Our recent calls that there would be no tapering in September have turned out to be correct. Let’s take a look at recent events and what is coming.

Get Ready for A Lot More Printing

The White House has indicated that Obama will nominate uber-dove Janet Yellen for the position of Chairman of the Federal Reserve. Yellen is a true Keynesian who believes firmly in printing money to manage the economy. Her nomination is extremely bullish for gold, because she will likely have no problem printing for her entire term, and having her as Fed Chairman virtually guarantees higher inflation over the next four years. Reuters describes her as “an advocate for aggressive action to stimulate US economic growth through low interest rates and large-scale bond purchases.”

The new view is that the dollar is an instrument of policy and not a weight or measure of value. — James Grant Economist Bloomberg Interview 10/16/2013

Loss of Confidence In U.S. Leadership Leads to a Loss of Market Confidence in Treasuries

American political dysfunction has once again placed the circus spotlight on Washington where leaders of the world’s largest economy squabble over raising the debt limit. The country crumbles while politicians make political theatre for the sake of raising the limit on the government credit card which will be used to spend lavishly on pet programs.

It’s the deadlock too far which has opened the eyes of those who still support the United States. A leader is followed when he is believed, not when he is ridiculous. — GEAB No78[1]

[Must Read: Kyle Bass: Fed Won't Raise Interest Rates for Another 3-5 Years; Stocks "The Only Game In Town"]

The insanity of this is off the charts. In March of this year I gave an analogy from previous GI’s of what the US government's fiscal situation looks like compared to a household budget:

| What our household earns per year | ,686.00 |

| What our household spends per year | ,955.50 |

| Debt on our credit card (total debt) | 3,508.80 |

| Total new debt added to card this year | ,269.50 |

| Debt on our mortgage (unfunded obligations) | ,296,667.85 |

The entire current fiasco has essentially been arguing about whether or not to raise the credit card limit to 5,000 or so. In the end, they have decided to simply have no limit, and we will come back to the can kicking in February 2014.

According to Moody’s, there was zero chance of a default as the “debt limit” only restricts how much money the government can borrow in addition to its revenue stream; it does not preclude the US from using its existing revenue stream for paying its debts. Debt in this sense is being used to describe the one thing which if defaulted on would send the entire world economy into collapse, i.e., scheduled payments on US Treasuries. US Tax revenues have averaged 4.8B per month, while treasury interest payments have averaged .6B per month. There was not, nor has there been, any immediate risk of default. Of course, this did not stop any politician from making it into as big of a circus as possible.

Even president Obama is guilty of drama and hyperbole when claiming the US could default on its obligations. Use of the word 'default' is incorrect and has only served to shatter the confidence of America’s creditors.

The most important takeaway from this is neither the circus nor the debt, which obviously can’t go on ballooning forever, but rather that the effect on a macro level is a general erosion of confidence in US leadership. Fitch Ratings has issued warning of US Credit rating downgrades[2] while China isn’t issuing warnings, it is just downgrading[3].

Chinese rating agency Dagong has downgraded the United States to A- from A and maintained a negative outlook on the sovereign's credit. — Reuters, Singapore

More interesting still is that it appears the United States' largest creditor has had about enough of the shenanigans. China’s official news agency has called for a “de-Americanized world” and that “The great Pax Americana is a failure on all fronts.”[4]

As a first step in creating a de-Americanized world, all nations must try to shape an international system that respects the sovereignty of all nations and ensures the US keeps out of the domestic affairs of others. — Xinhua News Agency

While there are those who may no doubt have some sort of dislike for the Chinese, when the bank that provides you the credit required to keep your lights on is saying such things about you, you might want to take it seriously.

Globally, countries are trying to free themselves from American influence and let go of a United States permanently discredited by recent events over Syria, tapering, shutdown, and now the debt ceiling. Watch carefully for a break of Saudi Arabia with the United States as that will signal the ending of the petro-dollar, the rise of the petro-yuan, and a change of world-state in full motion.

The End Game Is That This Is Leading Us to a Bond Market Reversal and a Sovereign Debt Crisis

US National Debt is surpassing ,963,874,810,878 as I write. The debt per taxpayer is 8,133, and that does not include unfunded obligations such as medicare and social security which equates to a liability per taxpayer of ,101,442. It is important to note that demographic trends have not changed since the last time I mentioned them; we are going to be seeing less workers and more retirees each year moving forward. The US is currently paying 5B in annual interest payments. What happens when interest rates go up?

The issue here, very simply, is the long-term solvency of the United States of America — This gap-based deficit is going to kill us — We are going to be in very serious trouble in this next year, and the global markets know this is happening. They are not going to address the long-term solvency problems of the United States. That’s going to trigger a massive decline in the dollar in the not-too-distant future, and that, in turn, will give us the early stages of hyperinflation in this next year. We’re basically at a point where we can’t kick the can down the road. This is it. — Going forward from here, you’re going to generally see a weaker dollar, and it will get much weaker. You’re going to have a dollar panic. — John Williams Economist

We Will Wake Up One Day Soon and Learn the Bond Markets Have Moved Against the United States.

