Summary

- ECB policy misstep may cause disruption.

- European credit and stock markets are showing stress and bold action is needed.

- Failure by ECB to ease further could weigh on markets.

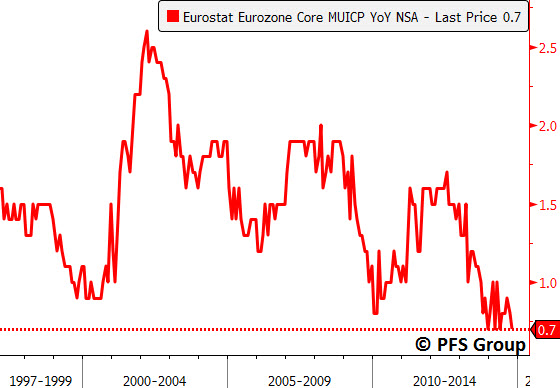

One of the chief concerns right now is the Eurozone, which continues to be faced with the specter of deflation and another recession. Parts of Europe are already experiencing deflation like Spain, Portugal, and Greece with core Eurozone inflation resting close to nearly a two decade low.

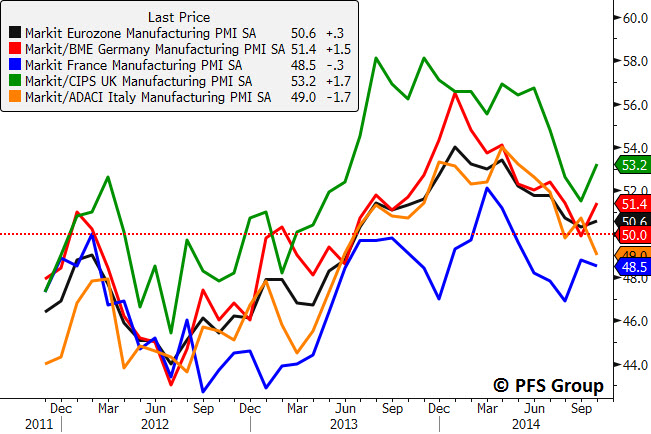

Economic activity is coming to a crawl as France and Italy are already experiencing an economic contraction as well (PMI reading below 50%) while the Eurozone as a whole is barely in expansion territory with its recent 50.6% manufacturing PMI reading (black line below).

A slowdown and recession in Europe would be a major problem given unemployment levels in the region. The unemployment rate for the Eurozone as a whole is still quite high at 11.5% with the PIGS (Portugal, Italy, Greece, Spain) at an alarming 22.7%. These countries are saddled with debt and the ability to service one’s debt always goes down in a recession as tax revenues plummet and the risk of default increases.

