A number of investors have subscribed to the theory that we are entering a new era of global energy abundance, led by technological advances in horizontal drilling and hydraulic fracturing. The domestic price of natural gas in the U.S. has plummeted, and crude oil production has increased to the degree that domestic production in October exceeded imported crude oil for the first time in 18 years.

So it was surprising that the most interesting message in the International Energy Agency’s (IEA) annual World Energy Outlook — considered the gold standard of energy analysis — was also the most disturbing for those who subscribe to the abundance theory: technology and higher prices have opened up new resources but the IEA is concerned that the world could face a ‘future oil supply crunch’ as shale development matures.

IEA Chief Economist Fatih Birol noted the positive growth in oil supply documented in the IEA report, but added “this does not mean the world is on the verge of an era of oil abundance”.

All Liquids Are Not Equal

The IEA report noted that total world oil production (including natural gas liquids (NGL’s)) in 2012 was 87.1 million barrels per day, an increase of 11.9 million barrels per day since 2000. But they noted that more than two-thirds of the increased supply was high-cost unconventional oil (tight oil, oil sands, deep-water oil) or natural gas liquids.

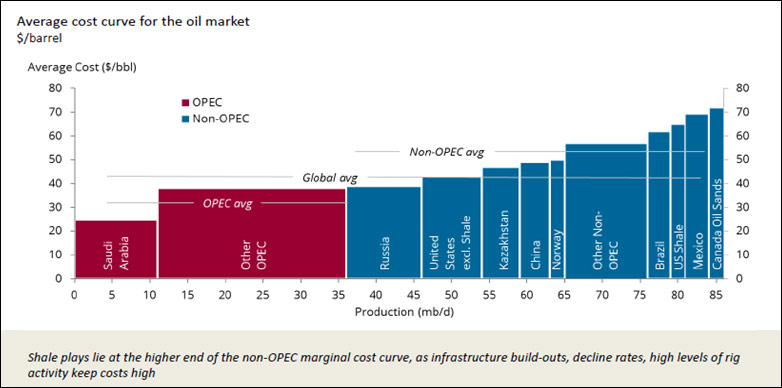

This distinction is important for two reasons. First, unconventional supplies generally have much higher break-even costs than conventional reserves. Finding and development costs from new reserves in unconventional shale plays run from $50 to over $80 per barrel. In 2000 conventional oil reserves were being added in the $10 to $30 per barrel range. Any sustained drop in global oil prices will quickly delay exploration efforts in high-cost prospects.

Second, natural gas liquids have a much lower energy density than crude oil. A barrel of NGL, energy wise, is not equivalent to a barrel of conventional crude oil. The heating content of NGL’s is generally around 60-70% that of crude oil, and the sharp increase in U.S. liquids production from the Bakken, Eagle Ford, and Marcellus shales have a large NGL component. Refineries are limited as to how much NGL’s they can blend into their feedstock when producing transportation fuels, which along with the lower energy content, explains why NGL’s sell at a significant discount to crude oil prices.

U.S. Production Booming

Led by booming shale output, the IEA noted that non-OPEC supply gains from countries such as the U.S. were offsetting reduced OPEC production volumes seen from Libya, Nigeria, and Iran. The IEA raised its estimate of non-OPEC crude oil supply growth for 2013 by 0.1 million barrels per day to 1.3 million barrels per day in their report. For 2014 the IEA increased the non-OPEC growth estimate to 1.8 million barrels per day. Keep in mind, as noted above, this includes NGL’s.

The massive increase in production in the U.S. has been centered in two states: North Dakota and Texas. Charts of historic crude oil production for the last 32 years set out below, courtesy James L. Williams of WTRG Economics (wtrg.com), illustrate the trend:

Exponential Decline Curve

While output in the U.S. is booming, the IEA raised concerns about supply growth longer term. The ‘decline curve’ — that is the natural decline in production rates — from hydraulically fraced wells in the Bakken and in the Eagle Ford formations is much steeper than for the conventional wells drilled in 2000.

While output in the U.S. is booming, the IEA raised concerns about supply growth longer term. The ‘decline curve’ — that is the natural decline in production rates — from hydraulically fraced wells in the Bakken and in the Eagle Ford formations is much steeper than for the conventional wells drilled in 2000.

