Dear candidates for the 2016 US presidential race,

Five of you remain with less than 31 weeks until Election Day. Three of you won't even make it out of the primaries. And yet, American voters and foreign observers all search for substance in your stump speeches, trying to imagine their lives and the world as a whole under your leaderships. Those of us who view the world through the prism of geopolitics remind ourselves that campaign rhetoric tends to diverge from the post-election policy. The constraints built into the presidency, as well as those shaping the international system, will inevitably blur personal distinctions and mold policy decisions, whether the winning candidate carries anti-establishment credentials to Washington or is working to create or uphold a political dynasty. We understand that perspective is hard to come by at this stage of the race, and you are obsessively watching the polls and attempting to shape your image to a media ready to pounce on every slip. But the world is watching at a time of considerable uncertainty. Candidates will require dispassionate analysis and a deep understanding of history to navigate the challenges that lie beyond our borders. Whoever enters the White House come January, this briefing attempts to frame the geopolitical state of the world awaiting you.

Back to Growth Fundamentals

While it is easy to blame presidents for breaking the economy or credit them for fixing it, they will ultimately be judged by how well they manage the phase of the country's economic cycle that overlaps their time in office. It just so happens that the current phase of the cycle — the great global deleveraging — is comparable to that of the 1930s. Eight years ago, central banks reluctantly became the first responders to the world that had seized up after overindulging in credit-fueled growth enabled in large part by China's record rise. As debt repayments soared and global depression loomed, governments and central banks had no choice but to intervene. The painkillers came in the form of liquidity injections, large-scale purchases of market securities and a discomforting world of zero and negative interest rates, all in the hope of stimulating consumer spending to drive sustainable growth. As governments became more wary of their debt burdens and voters, they backed off, and the central banks were largely left to manage the crisis. And while central banks have lulled markets back into complacency and have bought political leaders time, growth engines are still sputtering, and income inequality has reached a point of political severity.

See Global Leading Indicators Fall Sharply Into 2016

The United States, less exposed to trade fluctuations than its peers, has been the first to recover and begin the process of normalizing its economy through a gradual rise in interest rates. But that strategy is sensitive to economic headwinds from abroad. The US economy cannot operate in a vacuum, and the global dominance of the dollar stretches US influence into nearly every corner of the world. And so while the US president does not influence the Federal Reserve's monetary policy, the consequences of that policy reach around the globe. For example, a dovish Fed policy in raising rates will limit the damage inflicted on the Chinese yuan by a strong dollar, but that move simultaneously creates more problems for the euro and yen by pushing them higher in relative terms at a time when both the European Central Bank and the Bank of Japan are running out of ammunition. The more unorthodox measures that central banks must undertake to stimulate growth, the more political scrutiny they will face as their efforts decline in utility with time. If central banks cannot carry sick economies through the deleveraging process, then the more burden politicians will have to shoulder to find the right blend of spending cuts, wealth transfers, and debt restructuring to pave the path toward rising incomes, productivity growth, and inclusive employment.

Those politicians, however, whether at home or abroad, face the tyranny of election timetables and are now caught in the middle of a revolt by voters fed up with years of economic stagnation and bereft of faith in government institutions. As the anti-establishment movement grows louder, political consensus becomes harder to find, and the probability of achieving a timely and balanced policy mix to manage this phase of the crisis decreases. The United States can take some solace in the fact that it is on the most stable economic footing about the rest, but there is more economic volatility to come in the rest of the world. The growing limits of foreign monetary policy in this great global deleveraging will be one of the several factors driving future geopolitical conflict.

Learning to Deal With Many Europes

The political consequences of economic stagnation will be highly pronounced in Europe, a continent fragmenting from north to south as well as east to west. Euroskepticism is not a passing phase; it is Europe being honest with itself and its past. It is much easier to paper over wide divergences in wealth and make compromises to national sovereignty in times of economic prosperity. But in times of prolonged economic stagnation, the interests of the nation come well before those of the union. The eurozone has avoided financial calamity so far with the help of the European Central Bank's quantitative easing program and low commodity prices, but slow growth, heavy debt burdens, and high youth unemployment will estrange the debtor nations of the south from the more fiscally responsible bloc in the north led by Germany. And the more experimental the European Central Bank gets in trying to fight deflation, the more German resistance will grow out of fear of inflation.

A refugee crisis fueled by conflict in the Middle East only accelerates European fragmentation as border controls resurrect the already economically troubled and politically vulnerable southern countries are stuck with the migrant burden. If European states are losing common ground over which to make the sacrifices needed to maintain a political and monetary union, then we cannot expect European countries under economic and political strain to make the sacrifices necessary to absorb large migrant flows. This is particularly the case as the persistent threat of jihadist attacks amplifies Islamophobia across the Continent.

