Details of the GOP tax reform bill have been released and what we’re finding is that it has the potential to impact taxpayers in several important ways, especially depending on where they live.

This time on Financial Sense’ Lifetime Income Series, Jim Puplava talked about what we can expect to see if tax reform passes.

For related podcast, see Tax Reform – Urgent – Call Your Advisor!

Tax Brackets Are Shifting

Historically, Republicans have focused on getting rid of deductions and Democrats have focused on raising tax rates. This can be good to an extent, but often, we’ve seen deductions taken away, only to see tax rate increases shortly thereafter.

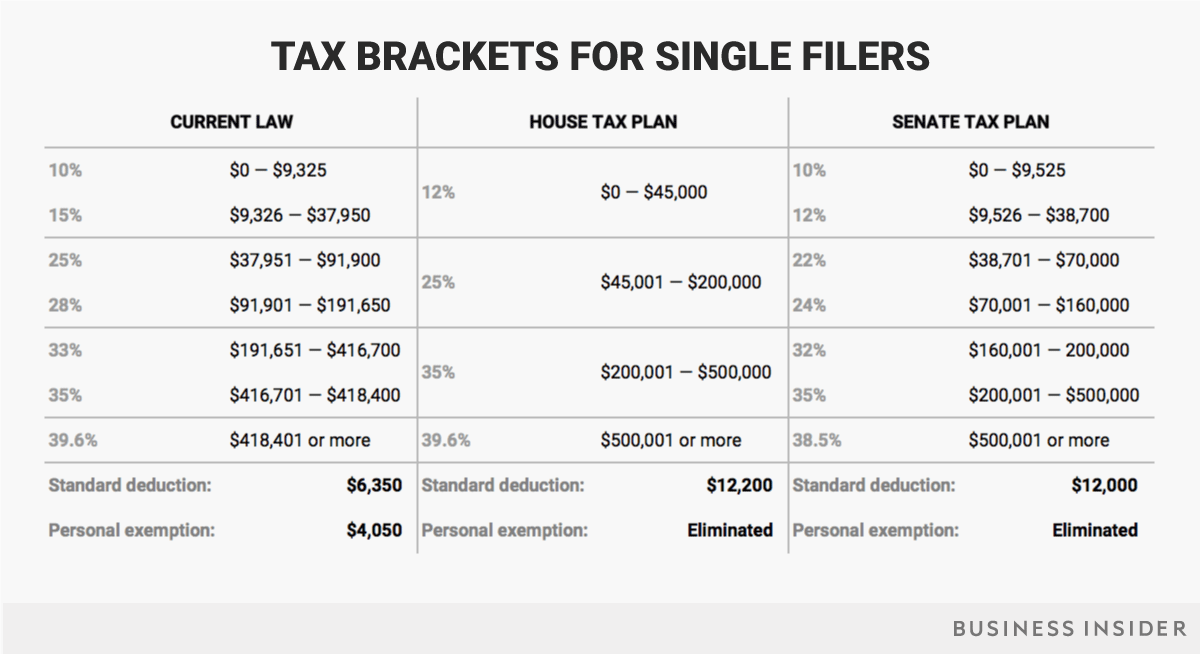

This bill does several things, Puplava noted. First, under the House version, two tax rates are actually raised. Those in the 10 percent tax rate bracket are bumped into the 12 percent bracket, and those in the 33 percent bracket are bumped into the 35 percent bracket.

Two tax rates actually fall: the 15 percent rate drops to 12, and the 28 percent rate drops to 25 percent.

The favorable part is that this bill raises the range in which these brackets kick in. For example, if a person is single, the first ,325 in earnings is taxed at 10 percent. Under this bill, you would get bumped up to a 12 percent rate, but that 12 percent rate would apply to the first ,000 in earnings, Puplava noted.

If you’re married, the range on the first 12 percent goes up to ,000. That would help a lot of families out because the 10 percent bracket right now is only up to ,650. The 15 percent bracket is up to ,900. The 25 percent tax bracket would start at basically up to 0,000, versus 3,000 today. There would be a big break there, Puplava noted.

The 28 percent bracket would be lowered to 25, and the 33 percent bracket gets bumped to the 35 percent bracket, but it’s essentially on income of over 0,000, so there’s also a big break there as well, Puplava stated.

Deductions Going Away

The Republican plan eliminates most itemized deductions. Medical deductions would be gone, as would property and casualty deductions, Puplava noted. Miscellaneous deductions and state taxes would also be eliminated. Both property tax deductions and mortgage interest deductions would be greatly reduced.

“It really depends on where you live,” Puplava noted. “This bill is not uniform. It’s going to impact individual investors much differently depending on where they reside.”

The main issues impacting retirees are the elimination of medical expenses, the reduction of the home mortgage and property tax deductions, and the elimination of the state income tax deduction.

For example, if we look at the mortgage deduction, under current law, taxpayers can deduct interest up to million on a first mortgage and 0,000 on a second mortgage. This bill reduces mortgage interest deduction to 0,000.

Another item that is related to this is the reduction of the property tax to only ,000. Several states have a 2.5 to 3 percent property tax rate, and if you own a 0,000 home, at 3 percent property tax, there’s ,000.

“The combination of mortgage interest reduction and property tax reduction would really impact homeowners,” Puplava said. “This could hurt the real estate market, and they don’t realize this. A lot of people are surprised, given the fact that most of Trump’s wealth is in real estate.”

Another big issue facing retirees, especially as they age and their medical bills mount, is that they’re going to lose their ability to deduct medical expenses.

“It’s really surprising how this is going to impact a lot of individuals,” Puplava said. “We’re finding out more and more that this is not a favorable tax bill for individuals.”

How to Plan for Estate and Retirement Tax Issues

The reality is, some taxpayers may have to leave high-tax areas.

“If you live in a high-tax state, in an expensive place to live such as California or New York, the best advice I can give you is to move,” Puplava said. “This is going to impact you. California has a taxpayer exodus right now, with companies and individuals.”

If this bill passes, this trend is going to accelerate, Puplava predicted. Last year, California lost 100,000 taxpayers, and over 2,000 companies in the last couple years.

“This is putting the state in danger of a fiscal crisis in the next recession,” Puplava noted. “If this bill goes through, that’s very well what you could see happen to California.”