Overview

- Zerohedge is at it again calling for a US recession

- Always take the source into context as Zerohedge often distorts reality

- I have my own 7 charts to argue the US is NOT in recession

A recent Zerohedge article is making the rounds showing the US is in recession according to 7 charts. I offer my own 7 charts showing that the US is NOT in recession with a little background on how Zerohedge likes to cherry-pick data to fit their often sensational and perma-bearish view of the world.

First, to the cherry-picking!

Early last year, food prices, especially beef and pork, were climbing quite steadily as the pig virus and drought were taking toll on herd sizes. A client asked if I was getting worried about soaring food costs and sent me a Zerohedge article (Soaring Food Inflation Full Frontal: Beef, Pork And Shrimp Prices Soar To Record Highs) with three charts showing an alarming spike in the price of beef, pork, and shrimp.

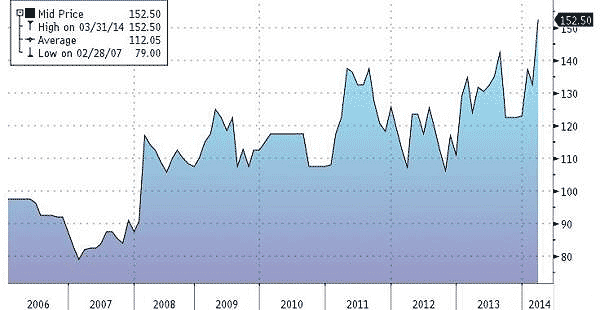

Just as there are multiple contracts for oil prices (Brent and West Texas), there are many contracts for other commodities. What contracts did Zerohedge show? Those that painted the most sensational picture of course. It gets better. For some reason I was having a bit of trouble finding the chart they used for pork, which was the following:

With some searching I finally found it. Rather than showing US pork prices that were actually in the process of FALLING, Zerohedge decided to show pork prices spiking when quoted in a falling overseas currency—Thailand's Thai Baht. Again, mistake or cherry-picking?

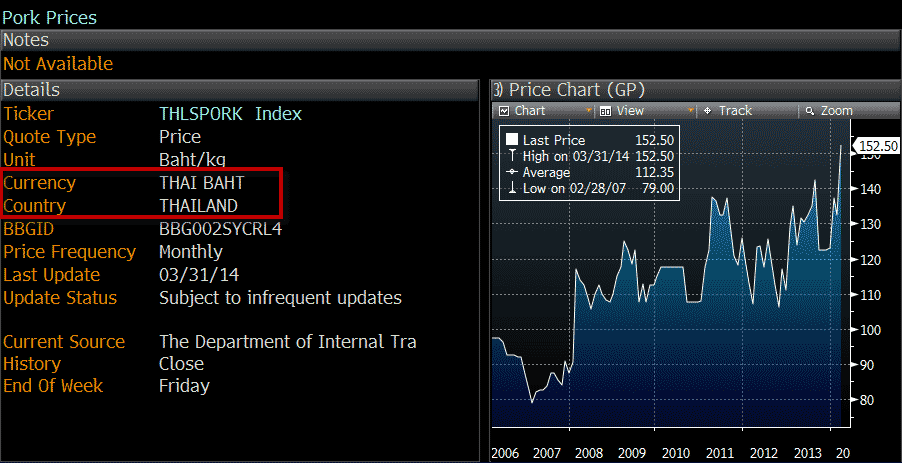

After reading Zerohedge through the years (often for entertainment), I'm pretty sure they intentionally distorted the real food inflation picture by cherry-picking charts that were strongly rising while ignoring ones that were actually falling and went so far as to use a chart for pork prices in the wrong country and the wrong currency. How did things turn out afterwards? Here's what food prices have done since:

Coming back full circle, the recent Zerohedge article that highlights seven charts as to why the US is in a recession is again cherry-picking the data to make their perma-bearish case and to counter their argument I have my own seven charts I’d like to present. The first of which is my own recession probability model, which relies on large array of economic data, and shows the risk of the U.S. economy either in or near a recession at 5.25%. Once we get near the 20% threshold, it's time to worry.

Another chart that strongly argues against a recession call is the labor market. Only when we see the U3 unemploymnet rate jump more than 7.5% on an annual basis or the 4-week moving average of jobless claims jump north of 15% on an annual basis should we begin to worry. Of note is that both annual rates are nowhere close to hitting recessionary thresholds.

