A new acronym has entered the lexicon of central banking in recent months – NIRP, which stands for negative interest rate policy. If ZIRP, zero interest rate policy, won’t stimulate faster growth in nominal spending and faster growth in the prices of goods and services, then perhaps central bank-engineered negative short-term interest rates will do the trick. In June 2014, the European Central Bank (ECB) introduced NIRP and the central banks of Switzerland, Denmark, Sweden, and Japan have recently done so as well. For the most part, NIRP involves a central bank paying a negative rate of interest on a portion of reserves or deposits held by private depository institutions (mainly commercial banks) by the central banks. One purpose of NIRP is to encourage banks to make more loans by penalizing them with a negative nominal return on “excess” reserves held by the central bank. Another purpose of NIRP is to achieve a lower structure of real (inflation-expectations adjusted) interest rates. After all, if the yields on short-maturity interest rates are at zero and investors expect deflation, then the real yields on these securities would be positive. (The real yield is the nominal yield minus inflation expectations. If the nominal yield is zero and inflation expectations are negative, i.e., deflation is expected, and then zero minus a negative number result in a positive number.) If nominal aggregate demand is growing at a sub-optimal rate, then a lower structure of real interest rates would likely cause the quantity of bank credit required to increase, which if the credit were granted would, in turn, cause growth in aggregate demand to increase. NIRP is a remedy for insufficient demand for bank credit.

Read Will the US Go Negative in 2017?

But if growth in nominal aggregate demand is sub-optimal because of an insufficient supply of bank credit, then NIRP will not be effective in remedying the situation. If banks do not have the capital to support their acquisition of more loans and securities with credit and interest rate risk, then charging these banks a “storage fee” for reserves held at the central bank will not induce them to create more credit. It will do the opposite. The extra expense charged banks by the central bank for reserves storage will reduce bank profits, inhibiting growth in the bank capital necessary to allow banks to increase their acquisitions of loans and securities.

The remedy for an insufficient supply of bank credit is an increased supply of a close substitute, central bank credit. This is what the central bank policy of quantitative easing (QE) is all about – providing an increased supply of central bank credit to supplement an insufficient supply of bank credit due to banks’ inadequate capital. The “gas” that inflates an asset-price bubble is credit. When the asset-price bubble bursts and asset prices deflate, the lenders who were providing the bubble-inflating credit suffer losses, which depletes their capital. If banks have provided significant amounts of the bubble-inflating credit, either directly or indirectly, then when the bubble bursts they will suffer losses that could inhibit their ability to extend new credit. What’s more, typically after an asset-price bubble has burst, the financial regulators impose higher capital requirements explicitly and implicitly on banks. If banks are capital constrained and central banks do not pursue an effective QE policy, growth in nominal aggregate demand will remain anemic.

Read also Russell Napier Forecasts Negative Rates in the US as Deflationary Pressures Spread

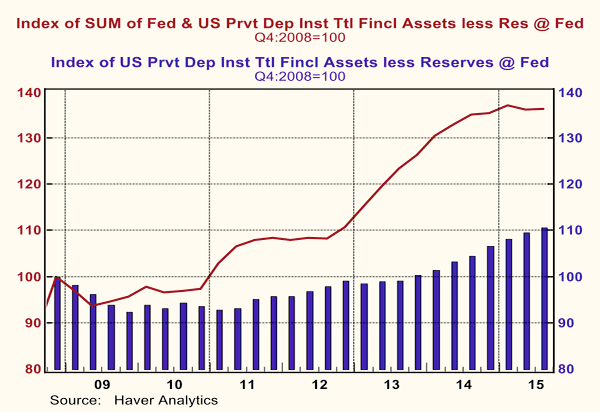

Let’s go to the charts. Plotted in Chart 1 are quarterly observations of total financial assets minus reserves held at the central bank (primarily loans and securities) for private depository institutions in the US and the Euro area. I have converted each series to an index number (with the Q4:2008 levels equal to 100) for ease of comparison. For US private depository institutions, non-reserves assets did not return to their Q4:2008 level until Q4:2013. But by Q3:2015, these assets on the books of US private depository institutions were at an index level of 110.7 or 10.7% higher than their Q4:2008 level. Initially, non-reserves assets at Euro-area private depository institutions increased by the end of 2011. After declining by the end of 2013, then rebounding in 2014, non-reserves assets at Euro-area private depository institutions stood at a level only 0.1% higher than they were in Q4:2008. In sum, over this almost 7-year period, non-reserves financial assets at US private depository institutions grew at a compound annual rate of just 1.5% while these assets at Euro-area private depository institutions, for all intents and purposes, showed no growth, on net.

