Gold is a strange animal, it can move for a plethora of reasons and no one ever knows which variable will carry the greatest weight in its movement. Is gold moving because of inflation expectations, trends in real interest rates, money supply growth rates in major world currencies, moves in the USD, or supply and demand? What appears to have been weighing on gold the most in the last few months was a spike in real interest rates, however, what may play an equal or even greater role in the next year or so is the creditworthiness of sovereign governments. As I show later in this article, individual corporations are now more financially sound than the government they operate in.

First Europe, then the U.S.?

While world markets have recovered significantly from their dramatic decline in 2008 and early 2009, it's good to ask: Has anything really changed? The massive debts that were accumulated over the decades were never dealt with, but rather just changed hands. Debt burdens moved from the private sector to the public sector as governments bailed out their banking institutions and simply kicked the can down the road. At some point the pied piper will have to be paid through bone-crushing austerity measures, default, or money printing...or some combination of all three.

Since the debt burdens of the world have never been dealt with and are actually building, is it any wonder that gold has been the only asset class that has had a positive performance record for the past 10 years? Government bonds, corporate bonds, currencies, stocks, real estate—no asset class but gold can claim positive returns over the past decade.

As mentioned above, the debt situation was never dealt with and was simply moved from corporations to sovereign governments. Thus, it is not surprising to see the creditworthiness of corporations relative to sovereign governments improve, but what is surprising is the degree with which this change has occurred. We are now witnessing sovereign governments display greater credit risk than the corporations within their own borders!

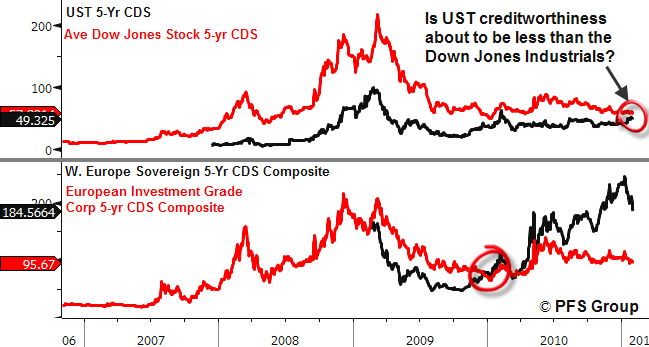

Case in point, the credit default swaps (CDS) on western European (W.E) debt are higher than W.E. corporate investment grade debt. Shown in the bottom panel below is an equally-weighted composite of 5-yr CDS on W.E. sovereign debt compared to a equally-weighted composite index of W.E. investment grade corporate debt. As can be seen below, in early 2010 as fears over a Greek default spread over Europe the sovereign CDS composite exceeded the corporate composite and the spread has only widened since then. The US, not to be left behind, shows the UST CDS closing the spread between the average Dow Jones Industrial Average company’s 5-YR CDS. It is almost unthinkable that a US corporation can display less credit risk than the government that they domicile in, but that is exactly what is occurring.

Already more than half of the Dow Jones Industrial Average companies have lower credit risk (using 5-Yr CDS) than the UST whose 5-Yr UST CDS stands at 49 bps.

Source: Bloomberg

As the creditworthiness for sovereign countries comes into question we are likely to see gold advance further. The linkage between sovereign creditworthiness and the price of gold can be seen below by looking at the spread between my W.E. sovereign 5-yr CDS composite and my W.E. investment grade corporate 5-yr CDS composite. The recent peak in gold didn’t occur until the CDS spread between W.E. sovereign and corporate debt contracted. There is also a decent correlation between the UST to Dow Jones CDS composite spread to the price of gold, which is on the verge of crossing as the UST 5-Yr CDS is only 9 basis points below the average Dow stocks 5-Yr CDS. Consequently, asking if the US is the next country to see its sovereign debt credit risk rise above its own domestic corporations is a valid question.

As gold now stands, there appears to be three out of four factors working in its favor that could put a bid under the yellow metal. The only negative right now for gold is that the spread between W.E. sovereign debt CDS and the W.E. investment grade corporate CDS composite is contracting as fears are subsiding in Europe (orange middle panel below). However, the spread for the UST to corporate debt is worsening (blue middle panel), real interest rates are falling (red, lower panel, inverted), and the USD is weakening (green, lower panel, inverted).

Source: Bloomberg

Technical Outlook

When I last wrote about precious metals (“Precious Metals Update”) I thought gold stocks were near a short term low but an intermediate low was still not in place. The low I called for turned out to last a mere three days before gold stocks headed lower to close out January in the red. I thought more downward price movement and time was needed for an intermediate low to occur and over the last few weeks many of my indicators have moved to intermediate low territory.

