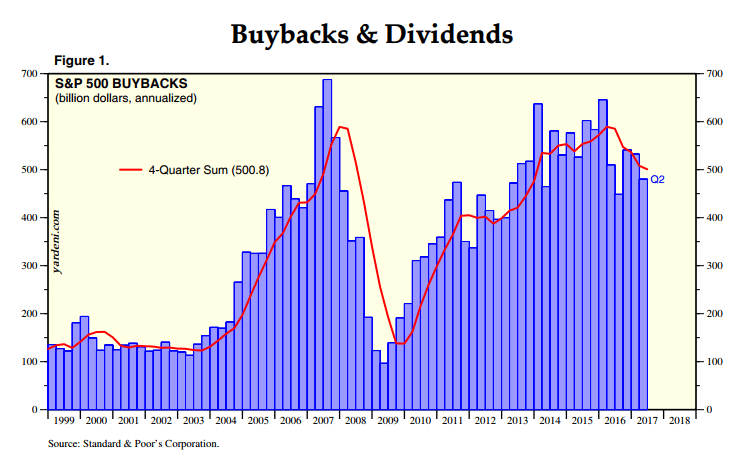

The latest US Federal Reserve data confirms a decided 2017 trend: Stock buybacks are generally trending down. The latest data from the Fed confirms several data points, including that from TrimTabs and Yardeni research. But there appears to be one dissenter to the trend: financial stocks.

Source: Yardeni Research

Using debt to finance “equity redemptions” in the form of stock buybacks has been a controversial maneuver in some quarters. The financial engineering measure boosts short-term gains while adding leveraged exposure to the company’s share performance. Fundamental critics have argued that such capital should be deployed to invest in research and development, production innovation or other long-term investments that boost the business case over the long term.

Regardless of the critique, S&P 500 buybacks have been on a downtrend since 2016, according to Yardeni research. In 2007, just prior to the global financial crisis, stock buybacks had climbed precipitously, almost touching 0 billion annually. In the wake of the financial crisis they feel dramatically to just over 0 billion annually – mirroring the low point in the stock market and buybacks.

While companies might have benefited most buy purchasing their stock at a low point, what happened is that as confidence grew the confidence in financial engineering in the form of stock buybacks grew to double top in the first quarters of 2014 and 2016. That trend is now declining, and the Fed data confirms the drop, as just over 0 billion share buybacks occurred in the second quarter.

But at this point the turn isn’t one that should be cause for alarm among those who consider buybacks to have a positive correlation with stock price.

The recent Fed Flow of Funds release points to a credit cycle that hasn’t turned and corporates not using leverage as much.

The recent Fed data is correlated with information from TrimTabs. The data pointed to only billion in stock buybacks for the second quarter, after jumping from a high of 7 billion in the second quarter of 2015.

During the second quarter stock buybacks were at 2.6 per day for .3 billion total, the lowest volume of buyback announcements since the second quarter of 2012.

During this second quarter only four companies, Walgreens Boots Alliance, Aflac, eBay, and Fidelity National Information Services, announced buybacks of more than billion.

“Corporate America is shutting its wallet as stock prices reach records,” said David Santschi, CEO of TrimTabs. “Corporate leaders may be losing faith in the Trump administration’s ability to deliver on its promises and worried about the impact of less central bank support for asset prices.”

There is one area where the buyback is alive and well, however. Financial sector financial engineering is continuing at a high rate, a Bank of America report noted.

By Mark Melin