As we write, the rally in the U.S. Dollar is ongoing:

We continue to believe that the breakout of the U.S. Dollar against other global developed-market currencies is the most important data point for investors to consider in the present environment.

Why the Dollar Is Rising — A Short History

Before the 20th century, the value of money was tied to a commodity, specifically gold. Fractional reserve lending by banks still permitted the money supply to expand, but with a fundamental constraint. In many respects, the economic history of the 20th century has been a history of the movement from commodity money to fiat money — that is, from money backed by a physical commodity, to money backed by faith in the economic stability of the entity creating that money.

Therefore, as the world entered the era of powerful central banks and fiat money, monetary policy became one of the key levers available to governments to manage their economies.

So, when we see a currency rising or falling in value relative to other currencies, we can bet that ultimately, government policy is behind the rise or fall. (The more economically powerful the country, the more likely this is to be the case. Economically weaker countries, especially those in the developing world, can often find themselves at the mercy of larger and stronger economies.)

Why Would a Country Cheapen Its Currency?

It is easy to see why a country might wish to cheapen its currency. A country with a cheaper currency will produce export goods which will be cheaper for foreign buyers, and the country will sell more exports. The “easy money” policies of a central bank that encourages a cheaper currency also tend to increase inflation, which in moderation acts as a spur to economic growth.

Most of the world’s central banks responded to the 2008 financial crisis with this very recipe — all using extremely loose monetary policy in an attempt to boost exports, raise inflation, and encourage growth.

[Hear: Marc Chandler: Be Prepared - Dollar May Climb for Several Years]

Those are the clear reasons why so many countries have spent the past six years in what some have called a “race to the bottom” — lowering the value of their currencies. If now, however, the U.S. Dollar is rising, we can be sure there are policy reasons why it is being allowed to rise.

Policy Reasons Behind a Stronger Dollar

Why might U.S. policymakers believe it is now in U.S. economic interests to allow the Dollar to rise?

First, the U.S. Federal Reserve is nearing the end of its most recent period of quantitative easing, or QE (that is, rapid expansion of the money supply). By purchasing U.S. Treasury bonds and mortgage-backed securities, the Federal Reserve has spent the past several years expanding its balance sheet dramatically:

The total size of the Federal Reserve’s balance sheet has expanded more than 4.5-fold since it began its extraordinary measures during the 2008 financial crisis. And its holdings of U.S Treasury Bonds have increased more than five-fold.

U.S. Treasury bonds trade in a market — and like other things that trade in a market, higher demand means higher prices, other things being equal. The Federal Reserve’s massive buying of Treasury bonds for the past several years has meant higher demand and higher prices for those bonds. Since a bond’s interest rate moves inversely to its price — with rising bond prices meaning falling interest rates — this Fed-supported demand for Treasury bonds had the very welcome effect of keeping interest rates low.

Now, as the current round of QE ends, the Federal Reserve is nearing the end of its unprecedented bond-buying spree. All other things being equal, this would mean decreased demand for Treasuries, and higher interest rates. Clearly, the U.S. government wants to keep its borrowing costs low. So with the Fed withdrawing from QE, how else could the U.S. government encourage demand for its bonds?

Enter Foreign Buyers

Other nations and currency blocs are still on the QE path. Japan’s vigorous QE is ongoing, and may increase. The European Central Bank (ECB) has so far been prevented from implementing outright QE by the resistance of Germany; but it is likely that Germany will eventually relent and the ECB will start QE as well.

All of the money created by the world’s central banks is looking for a home where it will earn a return — without being eroded by inflation. And right now, its best option is to buy assets denominated in U.S. Dollars. To some extent, this will be U.S. stocks, especially large-cap, high-quality companies. However, much of this money will flow into U.S. Treasury bonds.

A U.S. Dollar that is increasing in value may draw global financial flows into the U.S., support the demand for U.S. Treasuries, and help keep the U.S. government’s borrowing costs low.

Support for U.S. Equity Markets

A strong Dollar will also increase foreign demand for other Dollar-denominated assets — including U.S. stocks.

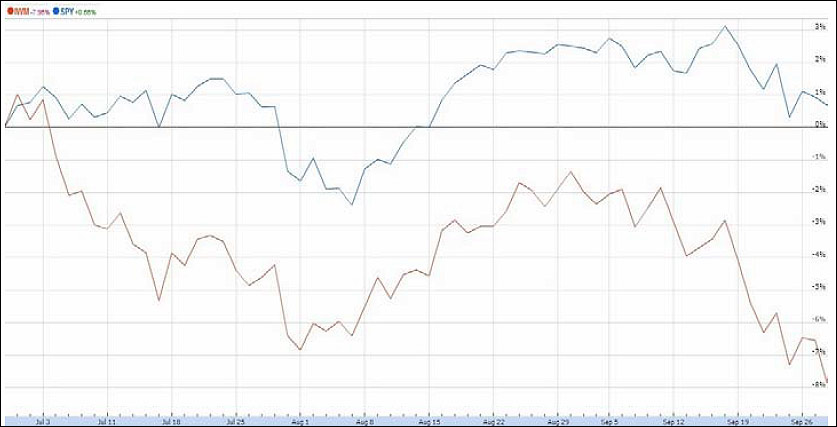

We would anticipate that foreign demand would especially support big-cap U.S. stocks. Since the Dollar’s breakout began in July, large-caps have decisively outperformed small- and mid-cap stocks. During the third quarter, the U.S. S&P 500 Index fund (SPY) returned a positive 0.6 percent. Meanwhile, the U.S. smaller company index, the Russell 2000 Index fund (IWM) returned a negative 8.0 percent. Note that the U.S. stock market is in a correction phase at present; bulls will buy after price declines.