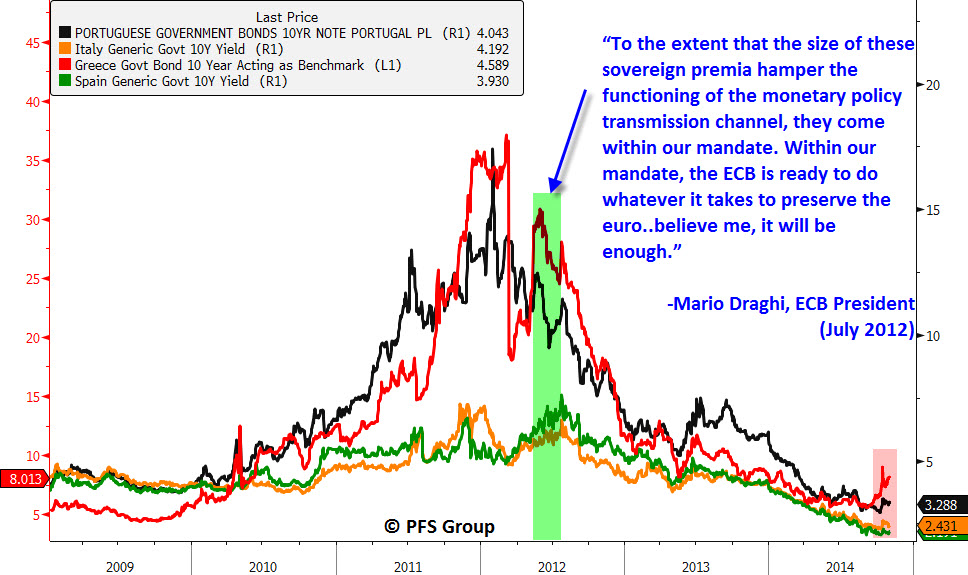

When much of Europe was in a recession (PMI < 50%) in 2011 and 2012, investors demanded to be compensated for default risk by requiring higher bond yields on sovereign debt. This is shown below in which Greek 10-yr bonds spiked to nearly a 40% yield in 2012 (red line, left axis below) while Portuguese 10-yr yields spiked to nearly 17.5%. Spain and Italy also saw large jumps in the cost of debt as their 10-yr yields spiked to nearly 8%. In a speech after the July 2012 European Central Bank (ECB) meeting, Draghi said “the ECB is ready to do whatever it takes to preserve the euro” (click for link). That speech kick-started a multi-year decline in European bond yields and sent their stock markets soring.

However, since that time the ECB's balance sheet has shrunk from just over 3 trillion euros to nearly 2 trillion and the biggest policy move from Draghi has been to cut interest rates close to zero percent. The rate cuts have failed to turn the Eurozone around and investors are looking for Draghi to now deliver further on his promise.

If you circle back to the European bond yield chart you will notice that yields are starting to creep higher again and with it the risk that a European slowdown could lead to future stock market weakness. We began to see credit default swaps on European sovereign debt start to creep higher beginning in June when investors were disappointed by a lack of big action from Draghi at the June ECB meeting.

There is a lot riding on the ECB to deliver at its Thursday meeting. It is currently the world’s most important central bank given the problems it faces (unemployment and deflation fears highlighted above) and the global systemic risk its financial markets pose. This risk was always present but had diminished since Draghi’s “whatever it takes” speech back in 2012. A growing divide among European policymakers however is now leading many to question the ECB's capabilities to do just this, as a recent Reuters article highlighted:

Central bankers to challenge Draghi on ECB leadership style

National central bankers in the euro area plan to challenge European Central Bank chief Mario Draghi on Wednesday over what they see as his secretive management style and erratic communication and will urge him to act more collegially, ECB sources said.

The bankers are particularly angered that Draghi effectively set a target for increasing the ECB's balance sheet immediately after the policymaking governing council explicitly agreed not to make any figure public, the sources said.

"This created exactly the expectations we wanted to avoid," an ECB insider said. "Now everything we do is measured against the aim of increasing the balance sheet by a trillion (euros)... He created a rod for our own backs."

Irritation among national governors who hold a majority on the 24-member council could limit Draghi's space for bolder policy action in the coming months as the bank faces crucial choices about whether to buy sovereign bonds to combat falling inflation and economic stagnation…

While a unitary state like Japan can make a radical monetary policy change with a slim majority, the ECB sources said it would be politically explosive for Draghi to try to force QE through in the multinational euro zone by such a narrow margin.

Concerns over Draghi’s ability to act in an aggressive manner are valid given the deterioration in the region's economy and still high public national debts among its members. If the ECB fails to act aggressively the Eurozone is almost certain to fall into another recession and witness a large spike in sovereign bond yields that it will have to address more aggressively than if it was more proactive.

These fears over how impactful the ECB can be given the divide Draghi is creating for himself are manifesting in European stock markets. A few weeks ago the number of stocks hitting 52-week lows hit 52% in the 50-member Euro Stoxx 50 Index, Europe’s leading blue-chip index. Readings north of 50% are exclusively seen in bear markets as highlighted below and suggests further damage to European markets may be ahead of us should the ECB fail to act aggressively.

