While the issue of the US fiscal cliff will certainly impact the economy in 2013, there are already trends in place that suggest Q1 2013 may show some turbulence regardless of political gridlock. The economy is still improving from the slowdown this summer and is likely to continue to improve into year-end, but various trends suggests that any post election rally may be an opportunity to ratchet down risk exposure and book some profits in this year’s strong stock market showing.

Employment Should Weaken in Q1

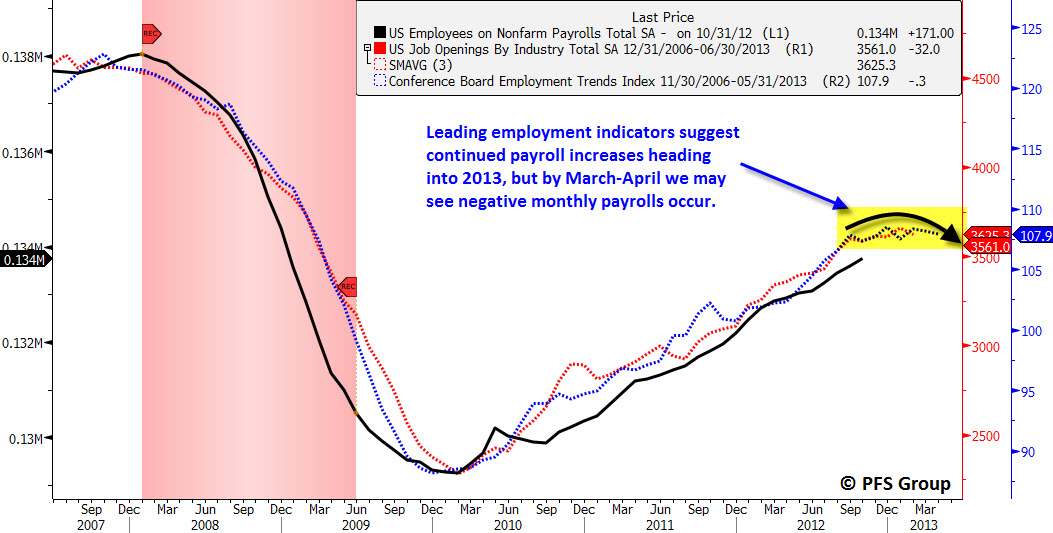

Two leading employment indictors that provide a fairly good trend for monthly payroll changes are the Bureau of Labor Statistic’s (BLS) Job Openings and the Conference Board’s Employment Trends Index which are shown below along with total nonfarm payrolls. They called both the 2007 payroll peak as well as the bottom in early 2010 and now, as they appear to be topping out, the indicators suggest payroll declines by early spring.

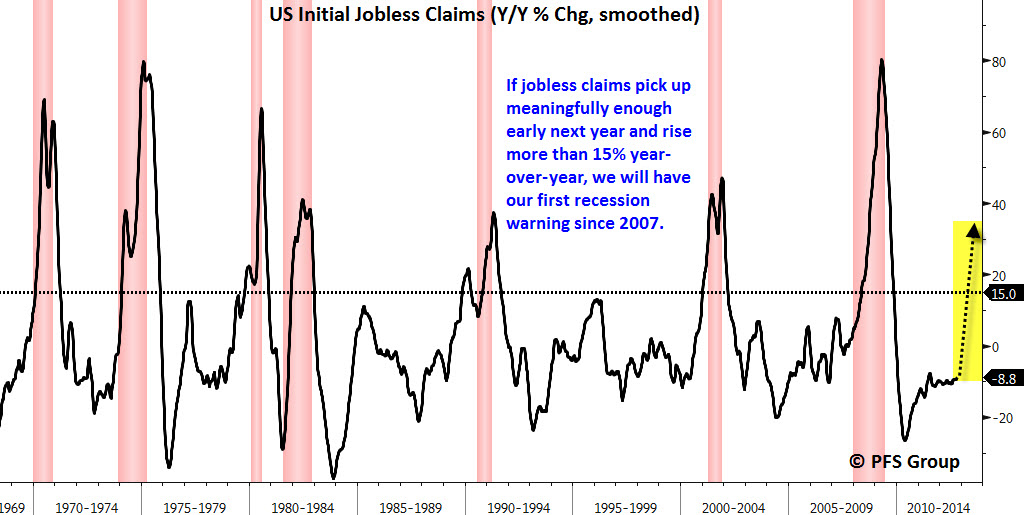

Interestingly enough, we may be witnessing warning signs of a potential employment decline in the Spring of 2013 in other indicators which would spell trouble for the stock market. The weekly jobless claims data that we get on Thursdays shows a strong inverse correlation with a coincident relationship to the stock market (shown below with jobless claims shown inverted on the right y-axis). You can see that jobless claims data back in 2007 was beginning to bottom (top in chart) with the low for jobless claims coming on May 18th 2007 at 302,000. From that period on you saw a trend of higher highs and higher lows (lower highs and lower lows in red on chart below, again the data is inverted for directional similarity) while the stock market hit new highs.

That was a big warning sign and we are starting to see the same thing again as jobless claims are not making new lows while the stock market is making new highs. It may be that the jobless claims data is reflecting the slow titanic shift in employment trends as the country may be moving from payroll gains to losses in the near future.

If we do in fact see jobless claims begin to move up from here we need to be on the lookout for sharp year-over-year (YOY) growth in jobless claims momentum. If we see YOY gains greater than 15% we may be slipping into a recession.

Outside of the message from employment leading indicators we see other subtle messages from the stock market that are also suggesting weakness in Q1 2013. The leading tendency of the performance for early to late-stage cyclicals relative to the performance of the stock market suggests that the stock market rallies post the election and does well in the first part of the year but then we see a selloff heading into the summer before we bottom. Looks like the “Wash-Rinse-Repeat Cycle Strikes Again” for a fourth year!

If we do run into late Q1 to early Q2 weakness in the economy in 2013 we are likely to begin seeing the early fingerprints of that in the stock market beginning now where the stock market rallies into the end of the year on weaker breadth and momentum. I’d encourage readers to be on the lookout for my “Market Weekly Bill of Health” reports that I try to put out on Wednesday’s which should help illustrate a topping process as evidenced by subsurface deterioration in breadth.

The election is just a week away and with that uncertainty behind us we are likely to get a pop in the markets and rally into year-end as the indicators above suggest, but the indicators also suggest it won’t be sustainable as recession risks in 2013 begin to heat up.