The existence of gold market intervention is known widely among experts. However there is very little awareness that there are actually distinct phases of intervention. But these phases in particular are essential when considering the current state of the gold market.

Intervention aimed at countering rising gold prices has occurred for many years. One of the reasons is efforts by central banks to quell doubts about monetary stability. Despite such primary objectives – leading characters, motives and times do not form a coherent unit. In particular there are clearly distinguishable phases.

Phase I

As early as 1993, worries circulated among central bankers over rises in the inflation-rate and the lasting functionality of the monetary system. The European Monetary System had collapsed and gold prices had increased dramatically during the first half of the year. There was a danger that a further increase in price would signal a rise in inflation and that, because of expectations, inflation would indeed return strongly. Some central banks, including the FED, agreed at the beginning of July not to tolerate gold prices above 400 dollars an ounce. Unperturbed, the price of gold marched higher topping the mark. The day had come: On August 5, 1993 at 8:27 AM (all time values are US Eastern time); the pact was put into action. Massive sales, mainly on the Comex futures market in New York, triggered a price free-fall. The sudden drop was supposed to unsettle investors and persuade them to stay away from the gold market. To this day, sudden price pullbacks are a key characteristic of systematic gold market interventions. The following chart shows the intra-day price movement of gold on August 5, 1993, the beginning of the systematic interventions.

Gold Intraday on August 5, 1993

(The start of the interventions)

Figure 1

Phase II

The physical metal required for pushing gold prices lower found its way to the market both through sales and lending activities. The so-called gold carry trade involves lending gold to interested market participants, who then sell it on the market using proceeds to invest in other higher-yielding assets. Since gold carry traders now owe gold they have a vested interest in seeing lower gold prices. If they can clear their books or back when prices are lower, they make a profit. That’s why they started a lobby and media campaign aimed at achieving increased gold sales and lending and thus a fall in gold prices. One of the biggest holders of gold was the Swiss National Bank. When it announced its intention to sell gold, it signaled lasting lower prices in the metal. Thus the second phase began on November 21, 1996 at 10:01 A.M.

The Phases of the Gold Price Interventions

Figure 2

One of the main characteristics of the second phase was the conflicting interests involved. Profit minded carry traders wanted lower gold prices, while central banks were satisfied with prices at least no longer falling. For that reason central banks increasingly fought against prices continuing lower; even Greenspan, who was among the initiators of gold intervention, now spoke in favor of gold. The other side included carry traders and a few politicians, which led to gold sales by the UK. Despite the downward trend in gold, there was an upper price limit during the second phase; which was pegged at 300 dollars per ounce. In addition there was agreement over a final year-end price of 290 dollars on the Comex futures market.

Phase III

As gold stock piles at central bank vaults continued to dwindle; it became obvious that prices could no longer continue to be held at low levels. That’s why in May, 2001 the best known of the carry traders were informed that they would have to expect rising gold prices at the end of the year. What happened then could have come from the pages of a crime novel: Several large market participants looking to take advantage of the situation forced the carry traders out of their huge short gold positions as the price of the metal exploded. Their action commenced on May 18, 2001 at 12:31 PM, thus ringing in the third phase – and that, even though their last attempt to trigger a price explosion had ultimately failed on the dominance of the central banks. However now it was clear that in the long run gold prices could no longer be held down. What’s more, since those very days the structure of the futures market has changed in an essential way. According to official US trading statistics, commercial traders are now markedly positioned on the sell side of the market on permanent basis. The following figure shows positioning of the "commercials" in the futures markets.

Gold and Net Positions of Commercials

(Proportion of the overall positions)

Figure 3

The third phase is typified by a climbing gold price. The goal now is no longer to hold prices steady or even to push them back down, but simply to prevent them from rising too rapidly. But also the strategy of supplying the market with stockpiles of central bank gold has changed. Until 2001, reserve banks had suppressed gold prices by selling and lending ever larger amounts of the physical metal to the market. But by doing so they had put themselves at risk: Loans were running at several times yearly consumption, an amount the banks could hardly take back through normal channels. That’s why since 2001 central banks sell about as much as they are able to take back in loaned gold. In essence they return loaned gold back to themselves. Effectively since the third phase began, gold no longer finds its way back to the markets from the central banks. Gold’s climb goes right along with it.

Phase IV?

Since 2008 the question has been whether we are now in the final phases of systematic gold intervention activities. In the wake of the financial crisis, large scale doubt about the stability of the currency system surfaced again for the first time in years. A rise in gold prices can still be prevented through massive interventions. There has also been far stronger intra-day price movement as in previous years. But what does gold have to do with the global crisis?

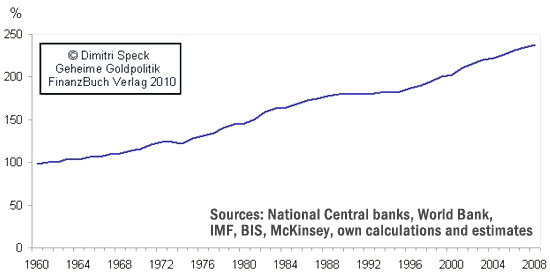

To this, the final figure shows the entire world’s debt compared with its economic potential. Included is not only the debt of countries, but also that of households and companies, because in the final analysis they also must be supported by economic potential. In addition the financial crisis has shown that the state must directly or indirectly accept private sector debt on its books in order to prevent collapse.

World: Ratio of Overall Debt to Global GDP

Figure 4

Since the 1960s, the world’s total debt has more than doubled compared to global economic potential. Classically the end of this kind of credit bubble results in collapse and default. These days, nations generally act to prevent that in order to avoid strong deflation and crisis. What possible outcome is demonstrated by Japan, which as early as the 1990s, was mired in excessive debt similar to the way the entire world is today. In Japan, it ended in decade-long stagnation, but at least not in catastrophe (at least not yet). In the best case, even climbing out of debt is possible the way Great Britain did after the Second World War. However conditions in those days differed dramatically. Besides, globally speaking there has never been a measurable reduction of debt for decades now (even from much lower levels). That brings us to another road down which an over indebted economy can travel. It has to do with the Janus face of debt: One man’s debt is another’s certified claim. If inflation expectations increase these claims could end up in circulation, which would mean a sort of flight to material assets. Because of large holdings of debt paper, potential for demand is high and with it an accordingly high potential for an advance in prices. That type of scenario is still not visible on the horizon. But if it should come to that, gold’s advantages as a non-replenishable and non-revalueable liquid asset would come to play – exactly the same advantages that have been motivating the central banks to execute interventions since 1993.

Dimitri Speck

www.geheime-goldpolitik.de/english

Translation of the article for the International Precious Metals & Commodities Fair in Munich, November 5 through 6, 2010. Original German version: www.goldseiten.de/content/diverses/artikel.php?storyid=14871