Throughout the current economic cycle I have continually referred to the characterization of “the tale of two economies." Specifically, I have been struck by the dichotomy between the fate and fortunes of large US companies relative to their much smaller business brethren. Not too hard to understand in that it’s the large companies whom have benefited from not only central bank stimulus, but are the very companies with access to once in a generation low borrowing rates via the public capital markets (also courtesy of the same global central banks). It’s important to total cycle character because small businesses are the jobs creators domestically. Of course you already know ours has been one of the weakest jobs recovery cycles on record. And for the younger generation, well, you don’t want to know. Barista’s and food service career opportunities are the new “killin’ it”, right?

It just so happens that the NFIB small business optimism survey hit the tape last week. Not a pretty picture at the headline level, but the February numbers certainly reflect weather-related effects. Interestingly, even geographic areas not hard hit by weather-related issues did not show solid strength by any means. Before taking even one step toward darker thoughts, the jury is still out as we’ll just have to see what lies ahead as we move into the spring months. But as I looked through the data, another, for now, short-term dichotomy stuck out like a sore thumb. I offer these thoughts for your reflection and forward monitoring.

We all know that the ever-prescient folks at the Fed have finally started down the path of tapering their “bond purchasing” (aka money printing). I personally believe they will be done by yearend, barring any interim downside jolt to the stock market. For the banks, this implies a slowing in the expansion of excess reserves accumulation. Reserves that have either been recycled right back to the Fed, used in trading, or actually lent into the economy itself. I’ll spare you the chart, but the total banking system loan to deposit ratio currently rests at a three decade low, so you get a feeling for what lending has, or more correctly has not, looked like in this economic expansion phase.

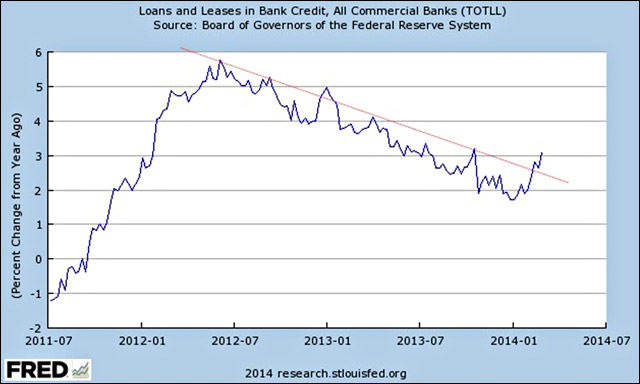

As I looked at the recent NFIB data, I’m now asking myself a new question — is what lies ahead the tale of two tapering impacts as this applies to large and small US businesses? I’ll show you exactly what I mean. Let’s start with the big macro. Below we’re looking at banking system data courtesy of the St. Louis Fed. It’s the year over year rate of change in loans and leases outstanding in the total US banking system. This may sound like a crazy question, but if this were a stock chart, would you buy it or sell it? Perhaps, and that’s the key word, we’re on the cusp of a rate of change breakout to the upside in banking system lending, we’ll just have to see. If nothing else, for now it’s a notable change (in the rate of change trend). Interestingly, it virtually exactly coincides with the onset of Fed tapering. Could it really be that if free and easy money is coming to an end, banks will actually have to increasingly earn a living by actually lending money? What a novel idea.

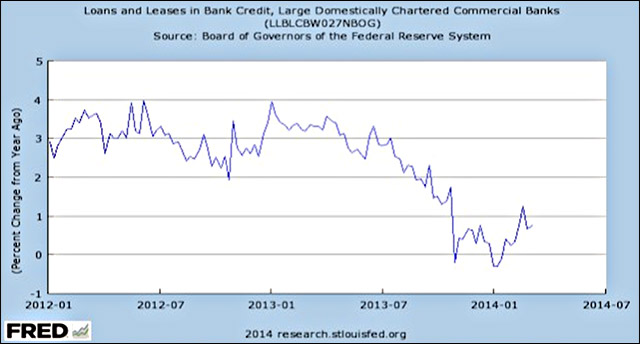

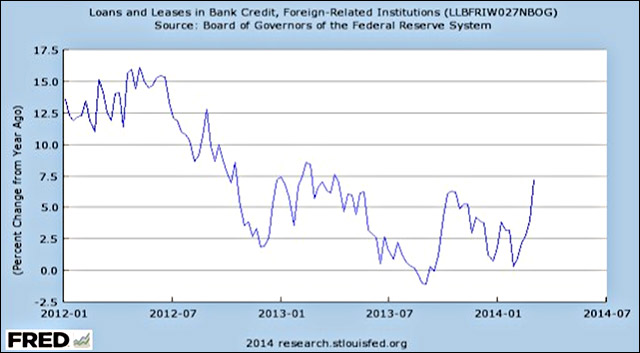

Time to look just a bit more closely at the micro of just which type of banking institutions are engaging in lending acceleration. In the combo chart below we’re looking at year over year rate of change numbers for large and small domestic banks, as well as foreign banks’ lending in the US. Here the picture gets a bit more interesting. Yes, the year over year change in large and small domestic bank lending has accelerated as of late, but, what, by a percent or so? Big deal. It’s the foreign institutions that have increased US based lending activities and affected the macro picture.

