Currently, our fundamental concerns primarily center on the possibility Portugal will become the market’s next target soon after some bailout is finalized in Ireland. Eventually, market participants will come after both Portugal and Spain; the question is how much time will the Ireland bailout buy the markets. We will need to keep an eye on Europe for the foreseeable future.

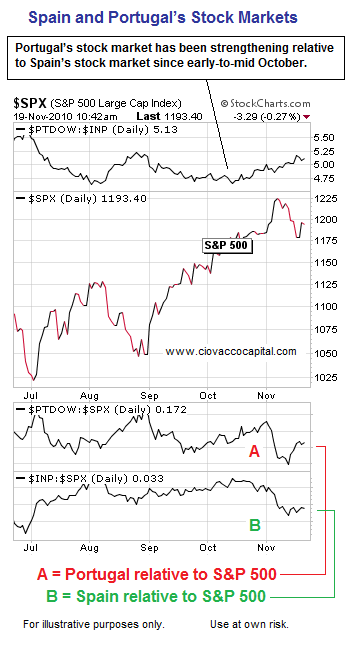

The bond markets are properly the primary focus in Ireland, Spain, and Portugal. However, their stock markets can also help us better understand the acceptance of, or aversion to, risk in those local markets. The bond markets tell us Portugal is weaker than Spain. The fact the stock markets are painting a slightly different picture is a development worth monitoring. As long as the A (Portugal) and B (Spain) lines in the chart below are rising, then risk aversion is not high in those markets relative to the S&P 500. If the A and B lines below continue to make lower lows over the next few weeks, it would add to our concerns about global risk assets in general.

Stocks in Portugal recently found some buyers at a logical point on the chart below. Portuguese stocks have some signs of increasing strength in the short-term.

Stocks in Spain have also bounced at a logical point recently, but they look more vulnerable than their Portuguese counterparts.

Back in the U.S. on Thursday, jobless claims came in better than expected, leading economic indicators increased by 0.5%, and the Philly Fed survey came in way above expectations. The Philly Fed number represented the 7th largest increase on record.

The chart below is a weekly chart of the S&P 500 ETF (SPY) as of 9:50 am on Friday (11/19); it can help us better understand the probable downside risks over the next two weeks. Several forms of possible support intersect near 114.90 for SPY which is roughly equivalent to 1,145 on the S&P 500. If 114.90 does not hold in SPY, then 109.98 becomes important (roughly 1,198 S&P 500). SPY also has some support near 119.25.

1,145 and 1,198 on the S&P 500 align well with the longer-term detailed analysis in How Far Could Stocks Fall? (FSO) We are working on a similar long-term analysis for the gold ETF (GLD). FSO readers may also benefit from scanning the basic concepts in Risk On Trade May Be Back; especially comments related to the U.S. dollar.