Part 2 Summary

- Major breakout in USD means:

- U.S. stocks over foreign markets

- Stocks over bonds

- Higher price multiples for U.S. stock markets

- Short-term, USD due for a breather and euro for a rally

Investment Implications of a USD Breakout

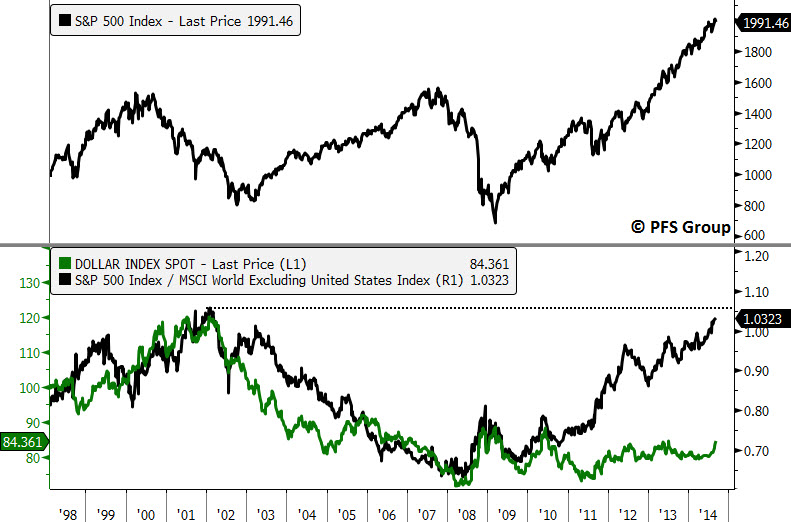

Should the USD break out from its 2005 to present bearish trend, we should see some significant developments in inter-market relationships. For starters, the relative performance of U.S. stocks to the MSCI World Stock Index Excluding the U.S. shows a strong correlation to the USD Index. Should the USD continue to rally we are likely to see U.S. stocks continue to outperform world stock markets.

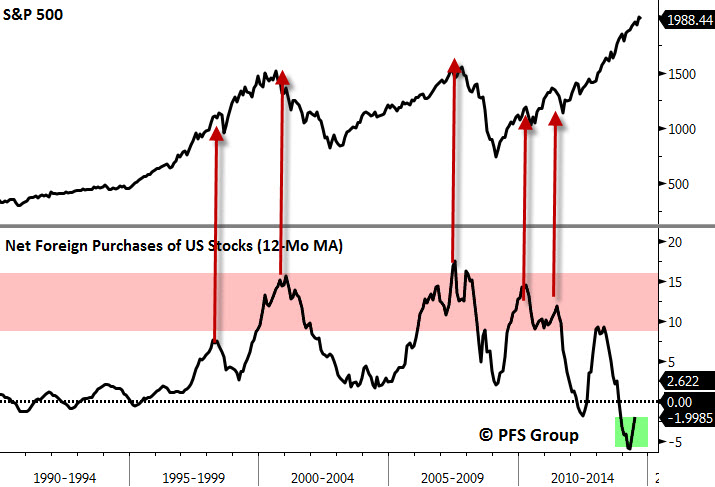

Should the USD strengthen ahead and the U.S. markets outperform world indices, we are likely to see a pickup in foreign investment demand for U.S. stocks. Currently the 1-yr moving average of foreign investor’s net purchase of U.S. stocks is still negative but has bottomed. Given the current low level of foreign investment to the U.S. stock market, we could see foreign buyers become a significant source of buying interest in the months ahead. As a side note, given foreign investors interest in U.S. stocks tends to correlate with major market peaks and bottoms, it is encouraging that their net foreign purchases are well off the levels that marked the 1998, 2000, 2007, 2010 and 2011 tops.

Not only should we see the U.S. stock market outperform foreign markets, but we should also see U.S. stocks outperform other asset classes like bonds and commodities. We can see this in the relationship between the USD Index (green line, second panel below) and the ratio of the S&P 500 to the CRB Index (red line, 2nd panel). As the USD heads higher, stocks tend to outperform bonds.