Euroskepticism can exist in many forms. Referendums, whether or not they pass, will be an attractive tool for countries to use to vent their frustration with the European project and renegotiate the terms of the union. Mainstream parties in unwieldy coalitions will fight for political survival by adopting a more nationalistic stance to reflect the moods of voters. The United States must see Europe as a collection of nations with widely divergent interests and pay careful attention to the political and economic stresses on the relationship between France and Germany as they, the two pillars of the European Union, head into 2017 general elections with nationalism framing their political campaigns.

Making Up for NATO’s Shortcomings

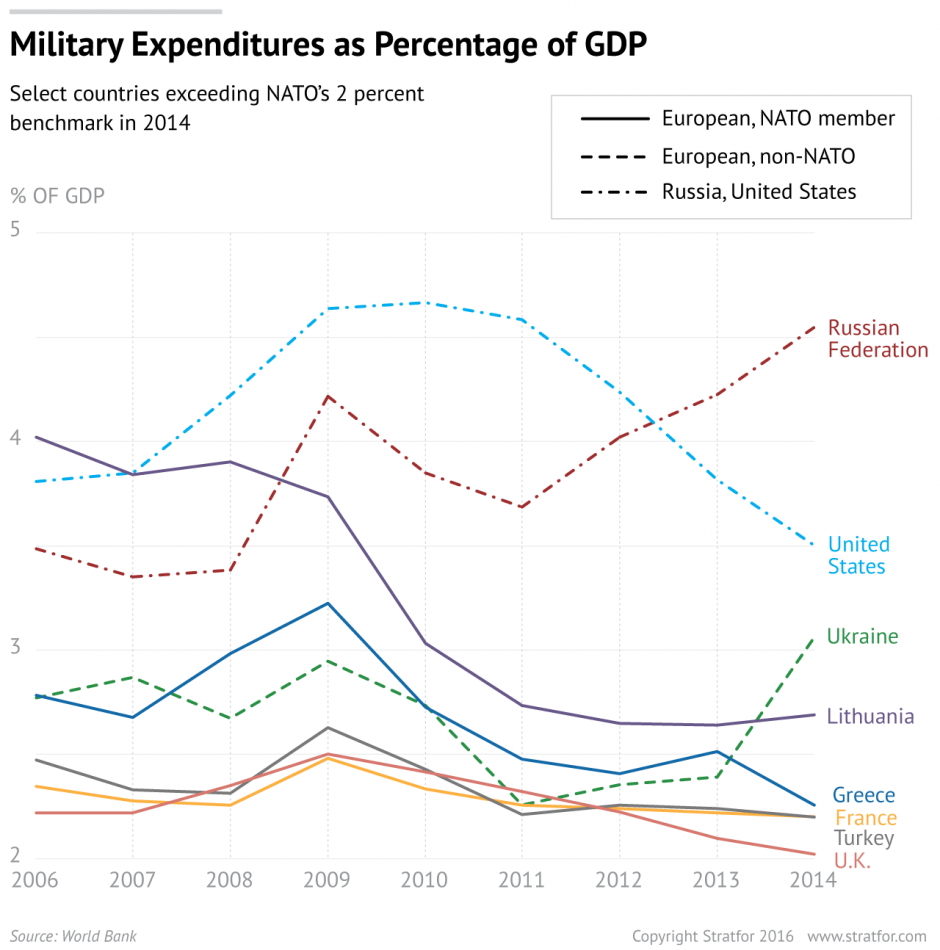

It is no secret that the United States spends far more on its military than its European NATO allies do, creating the expectation that Washington will fill the gaps whenever the need arises. Of NATO's 26 European members, only five — Lithuania, Greece, France, Turkey and the United Kingdom — spend more than the NATO-recommended 2 percent of gross domestic product on defense (Poland and Estonia are at 1.9 percent), according to 2014 data. The economic crisis in Europe is partly to blame for defense spending cuts, but there is also wide disparity within the bloc over where the alliance should focus its attention. The United States and the United Kingdom are more closely aligned on broadening NATO's scope to meet the challenges of the day, whether on counterterrorism campaigns in the Middle East or on cyber threats. France and Germany will be more careful in managing frictions with Russia but have also come to realize they cannot avoid their counterterrorism responsibilities abroad, even if they differ on which front to tackle. Turkey is being drawn into surrounding conflicts and, with or without NATO, will increasingly rely on the military to respond to threats in northern Syria and Iraq. The Baltic states and Poland will be the most responsive to the Russian threat and will try to focus the alliance on permanent deployments to Eastern Europe.

