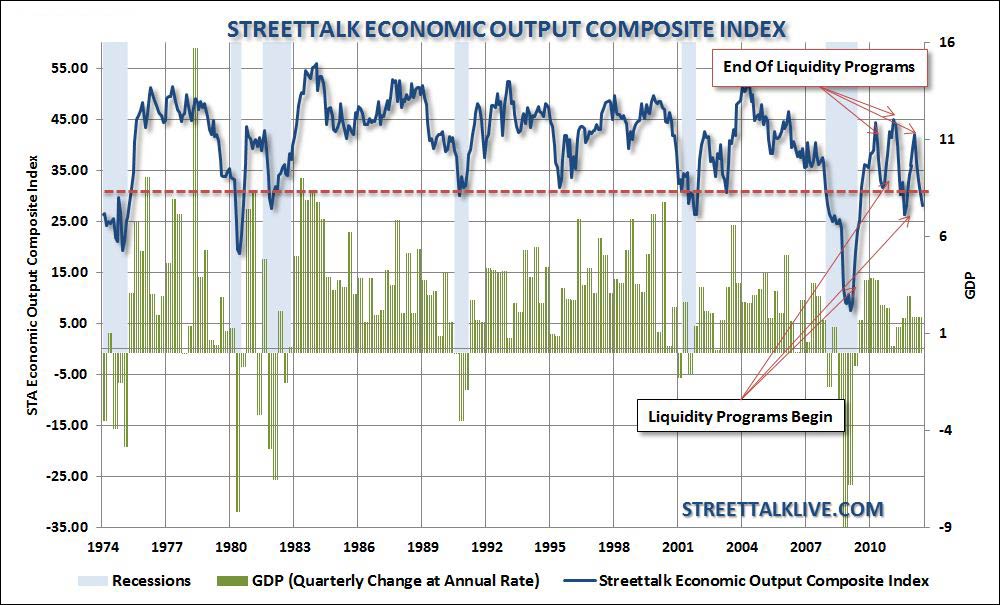

In the continual onslaught of economic data showing signs of increasing economic stress (see here, here and here) the recent release of the Richmond Fed Reserve Manufacturing Index added to the disappointment. It was the Philadelphia Fed Manufacturing report that two months ago was the first to show significant contraction in the monthly manufacturing conditions. This was followed by similar releases from the New York Fed and now the Richmond Fed at -17. Kansas is very close to contraction at 3 in June down from 9 in May as is the ISM Composite (the average of Manufacturing and Services) dropped to 50.7 in June from 54.6 May. The Streettalk Economic Output Composite Index (a very broad economic composite of the Fed Manufacturing Regions, CFNAI, Chicago PMI, ISM Composite and the NFIB Survey) declined in June below the critical 30 level to 28.17 from 31.63 in May. With the recent reports piling up to the negative we are likely to see further declines by the time the July data is compiled.

Each time the EOCI index dropped below the 30 level, historically speaking back to 1974 which is the earliest the data starts, the economy has either been in, or was about to be in, a recession. The only thing that has stopped the recent two declines were the implementation of further Central Bank interventions. The injections of liquidity into the system were able to drag forward future consumption, a consequence of which we will have to deal with later, in order to keep economic growth in positive territory. The only reason that I am not declaring an immediate and imminent recession is that it is very likely that the Fed will move to act again later in August or September which could again temporarily stave off a recessionary drag.

The long term impact of the interventions is yet to be fully known or realized. My gut instinct that the end result will not turn out favorably. However, in the meantime, we must analyze the data for clues as to the direction of the economy in the months ahead and what the likely effect on the markets will be.

Digging in the Richmond Fed report does not offer great signs of hope for a strengthening economy in the near term. The overall composite index, as stated above, declined deep into contraction territory at -17. However, this composite masks the real damage occurring beneath the surface. New orders, the very life blood of business, collapsed to -25 vs June's already very weak -7. Furthermore, and what does not bode well for future employment, Backlogs, plunged to -27 extending their run of deep contraction. When New Orders fall manufacturers turn to filling Backlogs to keep employees busy and plants running at capacity. When New Orders fall AND Backlogs are nearly depleted - employment requirements fall. As a result we are likely to see much lower employment numbers, and higher unemployment rates, in the next couple of months as the Employment component fell from 8 to 1 in July and down from 12 in May. Wages, already stagnant, fell from 10 to 9 as the Work Week was cut from 0 to -7. The declines in wages, hours and employment are not favorable signs given that consumer demand is already weak and economic activity is 71% based on consumption.

Shipments came to a screeching halt declining from 0 to -23 in July while Inventories rose from 9 to 21. Rising Finished Goods Inventories sitting on the shelves is not an economic positive as the build is likely unwanted given the weakness in New Orders. The weakness in orders also leads to decreasing rates of Capacity Utilization which slipped from -4 in June to -16 in July.

While one report from one district is not a game changer - the compilation of negative data from a multitude of economic reports does not paint a picture of a robust economy. More than 3/4's of the recent economic releases have been to the negative. More importantly, the weakness in these economic reports is aligning with consistent corporate earnings reports showing declines in revenue (top line sales) which makes bottom line EPS growth rates very difficult to maintain ex-accounting gimmicks and cost cutting measures. This all brings into question the recent calls that equities are "cheap" on a valuation basis at current levels.

We remain cautiously allocated at the moment as the weight of evidence builds against further robust market gains from current levels. It is unlikely that the Fed will act at the meeting at the July 31st-Aug 1st FOMC which could lead to further disappointment for the markets. With recession concerns growing in the U.S., recession increasing in the Eurozone and corporate earnings shows signs of strain the risk/reward balance is most definitely not in our favor currently.

Source: Street Talk Live