Do a Google search for Basel III, gold and tier 1 and you will see a lot of bullish chatter about banking regulations and moving gold from tier 3 to tier 1 or quasi tier 1 status. Gold is being brought back, at least in part, into the global financial system as money, ending the argument that it has no utility.

For additional analysis on this topic and related trades, subscribers go to Russ Winter’s Actionable. The subscription fee is $69 per quarter and helps support Russ’s work on your behalf. Click here for more information or to subscribe.

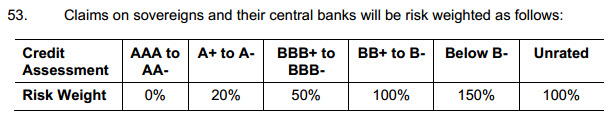

Basel III (and Basel II) divides bank assets into three risk categories (credit, market and liquidity risk) and weights its risk depending on its attributes. Gold is “zero percent risk-weighted” in terms of credit risk. This is a huge upgrade for the metal. Delving into the nuances, gold still has “market risk” stemming from its price fluctuations. This means capital must be marked to market. Physical gold is not treated the same as cash or AAA to AA- sovereign bonds when it comes to calculating its Tier 1 ratio. The market risk will only be negative if the value of the price of gold (POG) drops.

But what happens if POG takes off? Then well-positioned banks would see a boost in capital. The chance of getting a capital boost holding the assortment of faux, central-bank-inflated, “higher-rated,” no-return sovereign bonds is nearly zero. How much upside is there in a two-year U.S. Treasury yielding 25 basis points? The fact is that in a steep sell off, liquidity would erode fast. Some may argue that banks won’t make a directional gold bet using their equity as the buffer. I would argue that they make directional bets with currencies and bonds every day.

I believe that once the POG train leaves the station, banks will do the calculus and respond accordingly. Eric Sprott describes it thusly:

If the Basel Committee decides to grant gold a favourable liquidity profile under its proposed Basel III framework, it will open the door for gold to compete with cash and government bonds on bank balance sheets – and provide banks with an asset that actually has the chance to appreciate. Given that US Treasury bonds pay little to no yield today, if offered the choice between the “liquidity trifecta” of cash, government bonds or gold to meet Basel III liquidity requirements, why wouldn’t a bank choose gold? From a purely ‘opportunity cost’ perspective, it makes much more sense for a bank to improve its balance sheet liquidity profile through the addition of gold than it does by holding more cash or government bonds.

Basel III will also be adding an entirely new layer of regulation concerning the relative liquidity of the bank’s assets and liabilities. This is a little unclear at the moment, but it suffices to say that gold’s status will be upgraded even if not all of the way to a zero-risk rating. On this topic, Eric Sprott wrote:

There is a strong chance that this liquidity definition for gold may be changed. The World Gold Council has in fact been lobbying the Basel Committee, the Federal Reserve and the FDIC on this issue as far back as 2009, and published a paper arguing that gold should enjoy the same liquidity profile as cash or AAA-government securities when calculating Basel III’s LCR and NSFR ratios. And as it turns out, the liquidity definitions that will guide banks’ LCR and NSFR calculations have not yet been finalized by the Basel Committee. The Basel III comment period that ended on October 22nd resulted in the deadline being pushed back to January 1, 2013, and given the recent delays with the US bank regulators, will likely be postponed even further next year. Of specific interest to us is how the Basel Committee will treat gold from a liquidity-risk perspective, and whether they decide to lower gold’s liquidity “haircut” from 50% to something more reasonable, given gold’s obvious liquidity superiority over that of equities and bonds. The only hint we’ve heard thus far has come from the World Gold Council itself, which suggested in an April 2012 research paper, and re-iterated on a recent conference call, that gold will be given a 15% liquidity “haircut”, but we have not been able to confirm this with either the Basel Committee or the FDIC.

Regardless of the final nuances on liquidity, it’s clear that gold’s money status under Basel III will be significantly enhanced. Banks are looking for collateral and each credit downgrade removes more of it. Gold is logical, even if it is not given the exact same footing as AAA to AA- sovereigns.

But for some countries, gold will be given not a 15% haircut but equal footing. A BIS document describes aspects of this that may clarify some of the confusion. The BIS uses the term “national discretion,” which I interpret as giving Basel III national supervisors a choice or an option on the matter. The document clearly states that actual bullion (not paper derivatives) can be treated as cash and therefore risk weighted at 0% at the discretion of the national supervisors. Then, over the last several weeks, comes this news, which was virtually ignored by the mainstream media:

The Basel Committee it had been actively monitoring “on a continuing basis” the progress of members in implementing the Basel III package of regulatory reforms, as well as the implementation of Basel 2 and Basel 2.5. ”The number of member jurisdictions that have published the final set of Basel III regulations effective from the start date of January 1, 2013 is 11. These include Australia, Canada, China, Hong Kong, India, Japan, Mexico, Saudi Arabia, Singapore, South Africa and Switzerland. Turkey will issue draft regulations early in 2013.