Read Markets Facing "Global Overhang of Draining Liquidity," Says Expert

NATO is not obsolete, but it does need to evolve; Russia still poses a prominent potential threat to Europe's eastern flank, and every terrorist attack that hits the Continent shows the need for better security and intelligence coordination. Still, the United States will continue to carry a heavier burden than the rest, and Eastern European allies will have to look beyond NATO for bilateral security guarantees from Washington to fortify their shield against Russia. The announcement of a third US brigade rotating through Eastern Europe does not fundamentally alter the military balance between NATO and Russia unless European member states can match those levels. But quieter US deployments in Iceland, as Russian submarine activity in the Atlantic Ocean rises, to reinforce the "GIUK gap" (between Greenland, Iceland and the United Kingdom) point to a more comprehensive buildup by the United States, even if it is incremental.

A Dissection of Russian Strategy

The gradual US build-up in Europe ensures that the US-Russian standoff will be a major theme of the next US presidency. Russia's fundamental distrust of the United States is fueled by what it perceives as a deliberate Western encroachment on its doorstep. Moscow will try to mitigate the threat with a conventional military buildup as well as a distancing and possible break from previous nuclear arms-control treaties. Russia will also do its best to widen fissures in Europe to undermine both financial sanctions and overall US efforts to build a strong and coherent counterbalance to potential Russian aggression.

The third prong in Russia's strategy entails finding and creating levers in conflict zones that have the potential not only to bog the United States down but also to make the United States dependent on Moscow for an exit strategy. The Middle East is full of such opportunities, with Syria being the most prominent example. Russia is so entrenched in that conflict that it can either dial up or down the violence to shape its broader negotiation with the West. The stick comes in the form of intensifying the conflict through its military support for the Bashar al-Assad government, which in turn exacerbates the migrant crisis dividing Europe and stymies US efforts on the battlefield. The carrot comes in the form of implementing a cease-fire, coordinating on the fight against the Islamic State and working toward a credible peace deal and political transition with the expectation that the Europeans and the United States will be willing to bargain on sanctions relief, put pressure on Ukraine to recognize autonomy in its east and limit the NATO buildup. Tactical and incremental compromises are possible as both sides try to avoid a bigger conflagration, but Russia's standoff with the West is still deeply ingrained and, with the credibility of US security guarantees at stake, the United States is unlikely to make compromises that leave its allies hanging. As the conflict endures, the US president must stay alert to the layers of Russian strategy designed to draw Washington into strategic concessions at the expense of those allies.

Navigating growing competition between Russia and Turkey will be tricky for Washington. From the Middle East to the Black Sea region to Nagorno-Karabakh in the Caucasus, there are multiple opportunities for Moscow and Ankara to bump heads. The United States can leverage this competition to draw Turkey deeper into the NATO fold, but it must also be wary of being drawn into a fray between these old geopolitical rivals that could undermine the alliance and escalate into much bigger confrontations.

Get Used to Regional Powers Stepping Up in the Mideast

Power vacuums in Syria, Iraq, Libya and Yemen overlaid by deep sectarian tensions will provide space for jihadists to operate and a base from which grassroots operatives can draw inspiration, training, and expertise. Whether those jihadist pockets will thrive depends on the ability of the United States to attract more regional help with counterterrorism efforts. This dynamic is already in play, as a US strategy to reconcile with Iran has had the strategic effect of prodding the main Sunni players — Turkey and Saudi Arabia — into action to counterbalance Iran. The cost to this balance-of-power strategy is that all players and their proxies will pull in multiple and often opposing directions in pursuing their immediate interests. But after more than a decade of fighting in the Middle East, US policymakers should be used to working with a dizzying array of competing factions. The United States will have to bend with the strategies of its allies — and in some cases, allies will have to bend with the strategy of the United States. For example, the United States will continue to work with Kurdish militant proxies against the Islamic State but will also set boundaries as it prioritizes cooperation with Turkey. Israel will see its influence on the US policy in the region weaken as Washington is forced to rely on other regional heavyweights to manage these conflicts, but Israel will be quick to adapt by quietly building its ties to Sunni partners and by keeping on top of Russian activities in the region.

Read also Leading Indicators Show US, Global Economy at a Tipping Point

Saudi Arabia will remain close to the United States out of necessity, but it knows it cannot always count on the United States to be in sync with the Gulf Cooperation Council's agenda. Riyadh will attempt to consolidate a Sunni regional alliance to address regional threats, and the United States will not always be able to police such actions. Riyadh will also coordinate with its Gulf partners on its longer-term economic security. With low commodity prices delivering the latest reality check to Gulf monarchs on the importance of diversification, questions over the stability of Saudi succession will rise as Saudi economic, and potentially political policy becomes more experimental.

A close eye will need to be kept on Iran as well. The Iranian presidential election is tentatively set for June 2017, less than six months after the inauguration of the US president. Even as recent parliamentary elections in Iran favored the moderate camp led by President Hassan Rouhani, a slow economic recovery and growing resistance from political hard-liners threatened by Rouhani's political and economic opening have the potential to upset Iran's political path and raise more complications in the fledgling US-Iran relationship.