The trend in US based lending by foreign institutions is not hard to understand as we ponder the current economic landscape of say Europe, Japan, etc. As with global capital in general, global banking system capital is also gravitating to Bill Gross’ “cleanest dirty shirt” — the US. Regardless of the origin of capital, good for the US economy, no?

Sure it is. But which economy is the important question. One of my key personal macro perspectives of the moment is that as the Fed tapers, global peripheral economies are the first to feel the brunt of the liquidity contraction and, as a result, global capital is gravitating from the periphery (think emerging markets, etc.) to the core (the largest of global economies that is the US). Not just in the financial world, but likewise in the real economy. With all due humility, the banking system numbers seem to support this thesis. Foreign banking capital is leading the macro rate of change lending acceleration in the US banking system.

[Related: Gary Shilling: Bears Have It Wrong—U.S. Not Stuck With Permanently Slow Growth]

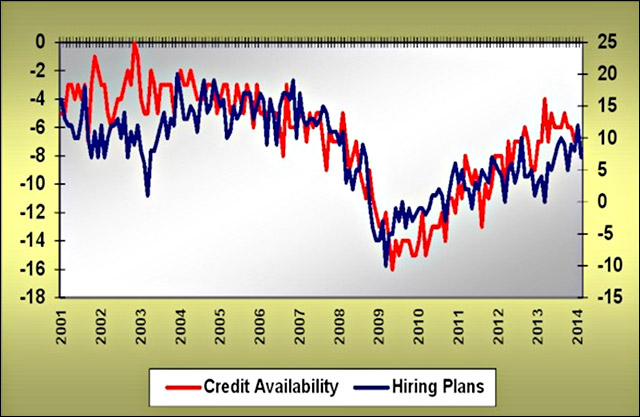

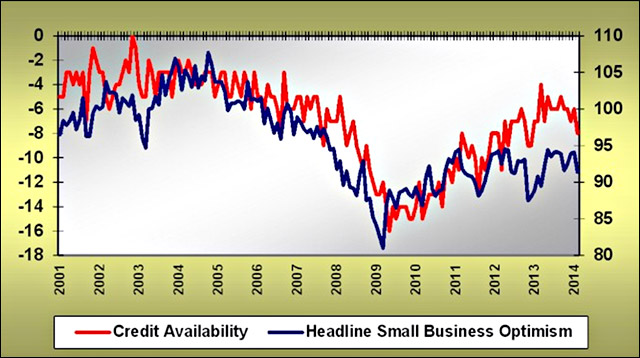

Sorry to take a number of pages to get to the point. For that, let’s look at some historical NFIB data that necessarily includes the current month. It just so happens that, historically, credit availability to the small business sector has been extremely important in small business sector capital spending, hiring and the overall level of headline optimism. Remember, it’s the small business sector that creates the jobs domestically. The better off the small business sector, the better the tone to the US labor market and domestic economy in general. But a funny thing has happened in this seemingly improved macro bank lending environment in the US. Small business perceptions/responses to ease of credit availability have actually deteriorated, not improved. As you’ll see in the three charts below, the correlation between credit availability and small business capital spending, hiring and optimism has been extremely high over time. But credit availability in the small business sector peaked in early 2013 and now rests at a level not seen since latter 2012.

As a result, for now, small business capital spending plans (for many the hoped for economic Holy Grail of 2014) have not improved much relative to where they stood a year ago.

Hiring plans likewise have certainly improved over the entirety of the cycle to date, but are now where we also saw them in mid-2012. Good, but not great. Again, maybe it’s the weather for now.

And, finally, as is shown below, since early 2012 the directional movement in credit availability has hugged the directional movement in the overall optimism index.

What this suggests is that as the Fed has tapered and caused global capital, inclusive of global banking system capital, to gravitate from the periphery to the core of the global economy, that increased capital flow has not yet benefited the US small business sector, despite its apparent abundance. It’s only natural that foreign banks, like foreign investors, are first seeking safety of capital employed and not necessarily leading with maximization in rate of return expectations. The grand experiment in US Fed QE has resulted in lopsided impacts on the US economy (large versus small company benefits) in its acceleration. And now it appears to be having the same lopsided impact in its deceleration phase. It must be warming the Fed’s heart all over, right? To be honest, it’s one of the reasons I personally believe they are walking away from the QE game — lopsided impacts not ubiquitous across the domestic economy.

[You May Also Like: Jim Puplava's Big Picture: Emerging Market Pain = Developed Market Gain]

At least from my perspective, the tale of two economies has been an enduring theme in the current economic cycle. Fed stimulus has disproportionately benefited large US and global corporations. The small business sector at least domestically continues in the fight to gain ground. Although it’s still early in the game, it appears now that Fed tapering is only reinforcing this dichotomous impact and the real world economic outcomes via the increasing concentration of global investment and banking capital in the safest of sectors and balance sheets — the large US and global blue chip corporations.

Really as an FYI more than not, I’ll leave you with one final chart. Below is the 3 month rate of change in the headline NFIB small business optimism index alongside the 3 month change in the S&P 500 (price only). Yes, we know that flows of global capital are benefiting the large equity indices. Just don’t forget that the fate and fortune of smaller US business is likewise important in the context of not only the financial markets, but the real economy itself. For now, the more things change, the more things stay the same.