The situation in Europe reminds us of a general manager’s dreaded vote of confidence for his underperforming and embattled coach. We will expand on some risk-management concepts today after the dreaded ‘we do not need a bailout’ comments coming out of Spain. From Bloomberg:

Spanish Finance Minister Elena Salgado said there’s “absolutely” no risk the country will need an international bailout as its borrowing costs compared with Germany’s surged to a euro-era record. Asked in an interview on Punto Radio in Madrid if Spain risked having to seek a rescue like Ireland or Greece, Salgado said “absolutely not.” The euro faces “speculative attacks” which Spain is in the “best conditions to resist,” she said. (Full Story).

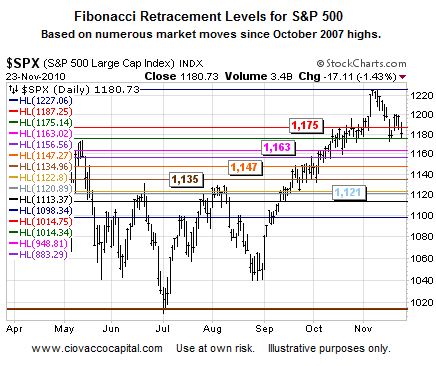

On November 17th in the FSO article How Far Could Stocks Fall, we used various methods to look at the S&P 500’s potential downside risk. One method used in the November 17th analysis was Fibonacci retracements. We decided to expand the retracement analysis since the market remains fragile due to concerns related to tensions between North and South Korea, as well as the ongoing debt-related problems in Ireland, Portugal, Spain, and Italy.

Being aware of retracement levels can help you make more informed buy and sell decisions. For example, if the current correction were to build some momentum, you may decide to wait for a retracement level to be violated on a closing basis prior to reducing your exposure to risk. The basic concept is all markets have natural ebb and flow where “giving back” some gains is a normal part of any healthy market. Retracements bring new buying interest and allow markets to move higher.

Retracements pertain to both market advances and market declines. They can be calculated using closing prices or intraday prices. In this expanded analysis, we added a few additional market moves and calculated the retracements using both closing and intraday prices. The values shown in the table above and graph below are the average results using closing and intraday prices. The levels enumerated below deserve the most attention based on a variety of factors, such as trendlines (not shown).

One of the most common mistakes made by individual investors is to underestimate the short-to-intermediate-term impact of loose monetary policy. This QE resources page can help you better understand the Fed’s impact on the price of stocks, gold, silver, copper, etc.