Last Monday OPEC revised its world oil demand growth upwards given the pace of global economic recovery. "Given the latest upward revision in world GDP, world oil demand growth is forecast at 1.23 bpd averaging 87.3 million bpd in 2011, 50,000 higher than last month's estimate. … The magnitude and the  speed of the world economic recovery will have a remarkable impact on world oil demand this year," it said, adding: "Weather in the northern hemisphere is gaining momentum and has slightly affected the heating and fuel oil demand."

speed of the world economic recovery will have a remarkable impact on world oil demand this year," it said, adding: "Weather in the northern hemisphere is gaining momentum and has slightly affected the heating and fuel oil demand."

Monday's announcement by OPEC was followed up by the IEA on Tuesday which raised its 2011 global crude oil demand for a fourth month citing stronger than expected economic growth. According to the IEA worldwide oil consumption will rise 1.4 million barrels a day, or 1.6%, to 89.1 million a day. The Tuesday revised estimate is 360,000 barrels a day more than it estimated last month. The IEA is calling for OPEC to increase exports by 300,000 a barrel a day to 29.9 million bpd to meet global demand. The IEA is projecting Non-OPEC producers will increase output by 600,000 barrels a day, or 1.1%, to 53.4 million a day this year.

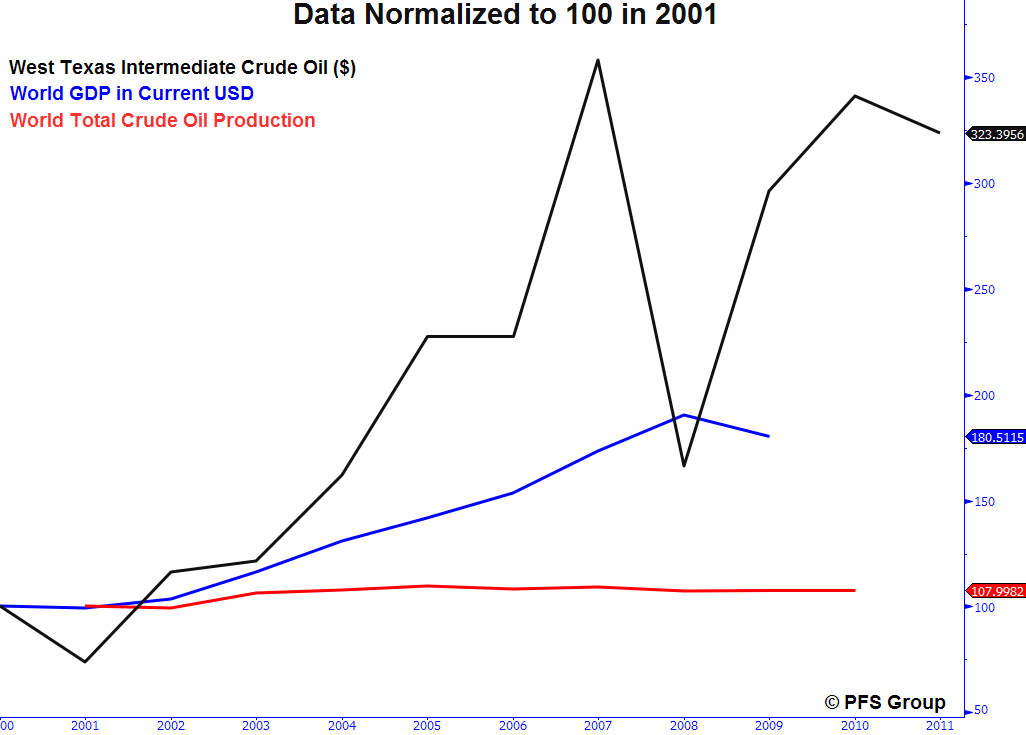

Depending on whose figures you follow demand for oil will increase by 1.23-1.4 million barrels per day as a result of stronger economic growth. If these demand figures hold true, we will surpass the demand levels reached in 2008 when oil prices hit a record of 7 a barrel. As the graph below illustrates, despite a seven-fold increase in the price of oil over the last decade, oil production has remained flat since 2005. As so many of my guests on FSN have commented on, from Robert Hirsh to the late Matt Simmons, crude oil prices have doubled since 2005, yet worldwide oil production has stalled.