From a recent interview with Jamie Dimon, Chairman and CEO of JP Morgan Chase:

Q: Do you worry that the bond market may someday move against the United States?

A: It’s virtually assured; the question is when and how. I don't know if it will be two years or five years, but it will happen. It is a matter of time; the United States can’t borrow indefinitely. Over hundreds of years there have been bankruptcies of country after country who thought they could get away with it because they had the reserve currency and the military power of the world. We are going to have fiscal discipline. It’s imposed upon us or we do the right thing and do it to ourselves the right way — America knows the way, but it doesn't have the will. — Jamie Dimon

Meanwhile, the IMF Is Laying the Groundwork for Global Wealth Confiscation

The sharp deterioration of public finances in many countries has revived interest in a “capital levy" — a one-off tax on private wealth — as an exceptional measure to restore debt sustainability. The appeal is that such a tax, if it is implemented before avoidance is possible and there is a belief that it will never be repeated, does not distort behavior (and may be seen by some as fair). — The conditions for success are strong but also need to be weighed against the risks of the alternatives, which include repudiating public debt or inflating it away. — The tax rates needed to bring down public debt to pre-crisis levels, moreover, are sizable: reducing debt ratios to end-2007 levels would require (for a sample of 15 euro area countries) a tax rate of about 10 percent on households with positive net wealth. (Page 49)

Download the IMF Report here: afeallocatedcustody.com/downloads/IMF-wealth-confiscation-plan.pdf

Why Is the Price of Gold Lower Now, and What Does It Mean Moving Forward?

On Friday, October 11th, there was a market selloff in gold which sent the price plummeting down per ounce. This is not exactly what already battered holders of gold needed to see. The year 2013 has been a year of non-stop hits to sentiment of anyone who owns gold. Major banks are telling people to sell gold as a “slam dunk” and that it's headed down to 50. It would be wise to remember that these same banks sold toxic Mortgage Backed Securities to their clients, knowing full well they were doomed, and then bet against their clients.

People who look at gold as a consideration for investment are concerned that it will continue to drop in price. I have personally spoken to numerous would-be gold investors who have told me that given the world economic situation, gold makes tremendous sense, yet they are unsure of an entry point.

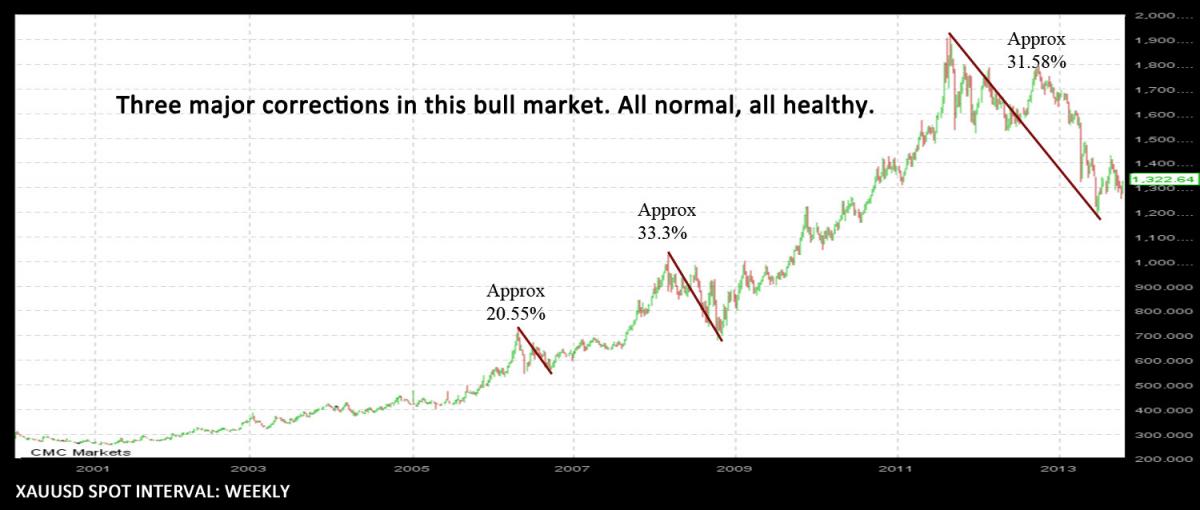

However incredibly bearish the market sentiment is for gold, by taking the entire year into view, the picture starts to emerge of a massive base building for a move up, not a new bear market on gold. This secular bull market in gold started in 2001. Keeping in mind that secular bull markets in commodities can last as much as 20+ years, gold may have yet to give up its bull run.

