The competition between China and the US seems to be on everyone's mind these days. We all acknowledge China's rapid growth, its huge currency reserves, and its vulnerabilities in areas like real estate, where house prices in major cities are priced at truly shocking multiples of incomes. The US has its own problems too - most visibly, a huge debt level - both at the sovereign level, and at the household level, and a work force that feels entitled to wages and benefits at many multiples of what Chinese workers earn. Of great importance to the relationship between the two countries, is the mutual dependence. Maintaining our present "stability" requires China to recycle capital back into the US. Chinese bond buying keeps long term interest rates from being forced higher in the face of colossal US borrowing. This recycling effort benefits China too, because it helps to maintain the confidence of American consumers. They continue importing Chinese-manufactured goods at levels which may keep China's factories busy. This later stage, of consumer confidence, may now be breaking down, and so it may upset the precarious balance and recycling operation that has long fueled the global Money Machine.

Image cannot be displayed

The above diagram is from an article I wrote back in October 2005: The Lessons of Grandparent

Not much has changed, except the US housing bubble has burst, so the engine of borrowing is no longer US homeowners, it is the US government itself. Even so, the current structure is more vulnerable, because the debt imbalance has grown far greater, and the jobs are still being created in China, not in the US. How are the inter-dependencies between these two giants going to play out? Should we be worried if China's rapid economic growth is now about to slow down, as Harvard's Ken Rogoff warned this past week?

Several weeks ago, China expert Arthur Kroeber and investment guru Marc “Dr Doom” Faber squared off in a video debate on the question of whether or not China is overheating. Video here: Insider.thomsonreuters.com

I listened to both presentations - They were very good, and I recommend listening.

These types of debates are often seen in the mainstream media. What we are exposed to less commonly is the disdain that some Chinese feel for America, and their great confidence that China is winning the global competition between nations. Here is a crude but effective presentation of some comparative realities:

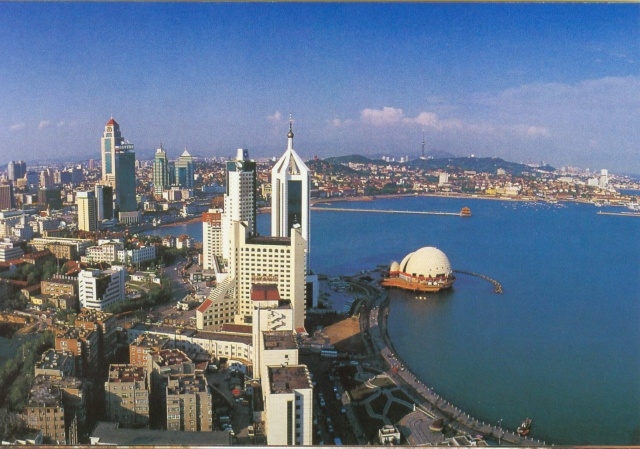

Ha Ha Ha America Part 1 / Quin Dao beats NYC

My thinking after viewing the second video was: How much does China really need its huge export market in the US - particularly when we consider that those exports to the US are often financed with China's own money? If they are going to do "vendor financing" in order to create a market for the output of Chinese factories, why shouldn't China merely provide vendor financing to their own people? - That way, both the jobs and the money stay at home in China, rather than sending their manufactured products and capital to Americans, who have become accustomed to buying cheap Chinese goods on credit. Too many in the West treat the flow of cheap imports, cheap money, and transfer payment, as just another "entitlement" which is their birthright as Americans. (Trust me, I have met plenty who really think that way, and not only in the US, but in Britain and Europe too.) Certainly, China sees the stay-at-home alternative. And they are being pressured by the US to raise the value of their currency. If the go down that path, why should they continue to send capital to the US, when it will simply mean that invested capital in US Treasury bonds will lose value when measured in Renminbi? The stay-at-home solution must be looking more compelling to China.

Of course, US and multinational companies that own or contract from Chinese factories like things the way they are. Many of them are essentially "platform companies" that need cheap products to feed their vast distribution networks in the US and Europe. They might earn 10-20% of the gross revenues, where their cost of sourcing products in China is only 20% or 25% of the end sales prices. For these global companies, the value is in the "distribution network", not in the factories. So they can move their production away from China, if costs are too high. But old habits die hard, especially when they are a profitable business activity. Most multinationals are comfortable in China and want to keep the present circle turning, even though the debt imbalances grow by the day, week, and month. To these companies, the debt problems belong to someone else. (To China perhaps?, since China holds all those dollar reserves. Or to the US tax payers? Who will have to shoulder the debt of their government.) But nothing so dangerously imbalanced can continue forever. And all those expensive distribution networks will be worthless, if the American and European buyers at the end of the long distribution chain suddenly stop buying. So America companies may have even more at stake than China in keeping the current status quo alive.

As we saw in 2008, banking problems can shut-off credit to Western consumers. And we may now be speeding into a sovereign debt crisis, as George Soros and many others have warned recently. Stock prices are gyrating wildly. Westerner consumers may get spooked by a second stock market crash, and stop buying again. Another shock may be enough to wake American people up, and make them realize that they really must change their consumption habits dramatically. Meantime, Europe has already begun its journey towards austerity, led by the new coalition government in the UK.

I believe that China will experience a serious and painful recession...

