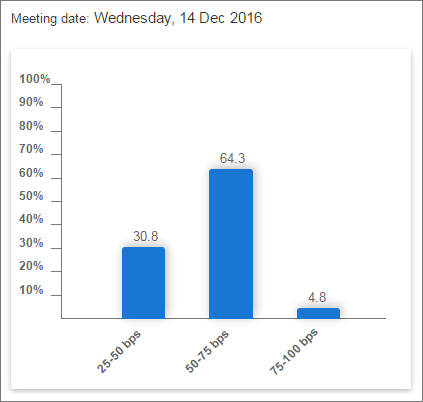

Looking at Fed Fund futures prices, it’s evident that the market is pricing in a rate hike for December. You can see this in the chart below, which shows nearly 70% of market participants expecting the Fed Funds rate to be 25 – 50 basis points higher following that meeting.

But a rate hike is not necessarily a done deal, as a number of factors are working against the Fed’s dual mandate of 2% inflation and maximum employment.

To start with, the Fed uses a theory known as the Phillips curve to describe the relationship between these two aspects of our economy. This theory proposes that falling unemployment pushes up prices and wages, which then requires tighter credit to keep inflation in check.

The theory was developed by economist A.W. Phillips in the late 1950’s, using data from the UK economy from 1861 to 1957.

The Fed’s support for this model is evident from Janet Yellen’s commentary. Back in 2010, she told lawmakers that despite some shortcomings, “the Phillips curve model provides a coherent and useful framework for thinking about the influence of monetary policy on inflation.”

Listen Jim Puplava’s Big Picture: Money Never Sleeps and the Great Reflation

More recently, Atlanta Fed President Dennis Lockhart said, “In the absence of direct evidence that inflation is, in fact converging to the target and in the absence of compelling or convincing direct evidence, I think a policy maker has to act on the view that the basic relationship in the Phillips curve between inflation and employment will assert itself in a reasonable period of time as the economy tightens up.”

The trouble is, the data shows this model is full of holes.

You can see this in the chart below, which looks at the relationship between unemployment and inflation during the expansionary periods in our economy since 1960.

If the Phillips curve was an accurate representation of the link between unemployment and inflation, we should see the lines in this chart generally sloping downward, from the upper left to the lower right.

That would indicate that lower levels of unemployment are associated with higher inflation, and higher levels of unemployment are associated with lower inflation.

But it doesn’t take a trained eye to see the immense amount of noise in this chart and what appears to be the lack of any relationship whatsoever.

Why is this important?

Because one of the primary reasons the Fed wants to raise rates has to do with getting ahead of inflation, which they believe will come on the heels of continued job gains. And if that relationship is broken, it suggests the Fed could be reacting improperly to developments in the economy.

Moving on, even if the Phillips curve relationship holds, recent employment data suggests that the job market is not as tight as previously thought.

Over the last few months, we’ve seen continued job gains, but the unemployment rate has held steady as a result of increases in the labor force participation rate (shown below).

Many people who were previously not searching for work have begun that search, and this is leading to an increase in the supply of available workers. That, in turn, is likely to suppress wage gains, which will result in less inflationary pressure.

Financial markets also have a habit of tightening in advance and on behalf of the Fed, and we’re seeing that play out as well.

Read Market Dynamics in a Rising Rate Environment

This chart of the US Dollar Index shows the recent appreciation in the dollar.

While a stronger dollar can benefit some segments of our economy, it generally has the effect of dampening economic growth and reducing overall inflation. If the dollar continues to remain strong, it may be enough to deter the Fed’s move in December.

Read Raising Rates in November Would Be the Most Apolitical Thing the Fed Could Do

Longer-term interest rates have also been on the rise recently, and this represents a de facto tightening all by itself. The chart below shows the yield on the 10-year treasury rising to near 1.8%, low by historical standards but high compared to the past few months.

Finally, recent developments, including those mentioned above, have resulted in deteriorating economic conditions and a worsening outlook on the economy.

After anticipating over 3.5% growth just two short months ago, the Atlanta Fed’s GDPNow forecast has dropped precipitously and is back to under 2%. If this continues to fall in the weeks and months ahead, it may be yet one more sign that economy is not ready for higher short-term rates.

In conclusion, while most of the market expects and is preparing for a rate hike in December, it’s not a done deal. A change in the narrative of labor markets, combined with a deteriorating economic outlook and tighter financial conditions, makes it anyone’s guess as to whether a rate hike will come to pass.

The preceding content was an excerpt from Dow Theory Letters. To receive their daily updates and research, click here to subscribe.