A Credible US Pivot to Asia

China is still massive and growing, but a slower rate of growth for a country as large as China puts the world in a whole new paradigm. As that painful adjustment continues to play out, we must bear in mind that Beijing understands the existential need to build up a large consumer class and move its economy up the value chain to rebalance. China intends for its tech industry to be a major driver for growth but also wants to move beyond just the assembly and production of electronic products into designing and fabricating components that it currently has to import. Government subsidization, corporate espionage and the direct purchasing of foreign tech companies will all be geared toward gaining the know-how needed for China to develop a more indigenous tech industry. This will be a key driver of Chinese espionage in the cyber realm, where the best options for defense by the United States are political rather than technical, given the rapidly shifting threat environment. Nonetheless, though cyber security may be a high-profile campaign issue, any future White House will have limited success in persuading China to take action against hackers except those outside its command.

While it is tempting to manipulate currency values in a prolonged period of economic stagnation to boost growth, the cost to the Chinese consumer will weigh heavily on Beijing's mind and shape a more cautious approach to managing the yuan. The daunting amount of structural reform needed to tackle industrial overcapacity and rebalance the Chinese economy will occur at a highly uneven and volatile pace as authorities face growing resistance on the central and local levels. Foreign and domestic calls for Beijing to allow freedom of communication and expression will fall on deaf ears as President Xi Jinping will work in overdrive to nip emerging factions in the bud as party competition escalates.

Don't miss CFOs Say China, US Political Turmoil Pose Greatest Risk to Economic Outlook

As China's economic and political challenges grow, the country can be expected to be even more assertive abroad. Both Beijing and Washington will court countries in Southeast Asia with the potential for robust economic growth as they take advantage of the Chinese slowdown over time. But the states in Southeast Asia will refuse to be drawn into a zero-sum game. On the security front, China is not looking to pick a fight with the world's military superpower, but it is serious about defining a naval sphere of influence and protecting and creating redundancy in its supply lines. Chinese efforts to project power into the wider Indian and Pacific oceans will rub against a US imperative to maintain naval dominance in these theaters.

North Korea's nuclear advances will only further complicate the security climate in the Asia-Pacific theater. A replication of the Iran or the Libya strategy will not work in trying to contain North Korea's nuclear ambitions. Pyongyang is aiming for a viable nuclear deterrent, and sanctions and military threats will only reinforce this goal. The United States will deepen its security ties with Japan and South Korea to mitigate the developing North Korean threat, an alliance that will also heighten frictions with China. Even as Beijing tries to leverage cooperation in dealing with North Korea to place boundaries on US security enhancements in the region, China's influence on Pyongyang's actions are visibly limited, and Beijing will avoid rocking the boat too hard for fear of creating a bigger conflict on its border.

Debates in South Korea and Japan over whether they should take the relatively short leap into activating their nuclear weapons programs predate by at least a couple of decades Donald Trump's remarks that Japan and South Korea will pursue nuclear weapons. The US focus on its allies in the Asia-Pacific theater and the strength and credibility of its nuclear umbrella will be the main deterrents to Seoul and Tokyo pursuing an independent nuclear path. At the same time, the United States will develop a stronger watch on the nuclear ambitions of its allies and will wield sticks when needed to dissuade strategic partners from unilaterally making an atomic jump.

A Silver Lining in the Commotion over Commodity Prices

While political volatility is a given for countries overly reliant on extractive industries and foreign credit for growth, the global commodity bust and credit crunch can be a boon to US foreign policy. From Latin America to Africa to Asia, economic cycles have reached a point where political leaders can no longer binge on credit-fueled growth to sustain populist measures. As credit gets squeezed, it becomes much harder to keep the public content through subsidies and to reward political allies through kickbacks from mega projects. Economic belts tighten, corruption allegations have the potential to mobilize the public, and social unrest ensues. Once the storm passes, some (but not all) countries will come out stronger as populist measures rein in and more reliable regulatory environments develop. The United States can also continue a policy of quietly supporting the creation of credible anti-corruption bodies to stabilize governments over the long term as it works to create a more dependable network of allies.

The Responsibilities of a Global Hegemon

This brief is by no means comprehensive but intends an honest attempt to build a framework around the foreign policy debate this election season. Per the usual, there is much talk this season about restoring American strength. The force underpinning the notion of American exceptionalism is deeply rooted in the country's geopolitical identity. The United States has two vast oceans for buffer and is built on a resource-rich and naturally integrated land that not only fosters a strong national identity but also enables broad economic linkages with neighbors on the North American continent. The United States needs a more robust alliance architecture abroad if it hopes to preserve its strengths at home. Whether you advocate a more narrow "America first" policy, or a more isolationist strategy, or only want to apply more scrutiny to US foreign activity abroad, the responsibilities of the US leadership will run deep.

"To the Future President of the United States" is republished with permission of Stratfor.