Interview with Odysseas Papadimitriou, CEO of CardHub, on their latest study examining the accelerating increase in credit card debt levels and why he thinks this is unsustainable and may soon “spiral out of control.” Subscribers can access the full broadcast on Thursday by logging in and clicking here. Not a subscriber? Click here.

Forgetting Lessons of Great Recession

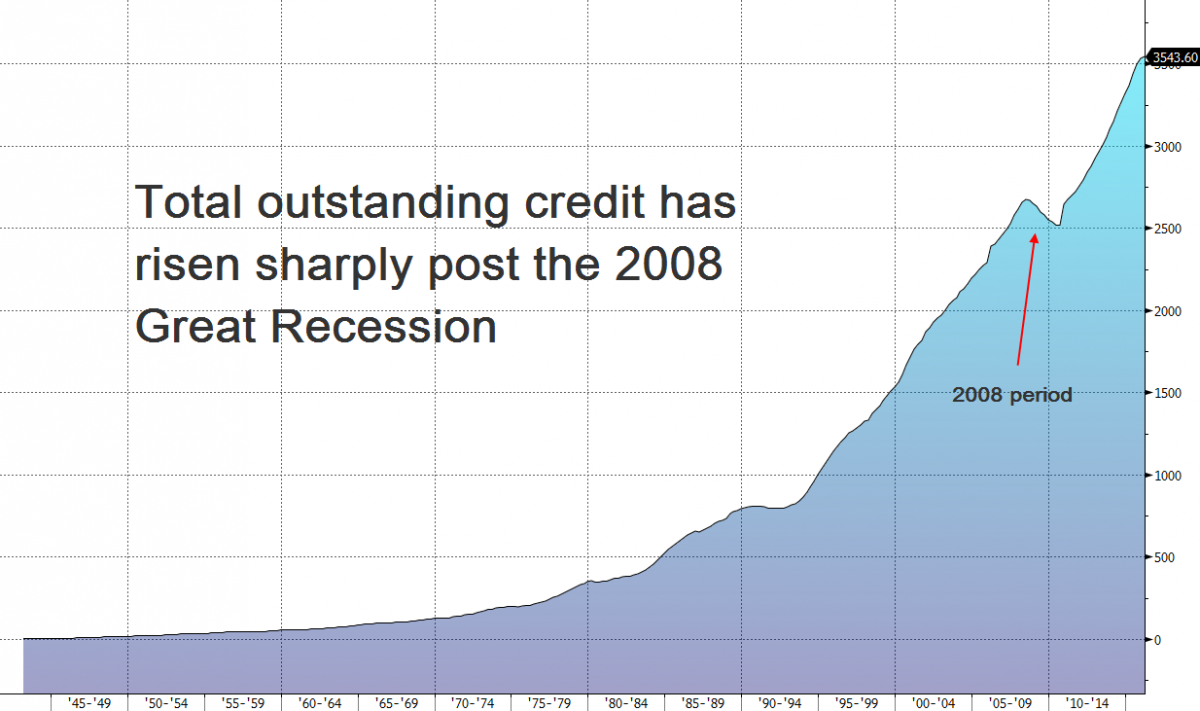

"A lot of consumers have forgotten the lessons of the Great Recession and, as a result, they are hurting their finances. It's not that they are in trouble and they need to spend in order to pay their bills or stay afloat—I do not think that's the case. I think it's the opposite. They are optimistic, they are happy, they have forgotten the lessons of the Great Recession and what too much debt does to a household and for the nation overall and, as a result, they are taking on more and more debt and they are deteriorating their finances to the point where it won't be sustainable for too much longer."

“In 2015, we accumulated almost $71 billion in new credit card debt. And for the first time since the Great Recession, we broke the $900 billion level in total credit card debt so we are back on track in getting to $1 trillion...these numbers are huge and a lot of people cannot comprehend (just how big they are)..."

Credit Card Debt Accelerating

“What we have been seeing is...things are just getting worse. So, it seems like every quarter that passes the increase we have in credit card debt is bigger than the increase we had a year ago or two years ago...

We are accelerating our appetite for credit card debt and that is consistent with human nature since we have a short memory and have forgotten about what happened and so the more time passes by, the more we forget and the more of an appetite we have for credit card debt.

It takes two to tango and, in this case, it is the consumers and it is the banks. If consumers don't want to spend, then credit card debt doesn't go up. If consumers want to spend but the banks won't give them the money, then credit card debt won't go up either. In this case, we have both wanting to tango: consumers want to spend more and banks look at those historically low charge-off rates, project them out, and they conclude that it is a sound lending practice to continue to lend to those consumers."

Debt Spiral

"The funny thing about credit card debt is that it's a little bit like musical chairs where everything is going well as long as there is music playing, but as soon as the music stops, some people are left standing...

What happens with debt is that everything is nice and rosy as long as you can afford the monthly payment...but then all of a sudden you reach the point where your debt is so high you can no longer afford the monthly payment on some of your credit cards or on some of your loans. And when that happens it spirals out of control extremely fast...”

Listen to this full podcast interview airing Thursday with Odysseas Papadimitriou, CEO of CardHub, by logging in and clicking here. Not a subscriber? Click here.