Over the course of this year, we have witnessed several instances of “massive sell orders” of huge quantities of gold futures contracts. These sell orders were placed with enormous concentrations which anyone who understands how the futures markets work knows would smash through the entire “bid stack” and force the price down. Traders who buy or sell large amounts will all tell you that if you are trying to get the best price for your sell order, you do not take out the entire bid stack guaranteeing that you smash the price down and get the lowest price for your sale.

Anyone with knowledge of the size and volume in the market would absolutely never, ever place a 5,000 [contract] sell [order] at market, because you could not estimate the offset price.[5] — Rich Ilczyszyn CEO, iiTrader

The ideal way to sell a substantial quantity of precious metals is to spread your sale out over the day or even several days into bite-sized chunks the market can absorb so that you get the best price for every ounce you sell.

I encourage you to watch this video to learn how Endeavor Silver sells their monthly production into the market by staging it across multiple sell orders to get the best price possible:

| Month | High | Takedown | Move |

| June | 00 | 80 | 0 |

| July | Recovers to 30 | ||

| August | Recovers to 20 | ||

| September | 00 | 00 | 0 |

| October | 30 | 65 |

In this series, we see the price down from 00 to 80 in June (0 per ounce), then another big hit from 00 to 00 in September (0 per ounce), and finally 30 to 70 in October ( per ounce).

Let's do some back-of-napkin math and estimate that it costs China 0M using proxies to knock the paper price down per oz. By some estimates, China has imported over 1700 tons of physical gold this year so far. This comes to about 54.656 million troy ounces. If we assume a savings of per ounce on the low side, this would save China a total of .27 Billion on gold purchases for 2013. Not such a bad deal.

The Chinese are some of the shrewdest negotiators and penny pinchers on the planet. This appears to me to be China slamming the market with big orders to gun the stops and shake loose weak hands in paper gold so they can buy the dips and accumulate massive physical positions.

Based on Record Physical Gold Buying, the End Game for China Is in Gold

Gold is unique among assets in that it is not issued by any government or central bank, which means that its value is not influenced by political decisions or the solvency of one institution or another. — Salvatore Rossi Chief, Central Bank of Italy September 30, 2013

I have said numerous times over the years that the next world currency system will be tied to gold in some way. In January of 2012 I gave a speech to a Chinese government think tank in which I advised them to raise Chinese gold reserves by several thousand tons so that they would have more bargaining power when the time came to re-arrange voting rights at the IMF or form a new international financial body which determines the future currency system.[7] I do not know if they have taken my advice, but it seems evident that they see the potential future wreckage of the bond market ahead, a sovereign debt crisis in the making, and are taking no chances.

The developing and emerging market economies need to have more say in major international financial institutions including the World Bank and the International Monetary Fund. — Xinhua News Agency

With China now openly calling for an end to the US Dollar as the world’s reserve currency, we must all seriously ask ourselves what we think the next system is going to look like. More importantly, however, we must ask how are our portfolios and businesses are positioned to weather the transition. It is more clear by the day that we are about to see some very turbulent waters. Yes, even worse than the past five years.

Gold has and always will be the final line of defense versus government fiat irresponsibility. That has been true for thousands of years and it is still true today.

The fanatics in the Washington establishment don’t get it that Keynesianism does not work. You cannot increase your debts to pay off your debts. You cannot print more money to cure all of the money you’ve printed, and all of this printed money is flooding out all over the world and wreaking havoc everywhere. They are all running the printing presses. Mark my words, if you don’t own gold, you will rue the day you decided not to buy it. — James Dines Hedge Fund Manager

Today’s gold price range is an excellent entry point for anyone who has yet to take a position in their portfolio. If you view gold simply as portfolio insurance and not for chasing yield, it may begin to make a lot more sense.

Resources

- GEAB No78 https://www.leap2020.eu/GEAB-N-78-is-available-The-de-Americanisation-of-the-world-has-begun-emergence-of-solutions-for-a-multipolar-world-by_a14827.html

- Fitch Downgrade Warning https://www.news-press.com/article/20131015/NEWS01/131015024/0/SS23/Fitch-issues-warning-U-S-credit-rating?odyssey=nav|head&nclick_check=1

- Chinese Rating Agency Downgrade https://www.reuters.com/article/2013/10/17/idUSL3N0I71YW20131017

- Xinhua call for “de-Americanization” https://www.ibtimes.co.uk/articles/513431/20131013/china-debt-ceiling-shutdown-xinhua-de-emericanised.htm

- Traders call foul on massive gold sell order https://www.cnbc.com/id/101110403

- Floor Trader “when it happens five times over a period of months, it does raise questions” https://www.mining.com/art-cashin-on-the-strange-happenings-in-the-paper-gold-market-53936/

- Alex Stanczyk speech delivered to Chinese Government think tank https://www.financialsense.com/contributors/alex-stanczyk/golds-role-in-...