I listened to Big Ben yesterday and what I heard is a guy who's on the defensive. He spent most of his talk describing in some detail why the Federal Reserve and its cheap money policies of ZIRP and QE have not added to the inflation picture.

IMHO Ben should have stepped up to the plate and said to the world that in fact his policies have contributed to inflation. He should have confirmed, what we already know, the objective of current monetary policy is to stimulate inflation. After all, the idea that zero interest rates do not contribute to inflation is, well, a dumb idea that has no basis in fact.

While Ben was doing his best to convince the suckers that believe in his drivel the NY Fed was publishing a blog that concluded quite the opposite. (Link)

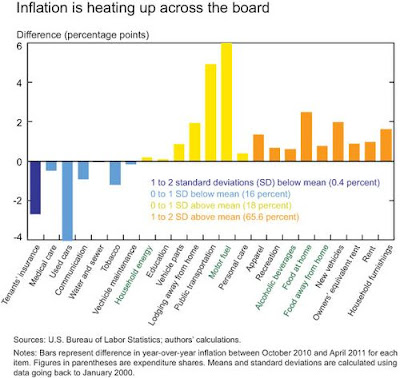

The title of this chart from the report says it all:

The report looks at what is rising in price. It equates it to what we actually consume. For example, while the fact that Tenant’s Insurance has fallen in cost is important to the CPI, it has little to do with what we actually spend money on. The conclusion from the NY Fed:

84 percent of all expenditures in the CPI basket were on items that experienced above-average increases in inflation in the last seven months.

The bottom line is that Ben can’t fool me. He can’t fool the economists at the NY Fed. He can’t fool the market. So just who is he trying to fool? I think he is trying to fool himself.

Source: BruceKrasting.blogspot.com