How Gold Is Currently Being Priced

Ahead of the Herd readers know I believe gold’s price is being driven by rising, or falling, real interest rates.

Real interest rates are the level of annual yield paid to savers and investors over and above the pace of inflation.

PIMCO makes a convincing case that the number one factor influencing the price of gold is the changes in real yield on 10 year US Treasuries.

"Based on our study, the regression shows that, all else equal, a 100-basis-point increase in 10-year real yields has historically led to a decline of 26.8% in the inflation-adjusted price of gold."

Chasing Yield

When real interest rates are low, at, or below zero, cash and bonds fall out of favor because your real return is lower than inflation - if your earning 1.6 percent on your money but inflation is running 2.7 percent the real rate you are earning is negative 1.1 percent - an investor is actually losing purchasing power.

So gold’s price is tied to low/negative real interest rates which are essentially the by-product of inflation - when real rates are low, the price of gold can/will rise, of course when real rates are rising, gold can fall very quickly.

[Hear More: Ronald Stoeferle: Monetary Tectonics - The Tug of War Between Inflation and Deflation]

Interest rates matter, they matter a lot. They affect the cost of borrowing for homes and business investment. They effect the rates paid on deposits and savings and also set the risk-free rate of return which is important for assessing returns from other asset classes like shares, bonds, precious metals, commodities and property.

According to PIMCO:

“Today the marginal price of gold is largely set by financial demand, as over billion of gold is held by ETFs, and investors choose to buy or sell gold ETFs by comparing the expected real return on gold to that of other liquid financial assets.” PIMCO

The world’s dominant gold Exchange Traded Fund (ETF) is the American SPDR Gold Shares. The SPDR had the largest outflow of any single ETP in 2013 at billion.

Commodity exchange traded products (ETPs) suffered their worst year on record as assets under management (AUM) declined by billion to 2 billion in 2013.

[Related: Jean-Marie Eveillard: Why Gold Never Took Off]

Total ETP gold holdings declined to 56.67 million ounces at year-end from 84.62 million at the end of 2012. ETF Securities estimated that of the roughly billion gold AUM decline, 46% was caused by a 28% fall in the gold price and 54% by investor outflows. The decline in overall commodity AUM was the most on record.

PIMCO’s advice for gold investors is the following:

“As gold increasingly becomes a financial asset, when real yields rise, gold prices should fall if they are to maintain a given level of financial demand relative to investors’ other opportunities. Similarly, when real yields fall, we expect the price of gold to rise. Investors should be aware of the relationship between gold and real yields because it has important implications for how they think about the role of gold in their portfolio in an asset-allocation and risk-factor framework.” PIMCO

What does PIMCO expect for short term gold prices?

"Looking ahead, we expect the Federal Reserve to move very gradually in reducing accommodative policy and for 10-year U.S. real yields over the next several months to be relatively steady around current levels, which would be neutral for nominal gold prices."PIMCO

According to a recent economist survey by Bloomberg the three-month Treasury bill rate will be 0.42 percent and the yield on the 10-year Treasury note will be 3.33 percent by the end of 2014. The Bank of Nova Scotia, in its January 30th 2014 ‘Global Forecast Update’ predicts U.S. 10 year Treasury rising to 3.40 percent Q4, 2014 and to 4 percent Q4 2015.

U.S. Economy

“Low or negative real rates are usually the result of two things. Interest rates are the price of money, balancing the demand of citizens to save with business’s desire to invest. So a low real rate may simply be a sign that both consumers and businesses are feeling cautious.

But interest rates are also affected by the actions of the central bank—particularly so at present when the monetary authorities are intervening at both the short and long end of the yield curve. Central banks want rates to be low to encourage business investment, and to discourage consumer parsimony.

In both cases, low rates are associated with a weak economy. If the economy is strong, businesses will be eager to expand and will compete for savers’ capital, bidding up rates. A strong economy would also create inflationary pressures as companies battle for workers and raw materials, pushing up wages and prices. In these circumstances central banks would be raising rates as a precaution.” The Real Deal, Buttonwood, The Economist

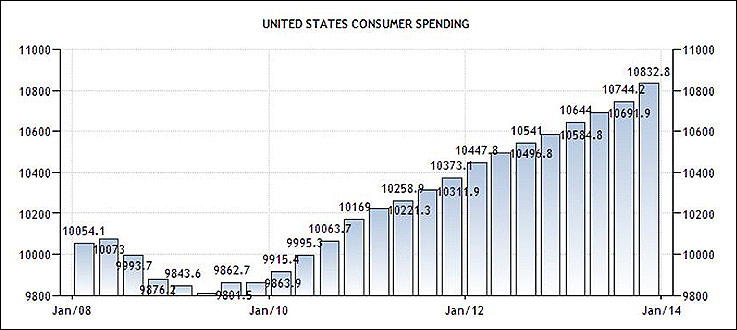

The U.S. economy grew at a 3.2 percent annual rate in the October-December quarter on the strength of the strongest consumer spending in three years. The fourth quarter increase followed a 4.1 percent growth rate in the July-September quarter.

“To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. The Committee also reaffirmed its expectation that the current exceptionally low target range for the federal funds rate of 0 to 1/4 percent will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.” U.S. Federal Reserve

Conclusion

The fundamental driving force behind the price of gold is real interest rates, specifically U.S. real interest rates because the U.S. dollar is the world's reserve fiat currency.

The U.S. inflation rate was 1.5% for 2013. The U.S. Federal Reserve spiked 10 year Treasury yields to 3.3%, from 1.6%, with its tapering talk. As I write this the current 10 year U.S. Treasury yield is 2.6%.

Low, and even into negative territory real interest rates produced a bull market in precious metals. Has that tailwind been neutralized as PIMCO suggests? Are we entering a prolonged rising real interest rate environment? Perhaps we’re heading back to negative real interest rates?

“Gold is the wild card. The gold price and investor positioning today reflects near unanimous negative sentiment on gold’s prospects, based on expected higher global interest rates and a strong U.S. dollar as the U.S. economy recovers. Any disappointment to this scenario will likely drive the gold price higher, making it one of the better hedges against the risk the U.S. economic recovery falters.” Nicholas Brooks, head of research and investment strategy for ETF Securities, in an interview with Kitco.com

Real interest rates should be on every precious metals and commodities investors radar screen. Is today’s reality of precious metal pricing on yours?

If not, it should be.

[Don't Miss: Ross Hansen: All Quiet on the Precious Metals Front - Metals Ready to Roll]