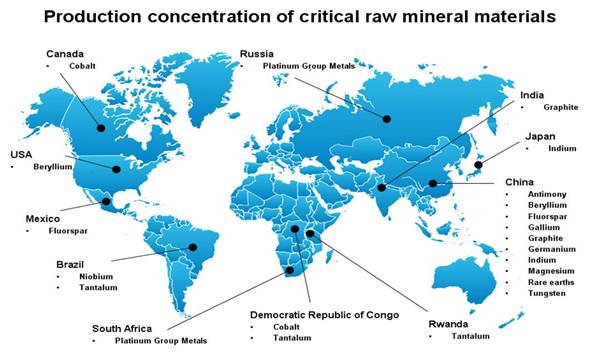

China has recently announced cutbacks in rare earth exports to other nations, which has caused quite a stir in the international markets. This is because China produces 90% of rare earths, and processes most of the rare earths mined into usable compounds by their factories. China is very much the current hub of rare earth production for the world, succeeding the United States which use to hold that crown in the Mountain Pass 'era'.

Source: USGS

Japan and China have been sparring over rare earths mainly because Japan has a strong technology economy which requires many of these elements, and China views domestic production and refining as the property of the Chinese state, and not of international markets. The reduction in rare earth exports puts Japan in a precarious position economically as they rely on technology exports to fuel their economy. As an example, the Toyota Prius uses 25 pounds of rare earths to power their hybrid engine technology. Without rare earths, Toyota and other manufacturers cannot produce the hybrid cars that the world wants.

The United States requires quite a bit of rare earths for military applications. With 1000 bases in over 100 countries, the US military is one of the largest users of rare earth materials for precision guided bombs and other weaponry. The US is, in particular, succeptible to rare earth hording by the Chinese economy because we have ignored our own rare earth production and allowed the Chinese to take strong international footholds in rare earth mining and production.

The United States does not possess the separation and production facilities needed to complete the rare earth supply chain, so any current rare earth mining requires shipping those minerals to China for final processing before returning to the US for incorporation into military and technology applications. This is both economically vulnerable and more costly than developing a domestic rare earth supply chain.

'RESTART'

As a consequence of the fact the US has largely ignored developing rare earth markets domestically and has allowed China to monopolize them, The US Congress has intiated several pieces of legislation aimed at closing the gap with the Chinese. One of these is the RESTART initiative which is aimed at building a domestic rare earth supply chain that incorporates not only exploration and mining, but the various stages of production required to produce a finished rare earth element product that industries such as the auto, defense, and green can use in producing end products to their consumers.

The purpose of the bill is To reestablish a competitive domestic rare earths minerals production industry; a domestic rare earth processing, refining, purification, and metals production industry; a domestic rare earth metals alloying industry; and a domestic rare earth based magnet production industry and supply chain in the United States.

Another piece of legislation passed by the House, H.R. 5136, calls for the Secretary of Defense to "assess the rare earth material supply chain to determine if any of the materials were strategic or critical to national security." The bill required a report on rare earth sustainability to be completed within 180 days. The report had to state whether rare earths were strategic, and if so, to develop a plan for long term availability of of a domestic supply of rare earths by December 2015.

Domestic Supplies

So then the question becomes, who has these rare earths and how do we manufacture them into a finished product? There are several deposits in the US owned by US and Canadian interests. Molycorp owns rights to the Mountain Pass rare earth mine, which produces mostly light rare earths. Mountain Pass has significant amounts of these rare earths such that the US will not starve if China chooses to keep all of their local rare earth production in the future as it appears they intend to.

Image cannot be displayed

Source: American Rare Earth and Materials

What the US lacks are heavy rare earths, which are critical to military and nuclear applications. For the time being, the US will have to work with Canadian companies to obtain the heavy rare earth elements we need.

Canada

Canadian companies have significant holdings of rare earths. I profiled Canadian interests in Rare earth investment potential is great ... if you are patient. These miners have both light and heavy rare earth holdings and are continually exploring additional rare earth deposits. The US manufacturers need to maintain relationships with these firms to have access to critical rare earth supplies.

US Heavy Rare Earths

According to Jack Lifton, longtime industry analyst and consultant, Diamond Creek in Idaho has a very high concentration of rare earths, including heavy rare earths that would be sufficient to supply the US for the time being. Texas Rare Earth Resources is claiming a potential large concentration of heavy rare earth at Round Top Mountain in Hudspeth County in Texas. Lastly, Canadian company Ucore claims to have heavy rare earths at Bokan Mountain, Alaska.

The development of these properties will be critical to supplying the needed heavy rare earths to US manufacturers in the near future. Now that the supplies have been identified, the next steps are building processing plants capable of separating and refining the rare earth materials into concentrated amounts suitable for end products.

Avalon has announced plans to build a $346 million separation plant capable of 25,000 tons per year capacity. But more work needs to be done before the US is independent of China in rare earth mining and processing. This process will take several years and billions of dollars of investment to accomplish.

As the US and Japan fight for what is left of Chinese rare earth mining and production, the next several years could be lean for the rare earths industry outside of China and will work as a strategic advantage for China over the rest of the world.