Gold is back in a new bull market as governments around the globe have moved to a new stage of desperation by toying with the idea of "helicopter money," Incrementum's Ronald Stoeferle told Financial Sense in today's podcast.

Stoeferle co-authors the widely read In Gold We Trust report, which has been published each year since 2006, and discusses its key contents, including his long-term outlook and price target for gold, in today's interview.

Here's what he had to say on the topics of inflation, "helicopter money," gold, and more:

What is your outlook for gold now that we've seen it break free from a multi-year downtrend?

"I think that gold is back in a bull market—that's definitely one of the strongest points I'm making in this report, which is quite lengthy. It's roughly 140 pages so I tried to really deliver the holistic view with not only supply-demand [analysis] but also currency markets and the very important interplay between inflation and deflation, interest rates, credit spreads, etc.

So, one main takeaway from the report is that gold is back in a new bull market and I think that in talking to institutional clients the last few months, everybody missed this huge move in the first quarter—gold had the strongest quarter in more than three decades—but nobody was really participating because when we think back to January 2016, everybody was bearish gold...

[A]t the bottom it was something between depression and desperation and selling panic and now...quite a lot of highly successful fund managers—David Einhorn, Steve Druckenmiller, George Soros, and so on—they all piled into gold in the last couple of months and so I think that we are on the verge of going into the second phase, which is the public participation phase when all the market analysts upgrade their price targets for gold, when everybody is becoming a little more upbeat regarding mining stocks, people become concerned regarding inflation, and so on..."

Scroll down to read more of his comments or click to hear a preview of his interview below. Subscribers can access the full audio by clicking here or via podcast on their mobile device.

Party Only Just Beginning

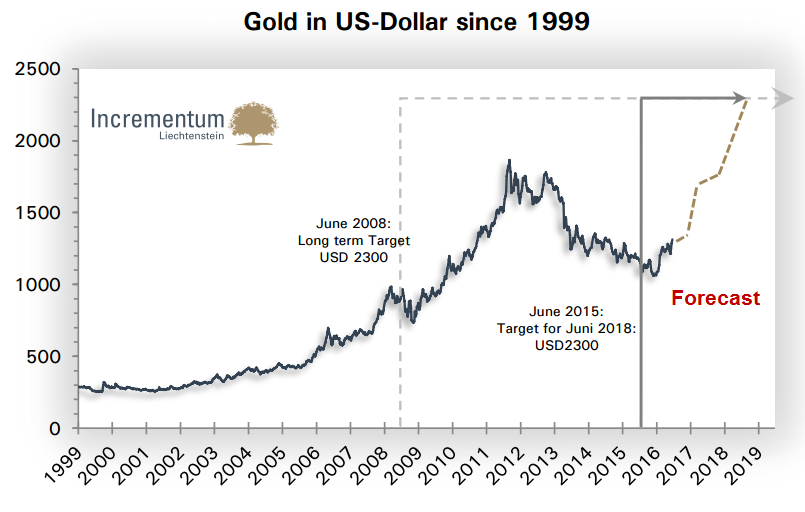

"I think we are at the beginning of this phase and my long-term target has always been ,300, which is the inflation-adjusted all-time high because normally in a big bull market you take out the inflation-adjusted all-time high and I think it's going to be like this again. Perhaps we'll have to raise our price targets—at the moment it still seems very, very high—but remember back in 2011 all the main Wall Street banks had price targets for gold between ,500 and ,000 or even more, so I think it's still kind of contrarian to be very, very positive on gold and I think we are only at the beginning of this party."

Inflation Picking Up

"Central bankers all over the globe are really desperate to create higher price inflation. As you know, my background is not only from the country of Austria but also from the Austrian School of Economics so, from my point of view, we are already seeing massive inflation. We are seeing monetary inflation and we are seeing asset price inflation but we don't see price inflation yet [however] it's going to happen and we are already at the beginning of that...

Our Incrementum inflation signal is showing massively rising inflation since March. We're seeing quite a lot of US inflation indices also rise. For example, the sticky prices index and also the median consumer price index—they are all rising now [which is important since]...rising price inflation or falling real interest rates are probably the most important driver for the price of gold..."

Helicopter Money

"The idea of helicopter money would be to circumvent banks and to directly inject money into the bank accounts of people who then spend it and create higher inflation and higher growth. Of course, if you know history and you know common sense you will know that this is a measure that cannot heal anything—it just buys time. On the other hand, for gold it would be the time for gold to shine if helicopter money would be implemented...

We are absolutely certain that sooner or later helicopter money will be implemented and it will not be called helicopter money but they will come out with a very sophisticated name, perhaps 'dividend for the people' or 'people's QE'—something like that. I'm absolutely certain it will happen but it will not have any positive effects. It will create some sort of growth and of course inflation but only for a very, very short time and it will be positive for gold..."

To listen to this entire podcast interview with Ronald Stoeferle and others, log in and click here. Not a subscriber? Click here