A number of the countries mentioned in the article have been making the gold-as-money transition all along. Turkey has even gone so far as to demand an increase in the proportion of gold held by its commercial banks as part of its reserves. China’s central bank has openly called for gold to be a part of a basket of assets used to support a new super-currency. China has encouraged citizens and institutions to hold gold, and it has imported and produced large quantities gold over the last two years. I see little doubt that banks and national supervisors in that country will be taking advantage of the 0% risk re-tiering advantage. Basel III goes a long way toward removing the “few attractive options” one constantly hears about China. Now, it has a clean option. In fact, for Chinese, ridding inflated faux sovereigns and goosing a price explosion in gold would recapitalize its banks overnight.

Countries like India have citizens with vast stores of gold. For that country, the liberal weighting also makes total sense. Therefore, many if not most of the aforementioned 11 counties will go with the liberalized 0% risk weighted rule for gold. This is also an important step toward diversifying exposure away from the same-ol’, same-ol’ faux-rated sovereigns. It might also cause an asset bubble in gold, but that’s a topic for another day. It could look like what Grant Williams describes in this presentation: a pricking of the bond bubble and a new bubble in gold.

12. Other assets

81. The treatment of securitisation exposures is presented separately in Section IV. The standard risk weight for all other assets will be 100%.32 Investments in equity or regulatory capital instruments issued by banks or securities firms will be risk weighted at 100%, unless deducted from the capital base according to Part 1.32However, at national discretion, gold bullion held in own vaults or on an allocated basis to the extent backed by bullion liabilities can be treated as cash and therefore risk-weighted at 0%. In addition, cash items in the process of collection can be risk-weighted at 20%.

Source: BIS Capital Requirements

With the Jan. 1 Basel III deadline quickly approaching, it’s not surprisingly the faux AAA rated countries, such as the U.S. and in Europe, are trying to delay its implementation. The issue is not the greater value being put on gold, as it even behooves banks not using Basel III to adopt this as it opens up a “freebie” in terms of capital. Unfortunately, virtually no U.S. banks hold gold, so that is not likely soon.

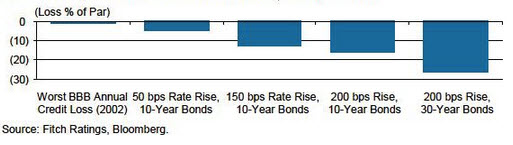

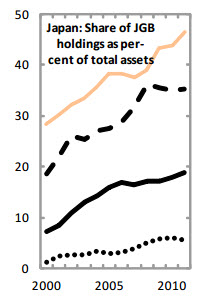

The real issue is diminished value from other assets, including downgraded sovereigns (see next chart). For instance, BBB+ rated Italy would be subjected to a 50% risk haircut (the same as gold under the old Basel II rules). Spain is at BBB-, so one more downgrade to BB+ would place the haircut at 100%. Here is where one can track Standard Poor’s rating system for countries. Of particular interest is Japan’s faux AA- rating, which means under Basel III a downgrade to A+ would require JGB to be risk weighted at 20% instead of 0% – a big event (see Setting up the Japan Panic Trade). Japanese banks hold 20% of all the outstanding JGB debt.

Another issue is that as the downgrades grind on bank capital is being eroded. As Basel III takes hold, there could be a tipping point where specific sovereign bonds — and sovereigns in general — are dumped in favor of gold. It’s ludicrous to expect the global banking system to regain footing through the increased ownership of central-bank-inflated, near-zero-interest government securities subjected to ongoing credit downgrades. Banks have been buying bonds because they have been forced to, not because they want to. QE combined with credit downgrades actually removes even more faux Tier 1 capital from the market (i.e. U.S. treasuries, etc). Since there are less near-zero-bound Treasuries to go around, banks globally need to find other Tier 1 capital. Gold will now offer banks a better alternative. If anything, we are now at a time when banks should do their utmost to avoid sovereigns bonds before the biggest “crowded trade” of all time begins to unravel itself. Even a modest 3% a year migration away from counter-party debt to unencumbered gold in all the commercial bank tier 1 capital in the world, would be about 2,500 tonnes of gold a year at current prices, or all of annual mine production.

Source: WallStreet Examiner