The Federal Reserve’s (Fed) extraordinarily low interest rate policies have encouraged fixed income investors to take on evermore exposure to credit risks. With the global economic recovery looking more and more unstable with every new piece of economic data released, fixed income investors may be following a strategy akin to gambling at the roulette table. Investors may want to be careful not to let this transpire into a bad vacation in Vegas; we are concerned many investors may find themselves left out of pocket, hung-over with a bad taste in their mouth.

As a result of the extremely low rates available in government securities and “high quality” corporate issuers, fixed income investors have flocked into lower credit quality issuances in addition to moving further and further out along the yield curve. The flood of money into such securities may be creating an asset bubble that could get very messy should it burst. Moreover, we consider that these same Fed monetary policies may ultimately be working to engineer a weaker U.S. dollar by stealth, actively overvaluing U.S. dollar denominated securities. As these dynamics play out, we believe high quality international fixed income investments at the short end of the yield curve may appear increasingly attractive.

Deteriorating Credit Quality

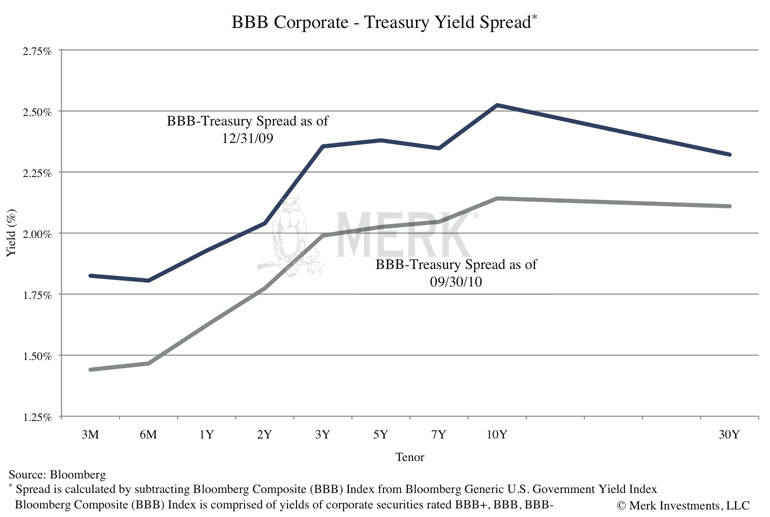

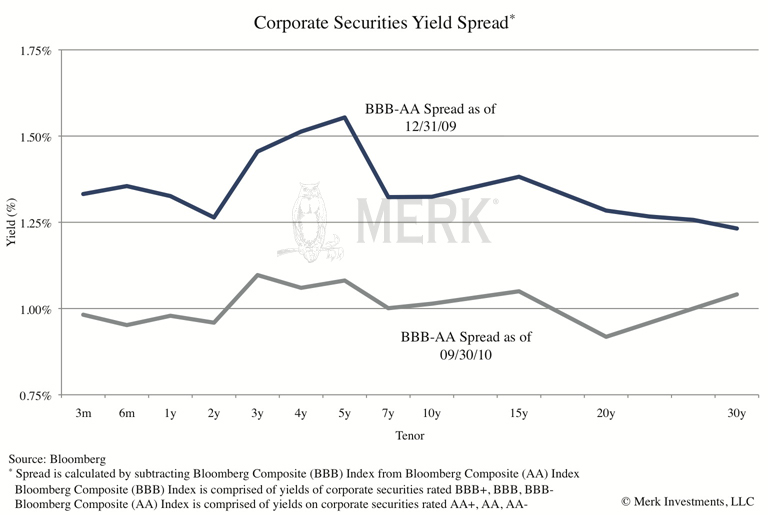

There is strong evidence that investors are increasingly moving into riskier securities. During 2010, the yield spread between Treasury securities and corporate securities rated BBB+, BBB, and BBB- (securities rated one, two and three grades above junk bond status) contracted. In fact, the average reduction in this particular spread, across the yield curve, between December 31, 2009 and September 30, 2010 was 32 basis points. Correspondingly, the yield spread between high quality corporate fixed income and lower rated corporate fixed income securities also contracted. The average reduction in spread between corporate securities rated AA+, AA, and AA- and corporate securities rated BBB+, BBB, and BBB- across the yield curve for this same timeframe was 34 basis points. This is indicative of greater investment demand for lower quality fixed income securities.

