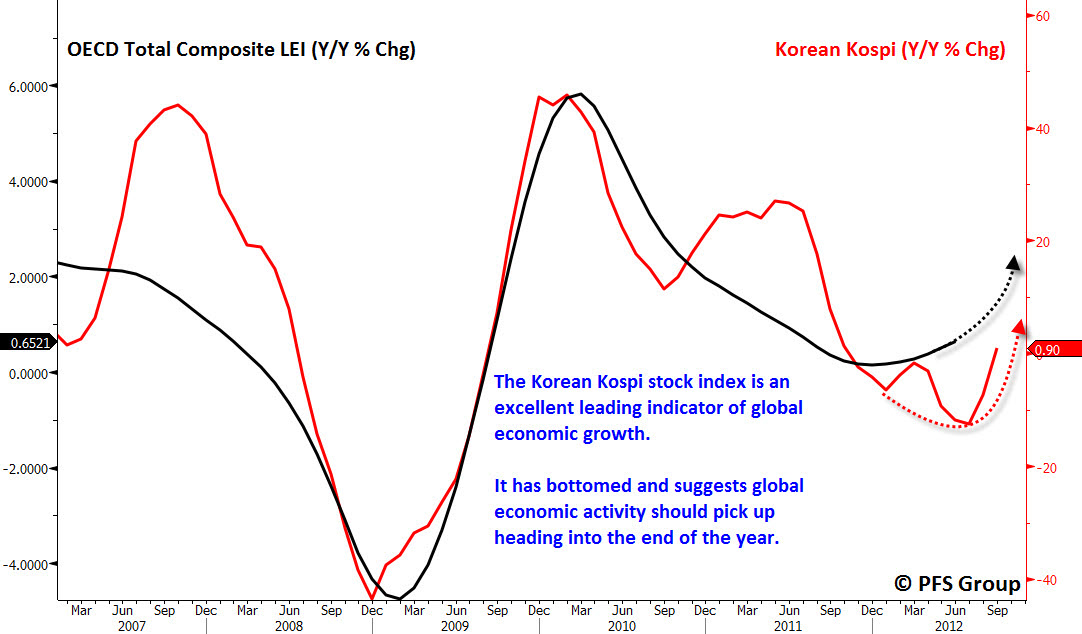

Besides the reflationary market signals seen above, we are seeing other signs that global growth (nominal, not inflation-adjusted) is likely to pick up to close out the year as the Korean Kospi has proven to be a reliable leading indicator of future global growth.

The pure simple fact is that central banks are propping up financial markets and economies as their importance displaces the private sector. For more than two decades the Federal Reserve’s balance sheet has represented on average 5.4% of the national economy (GDP). Fast forward to the present and we see a central bank nearly 20% the size of the entire U.S. economy. Clearly the central bank’s activities on the U.S. economy are not to be ignored. As the old saying goes, “Do not fight the fed.” This is more true today than ever before.

As was stated in the beginning, the race to debase through monetary expansion is not limited to the U.S. but is spreading globally. It is this coordinated global easing that is leading to the strength seen in precious metals, and gold in particular. Shown below is gold’s performance across 30 world currencies over various time frames from 1-day (far left) to 1-year (far right). As is clearly seen in the sea of green below, gold is up against virtually every world currency across multiple time frames except over the last year.

With open-ended QE in the US and Fed Chairman Bernanke saying that the Fed would not end its reflating actions prematurely, we can safely assume that the “Bernanke Put” is alive and well as the Fed supports the stock market. Elsewhere across the globe we have the ECB and the BOJ upping the QE ante as well, with the collective activities of the world’s central bankers likely to lead to increased global economic activity, which is already being telegraphed by the Korean Kospi. Clearly, the race to debase is on and the reflationary fuse has been lit.