Part of what fuels U.S. stocks higher with a strong dollar comes from the relationship of the USD Trade Weighted Index and the S&P 500 price-to-earnings ratio (P/E). A higher USD is correlated with multiple expansion while a weaker USD is correlated with multiple contraction. Continued strength in the USD ahead should translate into higher P/E multiples for the market, pushing stocks higher.

Short-Term Considerations

While evidence for a sustained bull market in the dollar is building, short-term the picture is less certain. The strong move over the last 3-4 months has pushed the USD Index into significantly overbought territory and it is resting near likely resistance at the 2013 highs. We are also seeing a Bloomberg TrendStall SELL signal as shown by the red triangle below, which suggests we could see a trend change develop. A pullback from overbought conditions would not be surprising and would be healthy overall.

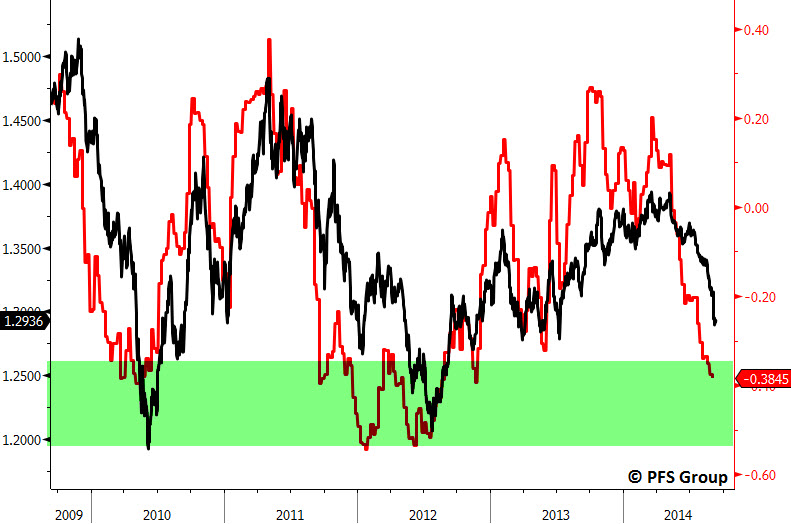

More support for near-term softness in the dollar comes from futures positioning in the euro. Net speculative interest by large traders in the euro as a percent of total open interest (red line below) is at levels that have marked prior significant lows (black line below) and suggests the euro should see an oversold bounce in the days and weeks ahead.

Conclusion

The USD Index has been on a tear over the last several months, pushing the currency basket up against a 9-yr bearish trend that has been in place since 2005. Much of this move has stemmed from weakness in the euro as investors are reacting to the perceived increase in the ECB’s balance sheet relative to the Fed’s. This is highly reminiscent to what occurred in 2011 when the ECB expanded its balance sheet significantly while the U.S. Fed was on hold. In 2011 we saw U.S. stocks outperform European stock markets while commodities tumbled.

While the weakness in the euro caused by ECB action is playing a major role for the dollar’s strength, as I showed in Part 1 that currency pair is masking the broad-based strength in the dollar versus nearly every other major world currency.

The recent surge in the dollar over the last few months is gathering a lot of attention yet, if we look back, its strength has been underpinned by several fundamental supports starting around 2011: an improved U.S. trade and budget deficit as well as higher interest rates. If the U.S. economy and domestic oil production continue to expand, this will provide a bullish backdrop for the dollar and also have the following investment implications:

- U.S. stocks outperform foreign stocks

- U.S. stocks outperform commodities

- U.S. stocks outperform bonds

- PE multiple expansion in stocks

While the longer-term picture for the dollar is bright, there are some near-term clouds that suggest some backing-and-filling. The recent move has pushed it into overbought territory and prior resistance at the 2011 highs. We are also seeing overly bearish sentiment in the euro, which suggests we should see a near-term bounce in the euro and sell off in the USD in the days ahead.