The decline in BBB-Treasury spreads illustrates that investors have increasingly shown a preference for corporate fixed income over Treasuries. Moreover, within the corporate space, investors have increasingly favored lower quality securities, as evidenced by the contraction in the BBB-AA yield spread.

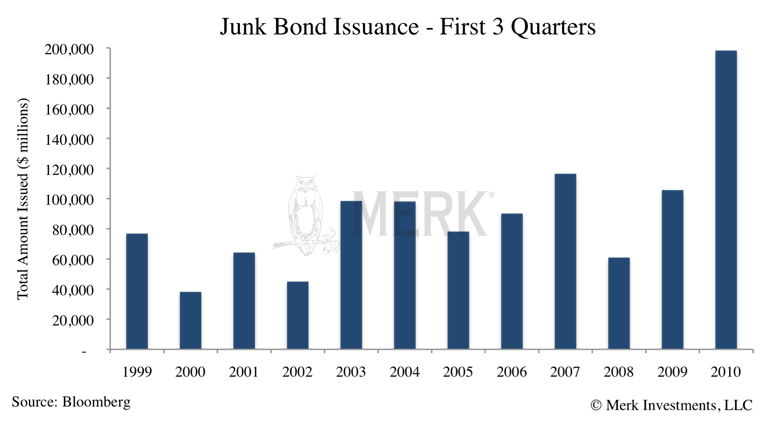

The extremely low rate environment also appears to have increased demand for high yield (junk bond) fixed income investments. For the first three quarters of 2010, there has been an unprecedented level of junk bond issuance. The value of high yield issues has exceeded that seen in any of the previous 10 years. The total value of junk bond issuance during 2010 was 2.5 times larger than the average issuance over the past 10 years and 1.7 times the second largest year where data is available.1

Despite the increased issuance, yields on junk bonds have dropped substantially. Through mid September 2010, junk bond yields declined by over 100 basis points since the end of 2009; as of August 31, 2010, the annual decline in yield was 300 basis points.2 This means investor demand for lower credit quality fixed income has more than outstripped the extraordinarily high levels of additional supply that has come into the market. Investors are actively putting more money into lower quality fixed income investments.

With reduced quality comes increased credit risk and rates of default. According to Standard & Poors, 11% of all high yield issuance defaulted in 2009. The lower the credit quality, the greater need for investor prudence and awareness relating to the underlying fundamentals of the issuer. Obviously, this is an additional risk investors have to deal with, and requires a very separate set of skills from forecasting likely interest rate movements, which is why investors are compensated with additional yield (premium) for lower quality securities. By implication, the recent compression in yield spreads depicted above infers that the market has increasingly lowered the premium attributed to this additional set of risks. In other words, the compensation investors receive for taking on additional credit risk has been reduced. Given that these dynamics have transpired with a backdrop of deteriorating economic fundamentals, investors may want to reassess the market implications of present fixed income pricing.

Additionally, lower quality fixed income securities tend to exhibit more price volatility than higher quality investments. The volatility of returns are exacerbated as the credit quality of securities issuers is reduced. The volatility of U.S. corporate fixed income has been 1.4 times greater than that displayed by U.S. government fixed income, while U.S. high yield fixed income has produced 2.5 times the level of volatility than that of government issued fixed income.3

