As we kick off 2011, there are plenty of things for investors to worry about, including budget imbalances in developed nations, high levels of bullish sentiment, and a fear of rising interest rates. As of late December 2010, the market’s technical profile remains healthy relative to the outlook for the next few months, something we expand on in the video below.

From Wall Street’s perspective, the positive drivers for stocks in 2011 include:

- The recent extension of the Bush Tax Cuts.

- Little in the way of double-dip talk.

- Positive outlook for the economy and earnings.

- Favorable market seasonals and cycles.

- Many companies have large stores of cash.

- Consumer confidence is picking up.

- The Fed’s desire to inflate asset prices.

- Consumer balance sheets have improved a bit.

- Stock valuations are not excessive (from the perspective of many).

- Low CPI inflation.

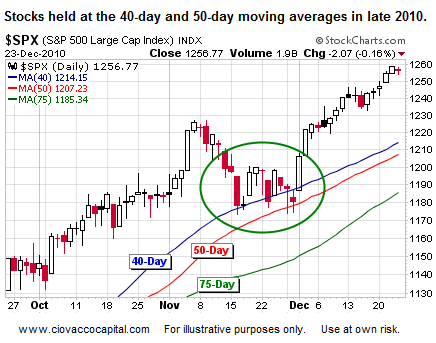

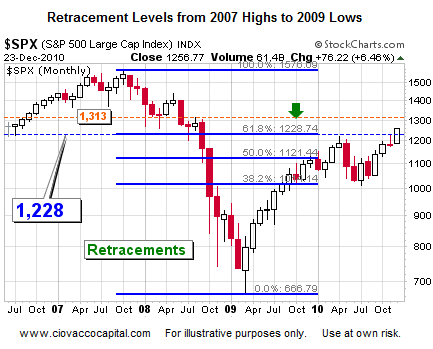

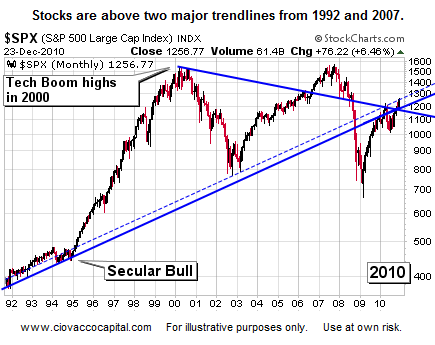

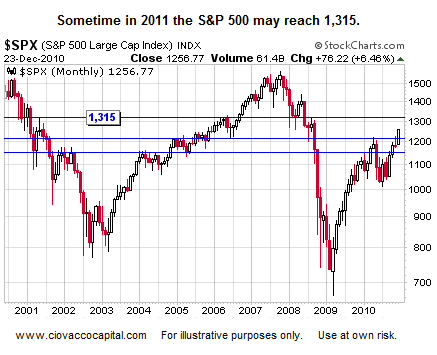

Part II of our 2011 stock market outlook expands on some of the concepts above with an emphasis on (a) what could derail the bull, and (b) the S&P 500’s technical profile. The technicals are discussed in a manner that can be understood by both professionals and investors who have limited experience with market charts. Copies of the charts reviewed in the video, as of December 23, 2010, are below the video player. A larger version of the video player can be found here.

Part I of II can be found in Risk Assets Respond to Quantitative Easing.