A different look at the labor market comes from the Conference Board’s Employment Trends Index. When this index’s annual rate of change dips into negative territory we’ve tended to be in a recession within several months. The last dip into negative territory came on September 2007, three months before the onset of the last recession which was on par with its 4-month lead time to the 2001 recession. At the current reading of positive 5.81% we are a far cry away from any recessionary signal.

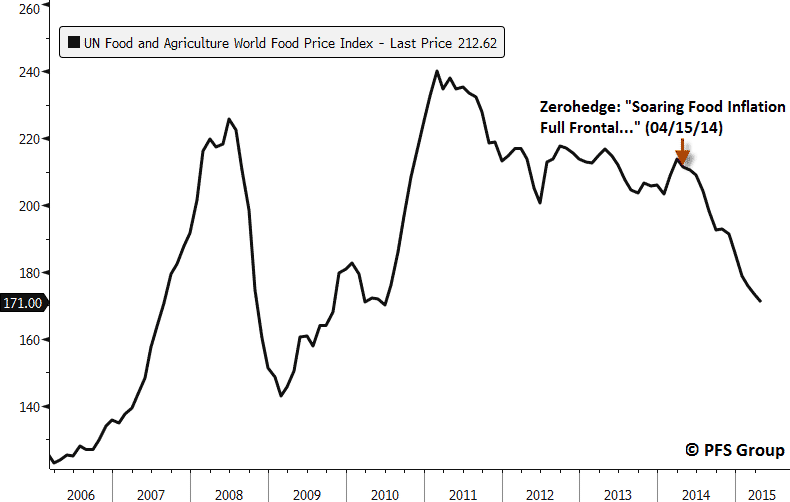

Another chart that argues against a recession is the breadth of industries adding to their payrolls where 66.3% of industries in the last three months have added jobs. Only when we have a 50/50 market where half of companies are firing while half are hiring do we tend to slip into a recession as was the case with the last two recessions.

Looking at the consumer, it would be very odd for the US economy to be slipping into recession when consumer spending on discretionary items like eating out at restaurants is as strong as it has been. A dip below 100 on the National Restaurant Association’s Performance Expectations Index occurred before the last recession and, at the current reading, we are just coming off of a 9-year high and well above levels associated with recessions.

If we were slipping into a recession we would likely see signs of stress by US consumers cutting back on discretionary items like restaurant spending and additionally we would also likely see a pickup in credit card delinquency rates. This simply is not happening. Prior to the last two recessions we saw credit card delinquency rates for the major credit card issuers begin to rise (see yellow highlighted boxes below). Do we see rising delinquency rates currently? Hardly! In fact we are seeing some of the lowest delinquency rates on record and there is no discernable trend higher—just the opposite.

I’m sorry but calls for recession are not passing the smell test. If we were in or nearing a recession don’t you think we would see weakness in the credit markets with credit spreads beginning to blow out higher? This is what we see just before recessions and there is no significant stress in the credit markets currently. Bloomberg has a composite of credit spreads that they call their Bloomberg US Financial Conditions Index (BUSFCI) and readings below zero indicate above average levels of financial stress while readings above zero indicate below average levels of financial stress. Of note is that the BUSFCI fell into negative territory well before the onset of prior recessions and we still remain in positive territory today.

While the above seven charts are my own "cherry-picked" arguments as to why we are not in recession, a weight-of-the-evidence approach tells me the odds of a recession are still quite low. Unlike Zerohedge, I am neither a permabull or permabear and will go where the data leads me. For example, here is a list of articles where I warned about a coming recession and bear market in 2007:

- Proceed With Caution (08/22/07)

- Credit Erosion: The Worst is Yet to Come (08/29/07)

- Will Financials Be to This Bull Market and Economy What Tech Was to the Last? (09/05/07)

Do I get it right all the time? No. I incorrectly called for a recession in late-2011 (see story) when economic indicators fell to concerning levels just before the Federal Reserve stepped in with more stimulus—something they may do again. The point is when the weight of the evidence supports a bearish call I will make it but until then I will leave my emotions at the door and go where the data leads me, which still points towards a continued economic expansion and bull market.