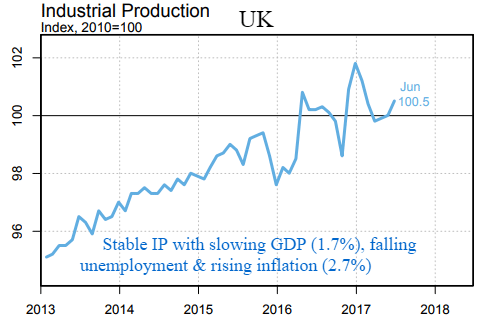

The global economy began a new expansion phase in 2016 after the oil market exited a severe 2-year recession. We have highlighted many examples of improving financial risk, new record highs in leading indicators and a rebound in industrial commodities. A good measure of the underlying strength of the goods-producing economy is encompassed in the Industrial Production Index. This aggregate of the national output of manufacturing, mining, and utilities gives us a barometer of economic vitality.

We have included here a plethora of charts from around the world that almost uniformly show a widespread resurgence beginning in 2016 and continuing today with a growing pipeline of new orders. While summer slowing is a bit of a seasonal occurrence, the strong growth trends shown here look firmly entrenched. Germany, as usual, leads the Eurozone charge along with its anomaly of just 3.8% unemployment vs near double-digit jobless levels among its neighbors. The US and Japan are registering some of their strongest readings in 2 to 3 years with record profits.

Check out Major Breakout in Emerging Markets

Even the emerging markets look healthier for a change with Brazil making its long journey from Depression-level GDP contractions a year ago to positive growth in 2017. The only major economy we didn’t include was China, who maintains what appears to be government-created artificial growth rates of 6% the past 2 years. China continues to be the only country in the world where major economic measures have almost no volatility compared to other more sophisticated economies.

The recovery from the global subprime debt panic starting in 2009 was on a trajectory that might have become overheated by 2015 if not for the shale boom inducing an energy sector recession. With 2 years of below-trend growth ending in 2016, we are again back on track for potential overheating should industrial production around the world continue on the trend of the past year through 2018.

It’s very encouraging to see the commodtized economies of Brazil and Canada exhibit sharp rates of industrial expansion in recent months.

The expansive industrial growth cycle in 2016 and 2017 is further supported by the new breakout in July by the base metals index (DBB). This industrial metals indication of industrial growth is further supported by the resplendent US shale sector that will soon achieve new record levels of production. Look for continued economic and industrial expansion trends into 2018-2019.