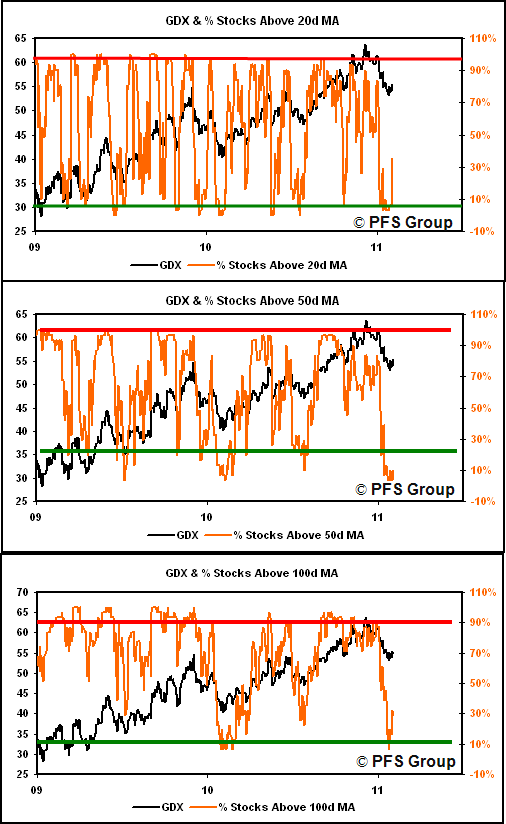

Looking at breadth in terms of the percentage of stocks above a key moving average within the Market Vectors Gold Miners ETF (GDX) is a helpful gauge in terms of capturing short term and intermediate term bottoms. Back in January I felt that while the percentage of stocks above the 20 and 50 day moving average (50d MA) were near oversold levels, the percentage above their 100 day moving average (100d MA) was still not oversold enough to warrant calling for an intermediate low. As shown below, all three breadth measures are in oversold territory and conditions are in place for an intermediate low.

Source: Bloomberg

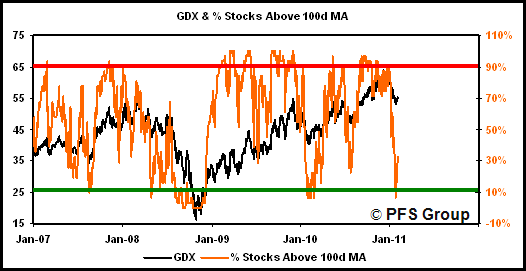

Looking at the 100d MA breadth indicator over a longer time frame does show we have an intermediate low in the making as we are as clearly in oversold intermediate-low territory. Now price just needs to confirm a low is in place as things can always become more oversold.

My gold technical indicator reached neutral territory when I last commented on gold, but not oversold territory. As seen below, my indicator shows the fourth most oversold reading since the 2008 bear market lows and does suggest a buying opportunity in gold.

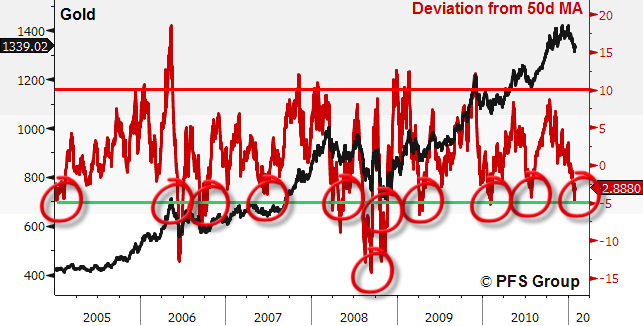

Another indicator I like to track is gold’s deviation from its 50d MA. As seen below, intermediate lows in gold are often seen when it falls 5% below its 50d MA, which was recently hit and is now recovering.

Source: Bloomberg

As I mentioned last time, I was most concerned about silver as my silver indicator reached the third most overbought reading in a decade and prior readings (2004, 2006, 2008) were all followed by long and drawn out corrections. Since silver peaked, my indicator has only moved to neutral territory and still has a long way to go before an intermediate low is in place. There is always the risk that silver might reverse and my silver indicator may not reach oversold territory, but I think a solid close above the 50d MA for silver is needed to reverse the bearish intermediate trend currently in place.

While conditions are in place for a potential intermediate low in precious metal stocks and gold, before we can definitively say an intermediate low is in place we need to see signs of confirmation the bearish trend has reversed. Right now I see the potential for gold stocks to become even more oversold and set up a major low before shooting higher. On the bearish side of the ledger, a potential wedge has been forming over the last two weeks (red converging lines below) as the GDX is sandwiched between the 20d and 200d MAs. If breaking to the downside, the 200d MA will most likely also be broken until the next line of support, which comes in between .50 and , or the 2010 summer lows.

As the bearish trend from December 2010’s peak is still in play, it is probably best to wait for gold stocks to prove themselves as downside risk is still significant, but now is certainly the time to get one’s shopping list in order as we are already at or near a major low for gold stocks.