Most of the major economic data you read about in the news each month are produced by the government with a handful of other reports also produced by private agencies.

Unfortunately, many of these economic releases are surveys, meaning they are both subject to human error and often revised multiple times after the initial release and market impact, which, if the revisions turn out to be quite large, may have been nothing but a head fake.

For all these reasons, we like to also take into account the message coming from real-time online sources of data that 1) don't rely on surveys, 2) don't come out with a long lag time, 3) aren't revised, and 4) have much larger sample sizes.

One such source for this data is provided by Jon Hartley at Real Time Macroeconomics who we spoke to on our podcast last month (see here) not only about the data they track and the outlook it provides but also about his fascinating background at the Federal Reserve, the Dallas Cowboys, and Goldman Sachs.

As he noted on our show, Real Time Macroeconomics aggregates "economically intuitive online data using computer code to create indicators that are helpful to economists, policymakers, and financial market participants."

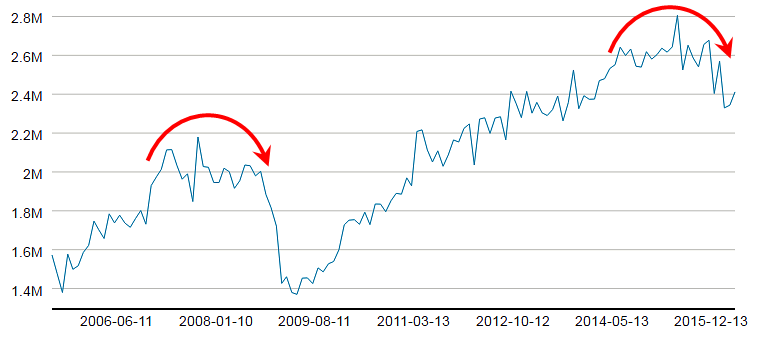

One such indicator they provide is New US Monthly Job Listings, which shows a clear divergence from the official survey data collected by the US government each month. Here's the chart (updated through April) where online job listings have clearly peaked and rolled over in a manner similar to 2008.

Source: Real Time Macroeconomics

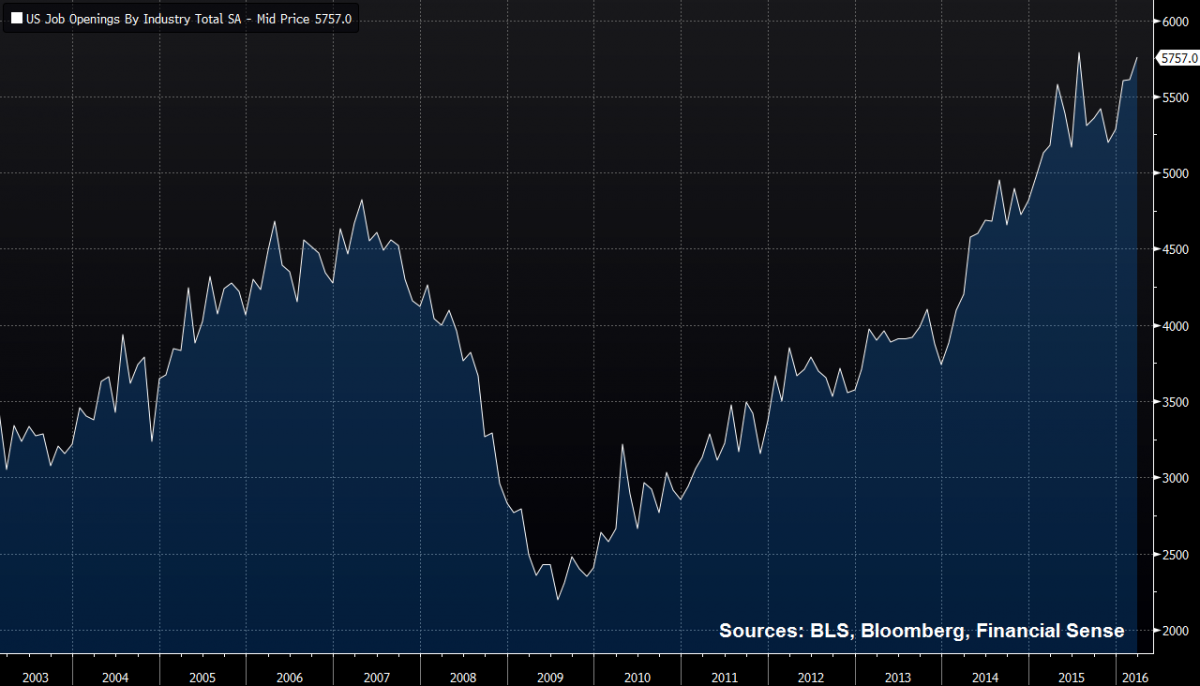

As you can see, this is giving quite a different message about the strength of the US economy and US labor market in comparison to the official JOLTS (Job Openings and Labor Turnover Summary) survey provided by the Bureau of Labor Statistics, which is lagged by a few months and shows data up to February.

So why the big difference? According to Hartley, there are a few reasons, some of which we highlighted above:

- The official JOLTS data is collected using a survey and has a smaller sample size

- Online data may skew towards higher paying white-collar jobs (a forthcoming paper to be provided on this, Hartley noted)

- Real Time Macroeconomics shows only new online job openings whereas JOLTS may include unfilled job postings from prior months

Given the above, the real-time online data is likely providing a more accurate picture of the US labor market vs. the official survey. Expect to see a string of downward revisions if that's the case.

To learn more about Real Time Macroeconomics, visit their website by clicking here or by listening to our most recent interview with Jon Hartley by clicking here.