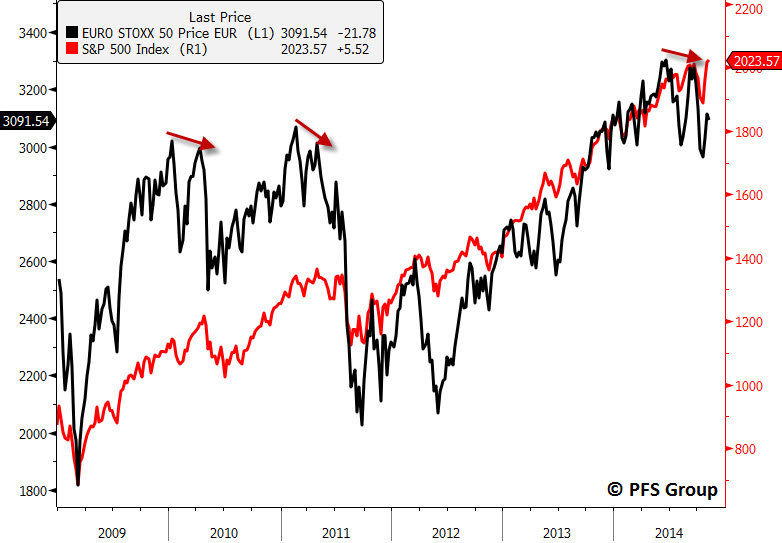

Given the Eurozone is the world’s second largest economy and has a sizeable influence on global economic growth, it’s not surprising to see U.S. equities correlated to European stock markets. While the U.S. markets can initially shrug off poor European equity performance, eventually our markets get pulled down as well as global growth concerns eventually outweigh. This was the case in 2010 and 2011 when the Euro Stoxx 50 Index peaked prior to the S&P 500 and gave an early warning to U.S. investors who paid attention (see red arrows). This year was no different as the Euro Stoxx 50 peaked in June and put in a lower high in September while the S&P 500 hit a new high, setting up a negative divergence similar to 2010 and 2011.

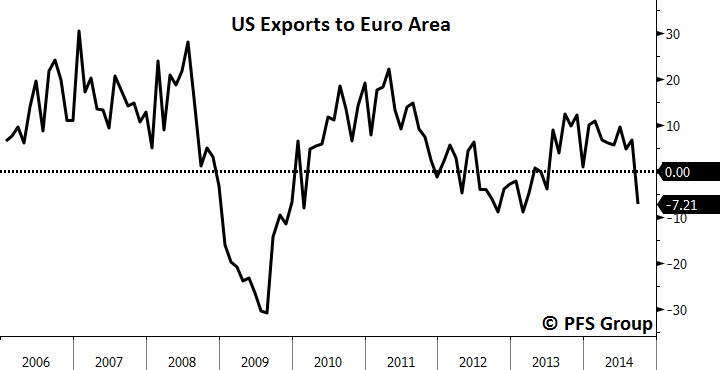

Exports to Europe are already at their lowest level in two years and a further decline in exports to the region would futher hurt multinational company sales to the region, which are already being hit by a strong dollar.

Concerns over a policy misstep by the ECB are nothing new. In fact, they have a recent track record of doing the exact opposite of what is needed (see red shaded regions below). Back in the middle of 2008, when the world was in the midst of a global recession and financial institutions were collapsing, the ECB hiked interest rates in July 2008 rather than cutting them. Within months the ECB had to backpedal when it began to slash interest rates in October 2008 at a peak of 4.25% to 1% a year later and aggressively expanded its balance sheet. The second misstep came in 2011 when the ECB felt the Eurozone was on stronger footing and paid more attention to transient inflationary pressures than economic growth and hiked rates twice and brought on a 37% bear market only to erase those rate hikes by the end of the year and massively expand its balance sheet.

Summary

While the U.S. economy remains strong and our stock markets have come roaring back to new all-time highs, investors should not get lulled into bullish euphoria. Europe remains a mess with serious risks of deflation and recession, and given the large debt imbalances of its sovereign members, keeping the economic engine going is vital to prevent a large spike in financial risk. Investors are becoming increasingly worried about the political divide within the ECB as Draghi’s support is faltering, which could lessen his ability to make bold actions when Europe needs them most.

We’ve seen how this played out in 2008 and 2011 when a hawkish German Bundesbank carried sway over the ECB to cause it to tighten when it should have eased only to do a complete about-face within months. Credit default swaps are rising again on European sovereign debt and European stock markets are incredibly weak with 52-week lows spiking north of 50% recently, a reading only seen during bear markets.

Should the ECB fail to act aggressively if economic data in the region deteriorates further we could see further weakness in European financial markets. In my eyes, Europe now poses the biggest risk to U.S. financial markets ahead.