Addressing decline curve issues for unconventional wells, Amrita Sen of London based Energy Aspects consulting recently presented her research to the Aviation Fuel Forum in Miami. In a paper entitled “Reality Check: Scarcity to Abundance” she noted production declines in unconventional wells can be very steep, and in the first year “can range between 50-70%”. Chart at right courtesy London-based Energy Aspects.

IEA Global Demand Projections Raised for 2014

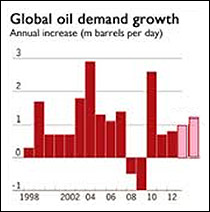

Based on the latest data the IEA raised its 2013 global demand estimate to 91.0 barrels per day, and raised their 2014 estimate to 92.1 million barrels per day. That represents a roughly 1.0 million barrel per day increase in 2013 and a 1.1 million barrel per day increase in 2014.

The consistent growth in crude oil demand over the years is illustrated in the chart at right from the Financial Times. Except for the years during the Great Recession crude oil demand grows relentlessly with the global economy. We added the latest IEA demand estimates for 2013 and 2014 (in pink).

The consistent growth in crude oil demand over the years is illustrated in the chart at right from the Financial Times. Except for the years during the Great Recession crude oil demand grows relentlessly with the global economy. We added the latest IEA demand estimates for 2013 and 2014 (in pink).

The good news, short term, is that if global demand increases by 1.1 million barrels per day as projected by the IEA, and U.S. unconventional production along with other non-OPEC members increases 1.8 million barrels per day, prices in 2014 should remain relatively stable all other factors constant. The IEA report predicts the price of crude oil will remain at the upper end of its recent range. But long term demand growth is relentless, year after year.

Supply Gains Are Costly, and Getting Moreso

The disturbing portion of the IEA report noted that capital expenditures in the energy sector have seen an astronomical increase. “These ever higher levels of capital expenditure have yielded ever smaller increases in the global oil supply” according to Mark Lewis, former head of energy research at Deutsche Bank.

Capital expenditures for oil and gas development increased from 0 billion in 2000 to 0 billion in 2012 (in constant dollars) according to the IEA report, while the global oil supply (adjusted for energy content) increased by only 14 percent. The report noted annual investments have effectively doubled from 0 billion in 2005 to roughly 0 billion in 2012.

Reviewing the exponential increase, Lewis concluded “the most straightforward interpretation of this data is that the economics of oil have become completely dislocated from historic norms since 2000, and especially since 2005, with the industry investing at exponentially higher rates for increasingly small incremental yields of energy”.

Industry has been willing to finance exploration efforts as global crude oil prices have increased from a barrel in 2000 to 0 in 2012 (chart at right courtesy Forbes). Since the cost curve for unconventional resource development is rising, along with capital expenditure requirements, any weakness in crude oil prices will be reflected in budgeting and will result in reduced developmental activity.

The “average cost curve for the oil market” chart below illustrates the fact that unconventional resources have a much higher break even cost levels (courtesy Amrita Sen of London based Energy Aspects). She concludes “shale plays lie at the higher end of the non-OPEC marginal cost curve, as infrastructure build-outs, decline rates, high levels of rig activity keep costs high”.

Morgan Stanley issued a report last month that also noted the rising incremental costs associated with increasing oil production. Supply gains are expected to be substantial, but any price declines would quickly impact activity and supplies. Morgan Stanley’s experts expect oil prices to remain “range bound over the medium term” (Morgan Stanley cost chart is set out at right).

Morgan Stanley issued a report last month that also noted the rising incremental costs associated with increasing oil production. Supply gains are expected to be substantial, but any price declines would quickly impact activity and supplies. Morgan Stanley’s experts expect oil prices to remain “range bound over the medium term” (Morgan Stanley cost chart is set out at right).

The steep decline curve for unconventional production, coupled with a slowdown in developmental activity should oil prices weaken, could quickly cause a ‘supply crunch’ and higher prices according to the IEA report and comments by their Chief Economist.

Global Refining Sector

The IEA’s World Energy Outlook also noted the huge global natural gas price discrepancy. Natural gas prices in the U.S. are currently one-third the price of natural gas in Europe and one-fifth the price in Japan. Expensive LNG imports to Japan, used as a power plant fuel to offset the shut-down of their nuclear power sector, have skyrocketed.