Support for the U.S. stock market has been a hallmark of the government’s QE programs so far. The idea is that national psychology is improved by the “wealth effect” — the feeling of those who own assets that they are becoming wealthier will encourage them to spend and invest, creating a “virtuous circle” of growth.

Other Reasons to Strengthen the Dollar: Foreign Policy

There are also foreign policy reasons why the U.S. would want a stronger Dollar.

Many globally traded commodities, especially oil, are denominated in Dollars. A stronger Dollar against other currencies therefore has the effect of making those commodities more expensive for non-U.S. customers, and leads to a decline in demand. We are seeing this play out in the price of crude oil:

WTI = West Texas Intermediate

Data Source: Energy Information Agency

The portion of the chart circled in red shows oil’s decline during the recent Dollar breakout that we highlighted in the first graph.

Lower oil prices do have a short-term domestic benefit, in that they will reduce consumers’ gasoline expenditures and increase consumer spending on other goods.

Lower oil prices also have a decisive foreign policy impact.

As we write below, we continue to view Russian ambitions in Eastern Europe as one of the most significant geopolitical risks. We have commented before on the dire situation of the Russian economy. Its transition to capitalism in the 1990s was a catastrophic parade of crony excess, with state assets being sold off at firesale prices to the politically connected. Ordinary Russians saw their life savings destroyed, and saw the new oligarchs reaping huge gains. Life expectancy and fertility rates declined dramatically. Educated Russians who could find work abroad left the country. Vladimir Putin rode a populist wave of reaction against Russia’s decline — but his own policies have simply served to deepen the power of his own crony elite. Russia has become a kleptocracy without a productive, growing economy — the major thing propping it up is oil and gas revenues.

Russia desperately needs those revenues to survive. Its budget is probably predicated on Brent crude above a barrel. Engineering lower oil prices may be the most effective tool the West has to put real pressure on the Putin regime and restrain it from attempting further reconquests of Soviet territory. If it helps U.S. borrowing costs and gives U.S. consumers cheap gas, so much the better.

Gold may come under double pressure — first, because a strong Dollar will suppress gold demand by itself, but also because a struggling Russia may be forced to quietly liquidate some of its gold as its budget comes under strain from lower oil prices.

[Hear Also: Dan Steffens: Rising Dollar Key Factor in Energy Sector Decline]

Saudi Arabia also counts on oil revenues to be able to meet the heavy burden of social spending it maintains for its citizens (especially young men who might otherwise turn to extremism). However, since it is a U.S. ally, it may endure lower oil prices in exchange for other benefits the U.S. can provide — such as assistance in defeating the radicals of the Islamic State (IS) who are as fanatically opposed to the Saudi royal family as to the state of Israel.

Will There Be Negative Effects?

A rising U.S. Dollar has benefits. As we discussed above, these benefits include: higher demand for U.S. Treasuries, lower borrowing costs for the Federal government, foreign demand for U.S. assets (including stocks), lower commodity prices, and especially lower oil prices, which will hurt Russia and benefit the U.S consumer by lowering the cost of gasoline.

Of course, a rising Dollar will also likely have negative effects if the dollar stays too strong for too long. These would take some time to manifest.

A higher Dollar relative to other currencies will make U.S. exports more expensive to customers abroad, and will hurt U.S. corporate profits — the more business a company does abroad, the more it will hurt. Ultimately, over the next few quarters, a Dollar that is appreciating strongly against other currencies such as the Pound, Euro, and Yen would be a modest drag on U.S. growth. Foreign goods would be cheaper, and the U.S. trade balance would deteriorate. These are longer-term concerns, and are not likely to have an immediate impact the flows of investment capital into U.S. dollar denominated assets.

[Read: Corporate Profits and Market Peaks - Are We There Yet?]

Investment implications: The U.S. Dollar is overbought and may have a short-term correction, but the dollar is in longer-term rally mode. If the current Dollar rally continues (and we believe that it will), beneficiaries may include companies dependent on commodity prices. Lower commodity prices create lower costs for companies who consume raw materials in order to produce a product. Lower input costs usually increase the profits of those companies.

Trucking companies, airlines, oil refiners, and chemical manufacturers may also benefit from cheaper oil.

Sophisticated investors with a long-term view might consider shorting foreign currencies such as the Yen, Euro, or Canadian Dollar, or developing-market currencies such as the Mexican Peso. In spite of the end (for now) of QE, a stronger Dollar could delay the rise of rates in the U.S. by supporting demand for Treasuries.

Overall, until any negative effects begin to manifest, a stronger Dollar suggests money will continue to be attracted to the U.S. stock market, especially stocks whose sales are primarily domestic, and not international, and particularly for large-cap stocks. This has already begun; larger companies have been outperforming small- and mid-cap companies since early summer. Investors should focus on large U.S. companies that do not get a major share of their profits from abroad. Stocks of companies that sell globally will see their foreign earnings somewhat diminished by a lower value of their foreign currency sales in U.S. dollar terms.

For more commentary or information on Guild Investment Management, please go to guildinvestment.com.