Now let’s see what the Fed and the ECB did to augment the anemic amount of credit created in this period by private depository institutions. Plotted in Chart 2 are the index levels of the sum of Fed financial assets plus US private depository institution financial assets fewer reserves at the Fed. Let’s call this amount, total thin-air credit. (Everyone may now knock back a shot.) Also plotted in Chart 2 are the index levels of non-reserves financial assets at US private depository institutions. Wow! What a difference a central bank can make in creating thin-air credit to compensate for weak credit creation on the part of private depository institutions. By Q3:2015, total US thin-air credit stood 36.3% above its Q4:2008 level, representing a compound annual rate of growth of 4.7%. Although 4.7% pales in comparison to the 7.6% compound annual growth in total thin-air credit in the 55 years ended 2007, it still is a heck of a lot stronger than the 1.5% compound annual growth in credit created by US private depository institutions alone from Q4:2008 through Q3:2015.

Now let’s look at these data for the Euro-area. Plotted in Chart 3 are the index levels of the sum of ECB financial assets plus Euro-area private depository institution financial assets fewer reserves at the ECB or total Euro-area thin-air credit. Also plotted in Chart 3 are the index levels of non-reserves financial assets at Euro-area private depository institutions. This chart contains data through Q4:2015 whereas data in previous charts ran only through Q3:2015. The reason for this difference is that the ECB has released Q4:2015 data while the Fed will not do so until March 10. Taking into consideration Q4:2015 data, Euro-area total thin-air credit grew at a compound annual rate of only 0.7% from Q4:2008. But if the ECB had not provided thin-air credit via various lending facilities to depository institutions and belatedly via QE, the change in Euro-area thin-air credit would have been even more anemic. When Q4:2015 is included, credit provided by Euro-area private depository institutions contracted, on net, vs. Q4:2008.The conclusion is that the ECB was late coming to the QE party and brought too little party “punch”.

So, let’s review. In the seven years following the global financial crisis of 2008, credit created by private depository institutions in both the US and the Euro-area, on net, has been anemic, if at all. Immediately after the crisis, the Fed created massive amounts of temporary credit to the US private depository institution system as well as non-depository financial institutions via loans. Soon after that, the Fed engaged in three separate rounds of QE that resulted in net Fed purchases of securities of .7 trillion in the 24 quarters ended Q4:2014. In contrast, the ECB has engaged in only one round of QE, which commenced in Q4:2014. In the five quarters ended Q4:2015, the net change in securities on the books of the ECB was only about 1 billion at current exchange rates. So, the Fed’s QE operations started earlier than the ECB’s, persisted on and off for a six-year period, and were cumulatively much larger.

Consider: Move Over Greece, It's Italy's Turn - George Friedman Sounds the Alarm on European Banking Crisis

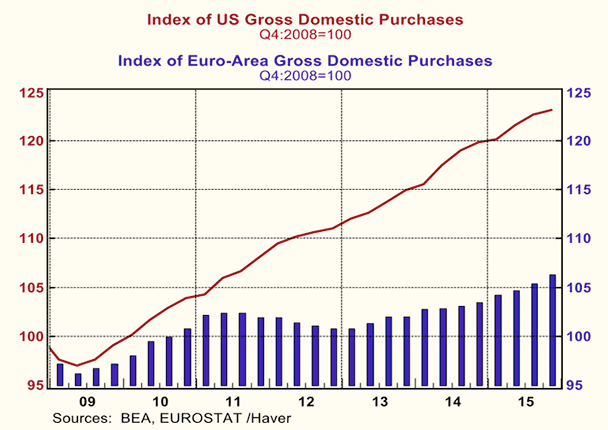

Now, let’s see which economy has experienced faster growth in nominal domestic demand. This is shown in Chart 4 where the index values of Gross Domestic Purchases for the US and the Euro-area are plotted. In the 28 quarters from Q4:2008 through Q3:2015, Euro-area nominal Gross Domestic Purchases increased at a compound annual rate of just 0.9%. In the 28 quarters from Q4:2008 through Q4:2015, US Gross Domestic Purchases increased at a compound annual rate of 3.0%.

The ECB will have a monetary policy meeting on March 10. It is likely that a more aggressive NIRP will be discussed. If the goal of the ECB is to stimulate growth in nominal domestic demand, it should not waste its time considering or implanting NIRP. Rather, go with what has “worked” for the Fed. The ECB should pursue an aggressive and persistent QE policy such that the sum of ECB credit and Euro-area private depository institution credit grows at some “normal” rate. Despite the success of QE by the Fed in stimulating growth in US nominal domestic demand, many a talking twerp is discussing the necessity of NIRP to bring the US economy out of its next recession. First, why worry about the next US recession when there is none on the horizon? Second, if QE worked to help get the US economy out of its worst recession since the early 1930s, why don’t you think it will work in producing a recovery from the next US recession, whenever it may come?