The precious metals stocks have played a supporting role, at best, in the world-wide commodity boom of the last few years. Oil, base metals, food commodities and gold bullion itself have outperformed the precious metals equities. That situation may be changing. Bullion’s return for 2008 is only slightly ahead of the HUI index, 3.0% to 2.8%. Those with an understanding of the fundamental situation and the patience to let events play out should be looking at this sector as ripe with opportunity.

Fundamental Picture

While oil has raced higher, reaching beyond $125 a barrel last week, it is due for a breather at some point this year. If the recession in the US deepens and spreads to Europe, the anticipation of slowing economies in the West will likely take some steam out of the price of oil, at least in the near term. Falling energy prices will help bolster the bottom lines for mining companies. Even with energy at record levels, the profitability is improving for the majors such as Newmont. It recently reported first quarter 2008 results of 82 cents a share, versus 15 cents in first quarter 2007. Producers are leveraged to the price of bullion, and even with rising costs, mining profitability is on the rise.

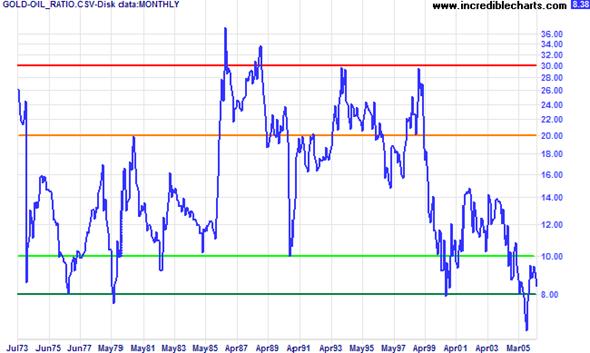

From an historical perspective, the ratio of gold to oil (price per ounce vs. price per barrel) certainly illustrates that gold is currently undervalued. The gold-oil ratio spanning over 30 years in the chart below helps to identify overbought and oversold opportunities for gold.

Gold stocks are also in undervalued territory versus crude oil.

Central Banks -- Pedal to the Metal

The US Federal Reserve and other key central banks are still printing money at a record pace, far exceeding the growth of their respective economies. The US money supply, as represented by MZM (a substitute for the discontinued M3) has been on fire in 2008. In the first four months of this year, MZM has exceeded a 25% annual growth rate, as the Fed flooded the financial system to prevent a total system collapse. Monetary stimulus of this magnitude will sew the seeds of much higher inflation than we have seen thus far (which is already accelerating and spreading throughout our economy).

The European Central Bank (ECB) has expanded its M3 money supply at an 11% rate through March, after an 11.5% increase in 2007. Other central banks have also been stepping on the monetary gas pedal, well in excess of nominal GDP growth. This is not the environment conducive for “quiescent” inflation, to use a term former Fed Chairman Greenspan preferred. It is looking increasingly like a period of virulent stagflation.

The Reuters CRB (commodity) index is up 24% since the Fed began cutting rates in September, 2007. And yet the US economy grew by only 0.6% in both the 4th quarter of ’07 and the 1st quarter of ’08. Inflation is clearly becoming embedded in our economy. All that remains is for the lagging “inflation expectations” among the public to fully catch fire and the inflation genie will be out of the bottle and on the loose. As this realization occurs, tangible asset investments will be in great demand as one of the few places to protect diminishing purchasing power.

Intense Short Selling

The metals stocks, particularly the juniors, have been under extreme short selling strategies by hedge funds and trading banks. Many of the hedges involved going long gold bullion and short the gold stocks. Eventually the shorts must cover as the value of the metals stocks is increasingly recognized and the long money begins to enter the sector in earnest.

More value in the gold shares versus the bullion.

The credit crisis also proved to have a debilitating effect on the metals stocks. As the crisis began last August, there was a general rush to safety by hedge funds and others, selling stocks with a bid and going to Treasuries and bullion. That trend now may be reversing, as the financial sector has calmed since the Fed bailout of Bear Stearns. Of course if we see new implosions of major banks or hedge funds, that will likely drive the price of gold substantially higher in another rush to the safe haven of bullion.

Peak Gold?

It is highly unlikely that gold mining companies can flood the market with gold, despite prices nearing 0 oz. We are living in an age of increasing scarcity, and that includes gold discoveries. Newmont’s general manager for Australia, Adriaan van Kersen recently told a gold mining conference in Perth, Australia that Newmont is having trouble finding gold, even as it spends 5 million this year on exploration. Van Kersen stated that Newmont plans to mine between 5.1 and 5.4 million ounces of gold this year.

“Newmont depletes its reserves at 10 ounces a minute and needs a replacement discovery rate of near 14 ounces a minute” said Van Kersen. “There has been a shrinking number of gold finds above 5 million ounces. Exploration is not only becoming tougher and riskier, it is becoming more and more difficult to find gold in any surface quantity. As an industry, we are spending more and more on exploration, but even in a high demand and high price environment, and more drilling happening, the gold sector is not discovering the same ounces it used to.”

Juniors as Take-Over Targets

This would seem to be evidence that junior miners, especially those in or near production, are going to be increasingly attractive as take-over targets by the major and mid-tier producers. The scramble to replace depleting reserves will become more intense if the price of gold continues to rise. And given the long range fundamentals, that occurrence is highly probable.

The Canadian junior stock index ($CDNX – mostly mining companies) priced in gold is at the lowest level since 2000. For the contrarian investor who understands the fundamentals and is patient, this appears to be a time of great opportunity in the junior mining sector. Investor sentiment is also extremely negative, adding to the impression of the junior mining sector as a coiled spring.

So despite rising costs, short selling and a credit crunch, all is not bleak for the precious metals stocks. The quality companies, with proven reserves and blue sky exploration opportunities should be able to get ample financing, if they are not taken over first. The key is to buy quality companies when prices are low and stay patient. When the precious metal stocks take their turn in the spotlight, you want to be in the front row.

Today’s Markets

U.S. stocks rose on Monday, with investor moods brightened by a report that Hewlett-Packard Co. is closing in on a deal to buy Electronic Data Systems Corp. for as much as $13 billion, as well as oil's retreat from record highs.

The Dow Jones Industrial Average was up 130.43 to close at 12,876.31. The S&P 500 Index rose 15.30 to close at 1,403.58. The Nasdaq was sharply higher, ending at 2,488.49, up 42.97.

In energy trading, crude oil futures fell, retreating after their record-breaking run in which they rallied more than 8% last week. Crude for June delivery closed down $1.73 at $124.23 a barrel in New York. Gold for June delivery closed at $884.90 an ounce on the New York Mercantile Exchange, down 90 cents for the session. It climbed as high as $888.80.

Tony Allison

Registered Representative