Last week oil prices sold off over fears of China's overheated economy. The current thinking in the market is that eventually China's tightening will produce a hard landing which translates into less demand for commodities, especially energy. The day before Bloomberg reported that China may face a diesel shortage this year as refining capacity expansion lags and falls behind the increase in consumption. Demand for diesel used in trucks and power generators may exceed supply by 3.5 million metric tons. Diesel demand is expected to grow by 6.2% to 164 million tons this year. Demand will increase by 6.2% while refining capacity will increase by 5%. This means China will have to go into world markets to purchase additional diesel fuel to help fuel demand. China's oil consumption may also grow by 6.2% this year.

All of this is beginning to sound eerily familiar to what happened between 2007-2008. Back then, like now, foreign central banks were tightening interest rates while the Fed was loosening. Commodity prices, especially oil, were rising as they are today. As demand rose supply was unable to keep up. Due to earthquakes before the summer Olympics, China had to step into the global markets to buy diesel fuels as it is doing today. As spare capacity diminished the price of oil rose and crossed over 0 a barrel. At 0 a barrel hot money flowed into the sector with oil topping out at close to 0 a barrel.

The question that nobody seems to be asking is will OPEC and Non-OPEC producers be able to deliver the extra oil needed to fuel economic growth this year? If supply wasn't forthcoming at 7 a barrel what leads experts to believe it will be forthcoming at less than a barrel. As I am writing, news just hit the wires that oil prices sold off on news that the Saudi's may increase oil production. If they couldn't increase production in the last decade why are we so certain they can do so now?

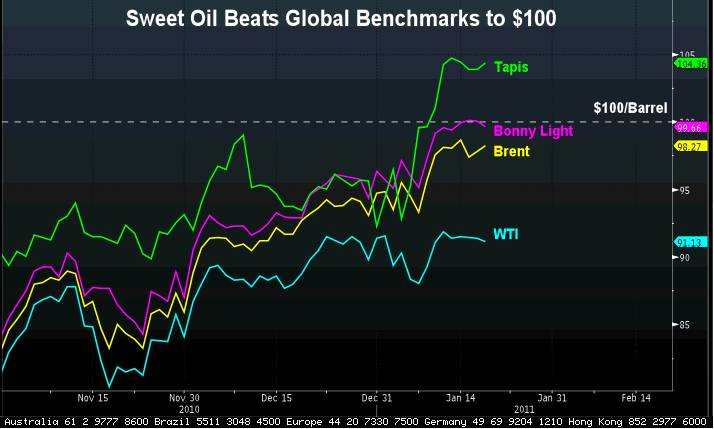

As I suspect, energy prices will play a greater role in determining economic growth in our future. Economic growth rates will no longer be determined solely by central bank policy alone. In our future the ability to access energy, especially oil, will play a more important role in determining economic growth. Since oil prices are subsidized in China and within OPEC the adjustment process will be left to the markets in the form of higher prices. In the west that means we are likely to see 0-0 oil prices this year. I'm guessing that a gallon gasoline will be a reality here in California by summer. We're already looking at over 0 oil prices for light sweet crude. Last week Nigeria's Bonny Light and Malaysia's Tapis rose above 0 a barrel. Iranian Oil Minister Masoud Mir-Kazemi said economic growth in Asia will push oil prices over 0. Mir-Kazimi reiterated the IEA's call for OPEC production to increase by 400,000 barrels a day to 29.4 million because of surging Asian demand. At this point 0 oil seems a given. The bigger question is will we see 0-5 oil before western economies begin to falter.

Higher oil prices also mean higher food prices. The combination of the two could thwart the Obama Administrations plans to revitalize the U.S. economy. Higher oil and food prices are already impacting profit margins for Q4 earnings. Today, McDonalds announced it would raise prices an average of 2-2.5% this year. Cattle prices are up 25 percent this year and corn prices have risen from .50 per bushel in June of last year to .56 this week on the Chicago futures market. In a conference call, Southwest Airlines CEO Gary Kelly said, "Except for fuel, we have a great outlook for 2011." Kelly's comment is a question that, as investors, we should all be keeping in mind this year, "Except for fuel, we have a great outlook for 2011."

Make sure you listen to our show this week as we explore the energy issue in depth on FSN with a panel of high profile experts in the field of energy.