James Bullard, of the St. Louis Fed, stated yesterday he believes the size of the Federal Reserve’s quantitative easing program should be based on economic conditions. He prefers going on a meeting-to-meeting basis giving the markets guidance similar to communicating intentions relative to traditional interest rate policy. Regardless of what the body of Fed voting members decides, it is important for investors to understand how QE works in the real economy and global financial system.

With markets coming off of overbought levels, bullish sentiment high, and gold backing off a vertical ascent, we believe investors need to be ready for a quantitative easing (QE) disappointment pullback. A “buy the QE rumor, sell the QE news” event needs to be considered from a portfolio management perspective. Having said that we also believe most investors and many financial professionals do not fully understand how QE works in the real world and that one of QE’s primary objectives is to inflate asset prices.

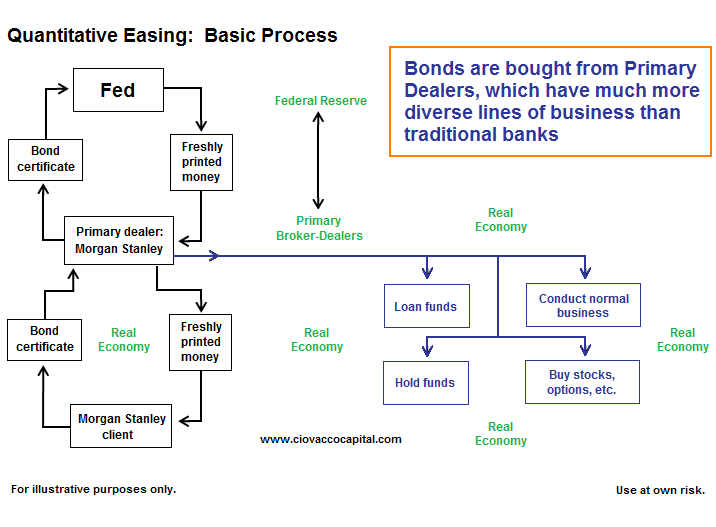

After hearing “QE won’t matter, the money will just sit at banks as excess reserves” from talking heads several times over the past three months, we decided to put together a series of brief videos describing how quantitative easing will be implemented by the Fed and the eighteen primary broker dealers in the coming weeks and months. You may be surprised to learn the Fed is encouraging the clients of primary dealers, including hedge funds and sovereign wealth funds, to participate in the QE2 process. We have studied the quantitative easing concept in detail in order to improve the odds of producing successful outcomes for CCM clients.

Common sense tells us money printing is probably not the path to long-term prosperity and low unemployment, but common sense also tells us after a possible QE disappointment pullback, newly printed U.S. dollars will be finding their way into the global stock, commodity, and currency markets. The big questions are (a) how much QE is coming in terms of a dollar amount, and (b) how much of that money will find its way into the financial markets.

After watching the video below, you may decide quantitative easing is more about inflating the money supply and asset prices, and less about bank reserves and interest rates. We will post five additional videos on quantitative easing over the next week or so, expanding on the concepts presented in the first video, “Quantitative Easing — How Does it Work in the Real World?” A larger version of the flow chart in the video is available below the video player.

This article contains the current opinions of the author. The opinions are subject to change without notice. This article is for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.