While global refinery throughput has declined since July we are now in the ramp-up season for demand. Europe’s refiners saw the worst of the decline. Throughput at their plants fell by more than 1 million barrels per day to what may be their lowest level since 1989 — 24 years ago. Global refining throughputs in the fourth quarter of 2013 are expected to increase 0.4 million barrels per day year over year.

Due to relatively cheap natural gas prices the IEA’s Chief Economist notes that more energy-intensive industries will relocate in the U.S. Not only are European and Japanese plants paying much more for natural gas, they are also buying crude priced on the higher-cost Brent pricing, giving U.S. producers a roughly per barrel advantage.

Add in electricity costs, which are normally much higher outside the U.S., and it is little wonder that a number of European refineries and chemical plants are experiencing financial difficulties. Refineries and chemical plants are in boom-mode in the U.S., with many announcing multimillion and multibillion dollar expansion plans or new plants.

Record U.S. Refined Product Exports

Exports of refined products from the U.S. have tripled in the last few years, from 1 million barrels a day to more than 3 million barrels per day. In 2011 the United States exported more petroleum products, on an annual basis, than it imported for the first time since 1949 — and the trend continues. November 2013 exports of gasoline should break all historic records according to a number of analysts, although official export data will not be released by the U.S. EIA until early next year (chart at right courtesy Financial Times, chart below courtesy U.S. EIA).

Exports of refined products from the U.S. have tripled in the last few years, from 1 million barrels a day to more than 3 million barrels per day. In 2011 the United States exported more petroleum products, on an annual basis, than it imported for the first time since 1949 — and the trend continues. November 2013 exports of gasoline should break all historic records according to a number of analysts, although official export data will not be released by the U.S. EIA until early next year (chart at right courtesy Financial Times, chart below courtesy U.S. EIA).

Part of the export trend is explained by the lower feedstock and processing costs mentioned above (crude oil, natural gas, electricity). But a large part of the trend is also explained by the fact that exports of crude oil from the U.S. have been limited due to statutory provisions adopted during the 1970’s era energy crisis. The export restrictions on crude oil do not apply to exports of refined products.

With crude oil output spiking in the Bakken and Eagle Ford fields, and crude oil export opportunities limited, refiners are exporting rapidly growing amounts of refined products. Brazil, Argentina and Venezuela have all doubled the imports of refined products from the U.S. since 2012. Exports to Nigeria have also increased substantially.

Further, distorting the market the 1920 Jones Act restricts the transportation of refined products between U.S. ports to U.S. flagged and manned vessels — as a result it costs one-third as much to ship gasoline from Houston to Europe or Africa as it does to ship it to New York. The Jones Act is a major economic incentive for the export of refined products to foreign markets.

Investment Thesis

Short term unconventional oil reserves being developed in the U.S. and elsewhere appear to be ushering in an era of cheap energy. In reality higher prices will be needed to maintain the capital expenditures needed to increase production. Technology should help moderate cost inflation, but the IEA’s data on capital expenditures in the energy sector indicate we are spending substantially more to find less — at least compared to historical norms.

The current explosion of domestic oil supply and restrictions on oil exports, combined with the pricing advantages enjoyed by domestic natural gas, oil, and electricity consumers, could generate short to mid-term opportunities for investors in the following sectors:

Domestic refiners, with access to discounted crude oil, natural gas, and lower electrical costs should have an economic advantage over European and global competitors

Energy intensive industries such as chemical and fertilizer manufacturers should observe substantial cost advantages versus global competition

Domestic crude oil transportation infrastructure including pipelines, barges, or railcars should see demand increase with production growth

The export of refined products should continue to set records, increasing demand for ocean transportation services

Firms providing engineering services to domestic refineries and chemical plants should see increasing backlogs as new facilities are built and existing plants are expanded. Current facilities should run at near capacity

Increase in the capital expenditures needed to increase production, documented in the IEA report, should benefit oil field service companies on a global scale

While global oil prices should remain ‘range bound’ near current levels, domestic producers who are increasing production and reserves should perform well. Global oil demand continues to relentlessly increase with economic growth