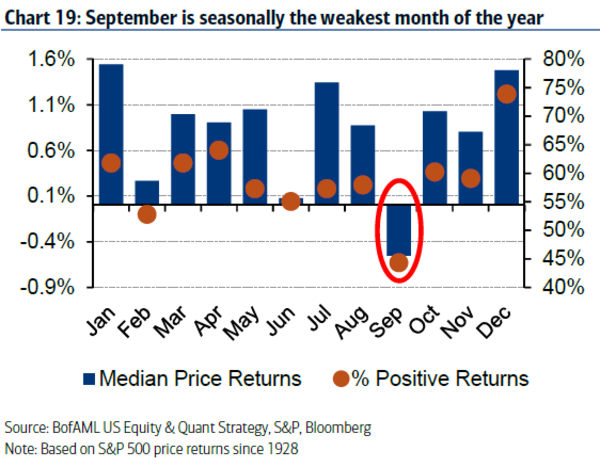

From our vantage point, the current correction is not the beginning of a major bear market but a necessary and long overdue pullback that likely has further to go. Similarly, given the record number of months without as much as a 3-5% correction, which is quite normal and to be expected, this puts the odds for seasonality to weigh on stocks in the historically weak August-September (particularly September) period at much higher than average.

One reason why we don't think this is the beginning of a major bear market has to do with the fundamental backdrop where, as we noted recently on our Global Macro Outlook Podcast with Callum Thomas, a wide range of leading economic data still align with a positive outlook.

Global trade growth and global PMI (purchasing manager index) data began to see a sustained pickup starting around mid-2016 and aren't yet flashing warning signs. That being said, upside growth is probably limited and may start to moderate from current levels.

Source: Topdowncharts.com

Thus, we are still bullish in terms of the market's primary trend—and think it slightly premature to call for a major top—but not aggressively bullish (having raised our cash and bond positions) while on the watch for the bull market and economic expansion to face some major tests starting next year in 2018. We explained our full outlook in last month's quarterly newsletter, Preparing for the End Game.

Though select areas and sectors of the market have reached attractive buy-entry zones, this is not the case when looking at the broader S&P 500 on an intermediate or long-term basis. We also see an abnormally large number of Hindenburg omens across the major indexes currently. For those looking to scale into the market then, patience is advised:

Sign up for a FREE TRIAL to our premium FS Insider podcast by clicking here.