Tim Manni, the Managing Editor at HSH.com, has a new commentary out entitled "The Salary You Must Earn to Buy a Home in 27 Metros". The opening tease is a question:

"How much salary do you need to earn in order to afford the principal and interest payments on a median-priced home in your metro area?"

[Hear Also: Jim Puplava’s Big Picture: Real Estate: Good For Investors – But Not All Homebuyers]

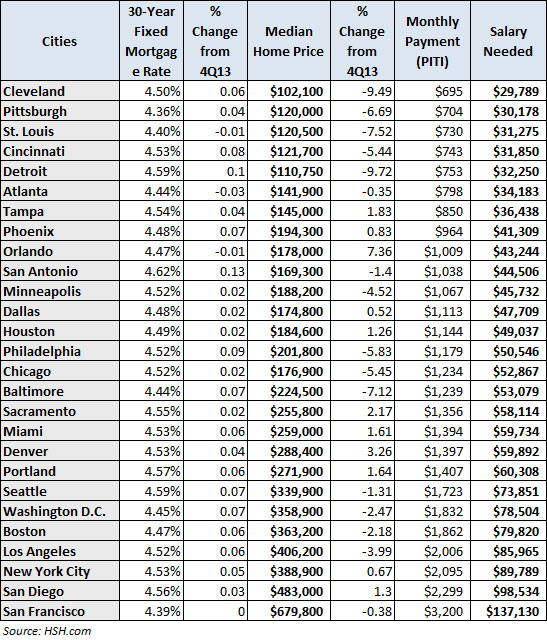

The article is a must-read for anyone interested in U.S. real estate trends and income demographics. Here is a slightly edited version of Tim's table of the key data. I've rounded the dollar amounts to facilitate reading. Note that the data is sorted by the salary needed to finance the median priced home with a standard 28 percent "front-end" debt ratio and a 20 percent down payment:

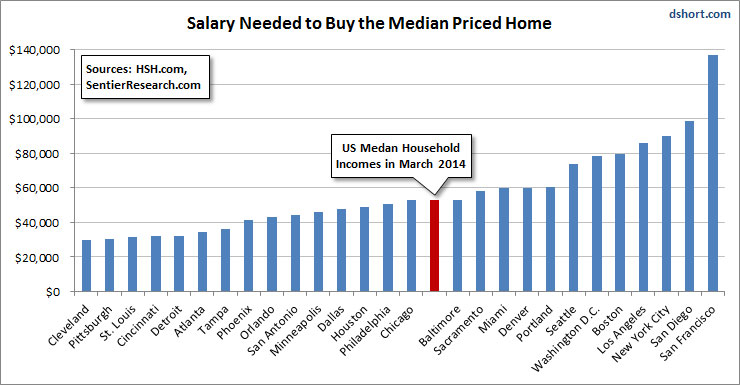

How do these metropolitan area real estate costs stack up against each other and the U.S. median household income? Here is a column chart to which I've added the latest Sentier Research data for the US median household income as of March 2014.

The table above includes a column for the percent change from the previous quarter (Q4 2013). Here are the 27 cities sorted by the change. The range of the percent change is quite astonishing.

I'll be keeping an eye on this series to see how these trends change over time. I highly recommend a look at Tim Manni's slide show of the 27 cities with additional details and city-by-city summary.

For additional research on various income-related topics, here are links to commentaries I regularly update when new data is available.