But meantime, Western economies will slide into depression (!). Eventually, just as we saw in the 1930's, the Western countries will fight the depression by devaluing their currencies... and massively. It may sounds impossible to some, but I think it is conceivable that the US dollar may be headed to 1:1 with the Renminbi equal to one US dollar within the next decade. At that level, the US will import far less from China, and will have to manufacture much of what it needs. Manufacturing jobs will return to the US, but the US living standard will be drastically reduced - perhaps in a true rerun of the Great Depression, all the way back to the levels of the 1960's or 1970's. But there will be one huge change : With a weaker dollar and a much higher dollar oil price: The US will no longer be able to afford to import so many millions of barrels of oil. Bye, bye to the American suburbs. This is a huge and genuine risk that few are prepared for.

The very wasteful American dream will have to be restructured, at long last. The world cannot afford the American dream. There simply are not enough resources to maintain wasteful consumption on such a scale. Not globally. And not even in America. And especially not in a future where America will have to produce actual goods to pay for its oil imports.

A second recycling operation, rivaling the Chinese recycling of dollars, was the one that the US has done with oil producers. In 2008, when the Oil price hit 7. the US was importing about 10 million barrels per day. At that peak price, that's almost .5 Billion per day of oil. Had prices remained there, it would have been over 0 Billion dollars per annum, a much larger import bill than the US had with China and the Far East. Falling oil prices have cut that bill, and at today's -75 per barrel, the oil import bill is about half the peak levels. But it still remains uncomfortably high. We cannot expect oil producing nations to go on recycling those dollars into government bonds and American assets, when the dollar is falling. The Oil exporters will not want to see their wealth eroding any more than we can expect China to build up dollar reserves forever.

The suburban dream was sustained for a few extra years, because oil exporters accepted American dollars for their oil. But they won't do that within a few short years. They will want real value, in goods and resources for that oil. America will have to live with less oil, and pay very high dollar prices for that reduced quantity of oil, as more and more of the scarce oil will go to China, India, and other emerging countries. Those countries with stronger economies and stronger currencies, will be the ones that get the scarce resource. Some may think that the US can go to war, to take oil it needs to sustain its current wasteful oil addiction, when it can no longer afford to pay for the oil. But that's a soundbite description of what happened in Iraq. One can believe that the US is now smart enough not to repeat that mistake, and probably it is now too poor to carry on a global resource war.

America's leadership is looking backwards. They are trying to restore a dream economy that stopped making sense many years ago . America lost its edge when rest of the world began to catch up, and the trade balance deteriorated. The dysfunctional decisions of America's leaders are simply squandering America's wealth. And many Americans realize that now. The tea party sees it clearly: as the debt burden rises, the private economy shrinks, and the public sector is the only part growing to replace it. This is unhealthy. Wealth is not created in the public sector, it is spent there.

Champagne-sipping economists like Paul Krugman may think that they can save the America economy from a depression by keeping the debt-induced party going, but the bills are being tallied even as Krugman calls for another round of spending. Even the average voter is realizing that the party can not go on forever. The prescription of massive stimulus was tried already in 2009, and it brought a few months of growth, but not the right type. The growth was unsustainable. Public sector employment grew, and so did the debt, the taxes, and the size of the future headaches. Krugman and the political leaders that listen to him now have a growing roster of critics. It seems unlikely that the snake oil can be sold again.

Maybe a painful depression is necessary, to bring reality home to America's political leadership. They need to start thinking in new ways: about deep cuts in spending, and putting Americans back to work within the private sector. These ideas are already being implemented in some other countries like Ireland and even Britain are beginning to address the real issues, rather than just "kicking the can down the road." It will be painful. Worse than most people can conceive of. And it will require a huge adjustment in exchange rates and standards of living. Few are making the life-changing modifications to their way of living that is really necessary. It is time to begin the adjustment, even if our leaders are slow to lead us that way.

..

Personally, I am waiting for reality to hit, and doing my best to invest my money in places where I expect my wealth to survive the coming tsunami. I have stopped dreaming. I am wide awake now. The sea pulls in upon itself, and the coming wave is sucking in its weight to wreck its damage. Both in the currency markets, and in the realm of our psychological expectations.

These moves come in waves, and the one I am anticipating, means that I will soon be buying puts on SPX, SPY, and QQQ. I may also be buying leveraged "short side etf's" - instruments like SDS, and BGZ (or calls on them). I reckon that a stock market slide could initially help the dollar, so the rally in the Greenback may not be over yet. But when the dollar fails to benefit from falling stocks, then it will be time to consider shorting the dollar by purchasing puts on UUP. And I will be watching bonds too. They typically benefit from falling stocks. But a new dynamic is possible, sometime in the next year or so: We may see rising rates, and a stock market that falls as rates rise. Asset prices like stocks and property are clearly vulnerable to rising rates. As stated above the US has been "dependent on the kindness of strangers" in China, Japan, and the Middle East. If they become less kind, and stop buying - or worse yet, start selling US dollar bonds, then I will want to be short Bond etf's like TLT. Another possibility would be buying calls on TBT, an leveraged etf, that moves in the inverse direction to TLT.

Interesting times lie ahead, and one should have an action plan before the tsunami hits again.

Trading instruments: SPX, SPY, QQQ, SDS, BGZ, UUP, TLT, TBT