While the stock market appears to be brushing off the shock of UK’s momentous vote to leave the EU last week, a large number of concerning economic trends were recently discussed on our podcast between Chief Investment Officers Brian Pretti of Capital Planning Advisors and Chris Puplava of our parent company, PFS Group.

For subscribers that have not yet heard the podcast, see Brian Pretti: Expect Continued Market and Economic Volatility on our site or Wednesday’s 6/29 podcast.

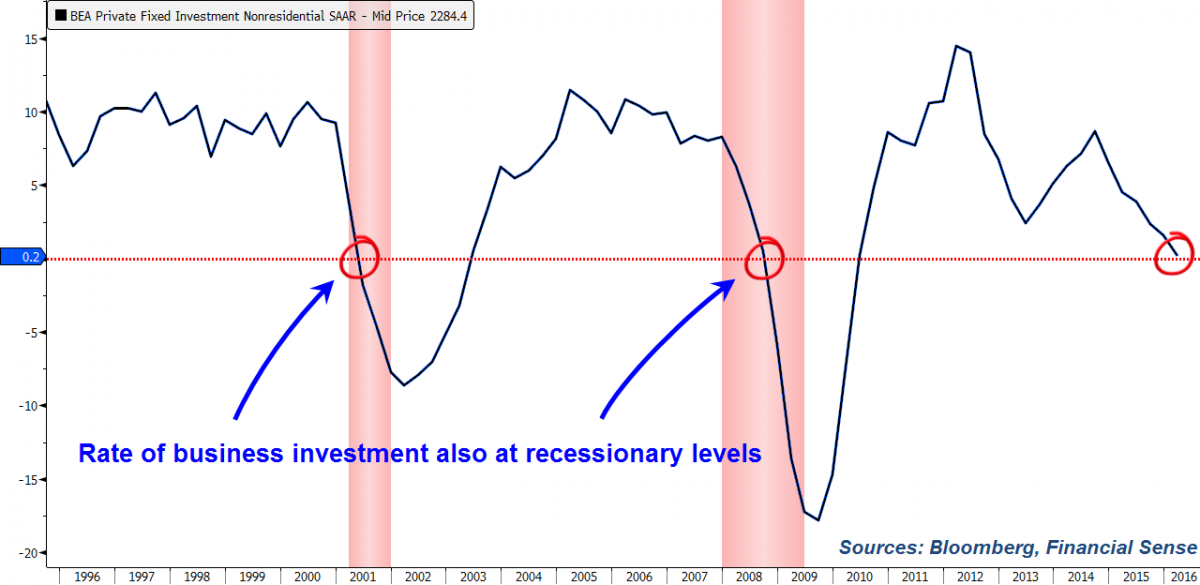

Here are some of the charts and economic trends they discussed that have them concerned about the current market environment:

Brian Pretti: "The world's not coming to an end here but if we look at the really big macro numbers, especially personal consumption expenditures and the rate of change in that thing, it's been wildly subdued in this cycle probably unlike anything we've seen in 50 years; and, again, that says a lot to me about the high end of the economy doing okay but middle and bottom of the economy not doing well."

Pretti: "[Businesses] are taking steps right now and...they have an uncertain future outlook. Given this environment, one of the comments from a lot of business owners is 'we've never seen anything like this before' in terms of the macro. To hear them say that—not that this should be surprising by any means—because when we look at the capital spending numbers over the last years...there's not a lot of new business spending going on to support new jobs and at the same time these business owners are fully cognizant of the numbers in their own businesses and now they're reacting and now they're taking action to protect these margins just given the uncertainty they see ahead."

Pretti: "We all know that what the central bankers have wanted to do is take away a safe rate of return and basically force capital into the equity markets, into the real estate markets, etc.—the whole belief in the wealth effect. Well, what we've ended up with is...Buffett's market cap to GDP [indicator] at second highest valuations we've ever seen. We'll be moving into six straight quarters of down S&P earnings right now and yet the markets hold up because, again, the central bankers have promised they'll do anything while the fundamentals tick away."

And here's the same chart zoomed in showing where global liquidity went negative in July of 2015 a month before the S&P 500 saw its first initial double-digit correction. As Puplava notes below, global liquidity levels are now lower than they were when the S&P 500 plunged at the start of the year.

Puplava: "If we weren't having the amount of activism we have currently with central banks, I think we very well could be in a bear market right now. Some of the things I'm looking at are liquidity. One of the indicators I like is the Bank of America Global Liquidity Tracker and when that's below zero, that's money flowing out of the system and when it's above zero that's money flowing into the system... it's been negative since the mid-part of last year when we had the Chinese devaluation in August and it remains negative. Not only that but it hit a new low recently where it is now lower than it was in January and February..."

Access this full conversation with Chief Investment Officers Chris Puplava and Brian Pretti by clicking here. Want to listen to the BEST financial podcast on the web 3 days a week? Click here to subscribe