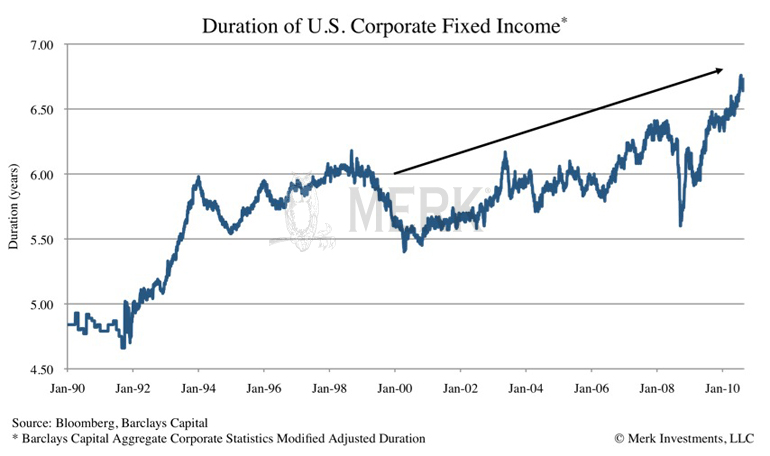

In addition to deteriorating credit quality, the average duration of fixed income investments appears to have increased dramatically. Searching for yield, investors have not only moved into lower risk securities, but have had to move out along the yield curve. We have outlined the risks associated with moving out the yield curve (see our analysis here), including higher volatility, fat tail return distributions, and a greater propensity to cause black swan events. Much of this analysis focused on trends within U.S. Treasuries; similar trends are evident within the corporate bond sector. However, this is not simply a recent trend. Of greater concern is that the duration of corporate fixed income issuance has steadily increased over the past 20 years. Present levels of corporate fixed income duration are at historic highs. At the end of 1990, effective duration of corporate debt issuance was 4 years 10 months; today’s effective duration is almost 2 years longer.

Of course, from a corporation’s perspective, this trend is a rational response to the Fed’s monetary policies: as the Fed lowered interest rates towards today’s historic lows, it only makes sense that corporations would issue lower coupon, longer maturity debt to lock in ever cheaper sources of funding.

Low Quality, Long Duration Fixed Income Bubble

Moving further and further out the yield curve and into increasingly risky securities appears to have become an evermore crowded trade. The Fed’s monetary policies have encouraged investors to increase the risk profile of their fixed income investments throughout the economy, and it may have driven the prices of low quality, long-term fixed income securities towards bubble territory. Should the market’s expectations change, we may witness large movements in the price of these securities. Such movements may be compounded, as so many investors scramble to exit their positions. In our opinion, this is a very real risk, given the experimental, unproven monetary policies the Fed is pursuing. The consequences of which may prove to be wholly unexpected. An inflationary shock may be a very real threat given the vast amounts of money the Fed has been printing.

Weaker U.S. Dollar by Stealth

To us, the implications for the U.S. dollar seem clear: the Fed’s policies are implicitly weakening the U.S. dollar. In many respects, it is a weakening by stealth. While many focus on China’s quasi-pegged yuan, along with Brazil and Japan’s recent currency interventions, we believe that the Fed’s actions are also actively working to manipulate the U.S. dollar to the downside.

Consider the following: one of the key goals of purchasing U.S. fixed income securities (whether government issues or mortgage-backed securities) is to drive down the yield on those securities. Looked at another way, the Fed is implicitly overvaluing these securities through its purchase programs. With further quantitative easing appearing probable, we are likely to witness a continuation of this process. As a result, rational buyers are increasingly incentivized to redeploy money elsewhere, into less manipulated returns. Indeed, international substitution has become increasingly attractive; we have witnessed the U.S. dollar decline in value relative to most international currencies. Many currencies display high yield differentials relative to the U.S., causing demand for those currencies. Such strong demand has caused Brazil to increase the tax rate imposed on foreign purchases of fixed income by 2% twice in two weeks, to 6%; Thailand also recently introduced a 15% withholding tax on all interest and capital gains on domestic bonds held by foreign investors. Such a trend may be only the beginning.

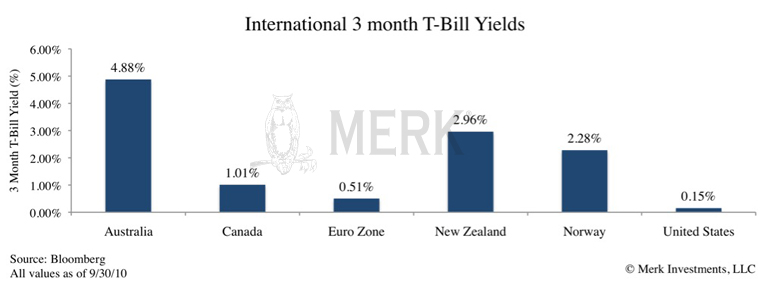

Indeed, in a recent Bloomberg interview, bond mogul Bill Gross stated that from PIMCO’s perspective, international cash instruments are increasingly attractive, given the very low rates available in the U.S. He is not only referring to emerging market economies: whereas the Fed is talking of additional easing, many western developed nations’ central banks have already tightened policies, raising short-term interest rates. As a result, short-term rates in many countries are relatively more attractive than those available in the U.S.

Now may be the time for investors to consider the international fixed income options available to them. With the likelihood of further quantitative easing and an extended period of a low interest rate environment here in the U.S., along with the possibility of further interest rate increases abroad, high quality international fixed income investments at the short end of the curve may appear increasingly attractive.

For a more comprehensive analysis of the U.S. fixed income market, please download our complementary white paper.