One of the Federal watchdog agencies established by 2010’s Dodd-Frank financial legislation is mulling expanding its scope to cover not just credit products, but also retirement savings plans, according to Bloomberg.

The internal deliberations at the Consumer Financial Protection Bureau (CFPB) have not been made public. Director Richard Cordray, whose January 2012 appointment during a congressional recess generated controversy for President Obama, said in an interview that the agency was “exploring… what authority [it has]” in retirement savings products such as 401(k) and IRA accounts. Americans’ retirement assets total some $19.4 trillion.

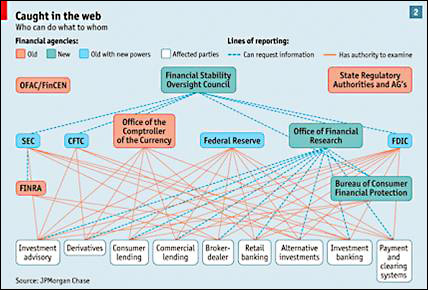

On the face of it, Dodd-Frank does not explicitly give the CFPB regulatory jurisdiction over retirement savings plans. Until now, that job has fallen predominantly to the Securities and Exchange Commission (SEC). However, Dodd-Frank has helped created a maze of agencies and agency relationships that’s far from clear.

Is the U.S. government looking for revenue in the tangled mess of retirement asset regulations?

Cato Institute scholar Mark Calabria observed in an interview: “I could imagine the CFPB growing into a role on investment savings if it seems like the SEC is asleep at the wheel.” The concept of a regulatory agency “growing into a role” rather than being assigned a role in a clearly delineated regulatory structure is alarming to some, and the CFPB has recently received critical scrutiny for its foray into large-scale data mining of consumers’ banking, saving, and spending habits.

Long-Term Questions and Problems

Long-term, we see several problems confronting U.S. fiscal policy that give us pause when we think of Federal jurisdiction over retirement assets.

One is the question of an eventual exit strategy of the Federal Reserve’s QE program. Another is the possibility of the eventual growth of the Treasury’s borrowing costs due to increasing skepticism about the “full faith and credit” of a Federal government that can’t get its fiscal house in order.

Either of these could create a situation in which lower demand for Federal debt would trigger higher borrowing costs, with all the attendant problems that would involve. Higher interest rates have historically often been the pin that pricked asset bubbles.

Retirement Savings—the Argentine Solution

One possible tool for increasing the “demand” for U.S. debt could simply be a mandate that Americans’ retirement accounts be comprised of a certain proportion of government debt. This would not be unprecedented; Argentina resorted to such a policy in 2008 to control borrowing costs after its devaluation of the peso. Since the value of the bonds that retirees were forced to hold immediately plunged, it amounted to a de facto partial confiscation of savers’ assets.

The present attention of the CFPB to retirement accounts is the most recent indicator that we should not consider such tactics to be unthinkable in the United States. For example, in 2010, Senators John Kerry and Jeff Bingaman proposed an “Automatic IRA” program that would have required employers to contribute an amount equal to 3 percent of an employee’s wages into a government-mandated IRA. Unfortunately, as well-intentioned as such a program sounds, it could easily become a tool for ensuring a flow of funds into debt that the U.S. Treasury needs to sell to pay its growing bills.

Byzantine legislation and regulatory agencies with unclear mandates always lead us to ask uncomfortable questions about the future.

To Learn How to Receive the Full Premium Commentary, Please Click the Following Link: Gold Subscription