Breaking Down Nonfarm Payrolls: "The total nonfarm payroll accounts for approximately 80% of the workers who produce the entire gross domestic product of the United States. The nonfarm payroll statistic is reported monthly, on the first Friday of the month, and is used to assist government policy makers and economists determine the current state of the economy and predict future levels of economic activity." (Investopedia)

The big news on Friday was the HUGE jobs miss. It came in so far below expectations that it even elicited a comment from the Donald on Twitter:

June 3, 2016

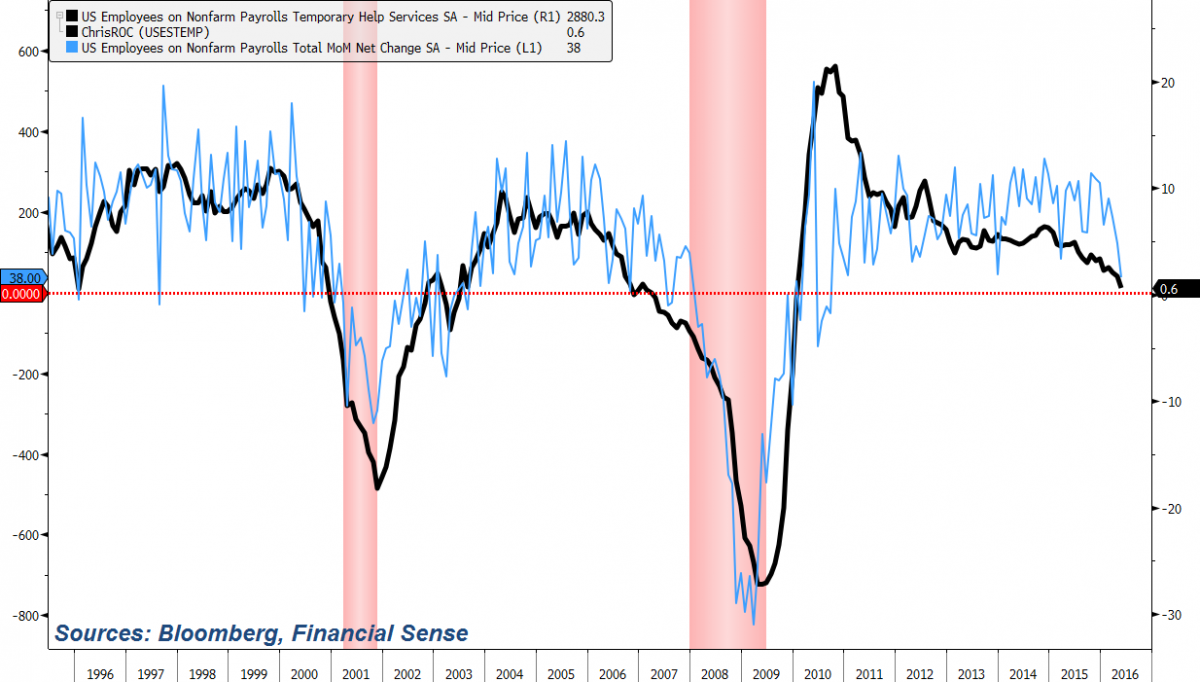

As you can see from the chart, it would appear that nonfarm payrolls are rolling over with Friday's jobs number at 38,000 the lowest in six years.

On top of the weak reading for May, there were also downward revisions for the two prior months leaving WSJ to report a 'sharp slowdown':

"Revisions of earlier reports reduce the number of jobs added in March and April by 59,000. May’s weak job growth and the revisions bring the average monthly job gains in the past three months to 116,000, a sharp slowdown from the average 219,000 growth over the prior 12 months."

In addition to the plunge in online job postings (see here), today's big miss reaffirms our view that bank tightening suggests layoffs ahead. Though payrolls tend to be quite volatile month to month, bank tightening trends (shown inverted) are highly correlated to the underlying trend in US employment and suggest overall deterioration ahead.

In our April piece, 15 Warning Signs of a Possible Market Top and Recession Next Year, we showed the correlation between nonfarm payrolls and temp jobs, with the latter serving as a leading indicator and recessionary red flag. The year-over-year rate of change of temp employment has been in a downtrend since 2015 and is currently hovering just slightly above zero. Should this trend continue, broader layoffs are likely to follow.

For a complete archive of our podcast interviews on finance, economics, and the market, visit our Newshour page here or iTunes page here. Subscribe to our weekly premium podcast by clicking here.