Over the last few months, jitters have gripped investors as the stock market has become a bit volatile on the downside. The last peak in stock prices came almost immediately after the Federal Reserve announced Quantitative Easing III in September. QE3 was the most widely anticipated monetary policy event of the current cycle, so maybe investors and stock prices broadly just needed a breather. But immediately post the US Presidential election a month ago, stock prices swooned anew, only finding their feet in late November. Recently the mainstream media has been highlighting Fiscal Cliff concerns as the raison d’etre for renewed equity investor angst. Is this really the case? Are equity investors looking at the Cliff, or perhaps over the Cliff? This distinction may become quite important ahead.

There’s an old saying in the financial world that “financial markets never discount the same thing twice”. It’s a timely reminder in that the Fiscal Cliff issues have been very well known for a year and a half. The “Super Committee” formed in December of 2011 essentially came up empty handed in terms of reconciliatory action regarding specific Fiscal Cliff items. Since that time, investors have had date specific certainty as to when Fiscal Cliff Federal spending cuts and personal tax rate increases would occur. The important message being that for the investment community, Fiscal Cliff issues we face are not now nor have they been any surprise at all, especially over the last two to three months. Is it really the case that investors have waited until six weeks prior Cliff mandates becoming law to worry about how this will influence specific investments?

Coincidentally, recent stock market price jitters have expressed themselves alongside another important period for news – the release of third quarter corporate earnings. The character of earnings in the most recent period deserves comment. Let’s start with some background regarding the key economic drivers of the current cycle. From 2009 until present, the two most important drivers of the US economy have been Government spending and very strong US goods exports.

As you may know, US Government debt has doubled since 2006, the bulk of this debt growth occurring since 2009. Much of this borrowing has gotten into the US economy in the form of direct stimulus, extended unemployment benefits, etc. Although current cycle Federal debt expansion will need to be reconciled ahead, the real economy would have suffered a much more serious contraction had the Government not acted as the broader financial backstop for the economy. Certainly Fiscal Cliff issues are important in that part of the Cliff mandate is a reduction in Federal spending, or really stimulus in reverse. It’s also clear that Government support since 2009 has helped support US corporate earnings growth. Point being, we can put aside potential Fiscal Cliff spending reduction issues for a moment and simply consider the impact on US corporate earnings if the Government just stops taking on an additional $1 trillion of new debt each year, as it has for the past few years.

We also need to look at the current character of the global economy and what that may mean for US corporate earnings in the quarters ahead. In the current economic cycle, the very large multi-national blue chip US corporations were tremendous beneficiaries of foreign government stimulus. One can look at a company like Caterpillar who has been a major beneficiary of Chinese government spending on infrastructure in years past via the export of its manufactured products to China. In the third quarter, Caterpillar lowered their earnings outlook all the way out to 2015, in very large measure due to the now visible macro economic slowdown in China and the greater Asian economies. The numbers as of the third quarter now show us that the year over year change in total US goods exports is as low as anything we’ve seen since late 2009. (The red bars in the chart below document prior official US recessionary periods.)

Certainly we’re not just experiencing economic slowing in China and greater Asia. Europe is in recession, and it’s not just the southern European countries that are struggling as per the latest numbers out of France and Europe’s historic strongman Germany. All of Europe is struggling. So it’s really no surprise as to why the rate of change in US export growth has slowed so dramatically over the past year. What is important is the impact of slowing exports on forward US corporate earnings.

Looking beyond the US Fiscal Cliff issues specifically, it’s clear that global economic slowing is negatively impacting US goods exports, one of the two key legs of the economic stool in the current recovery. Additionally, the ability of the US Federal government to continue to take on debt is more of a question mark than has been the case in recent years. Both of these issues have direct bearing on the forward character of US corporate earnings. Is this more likely what is causing angst of late among equity investors rather than the well known Fiscal Cliff issues?

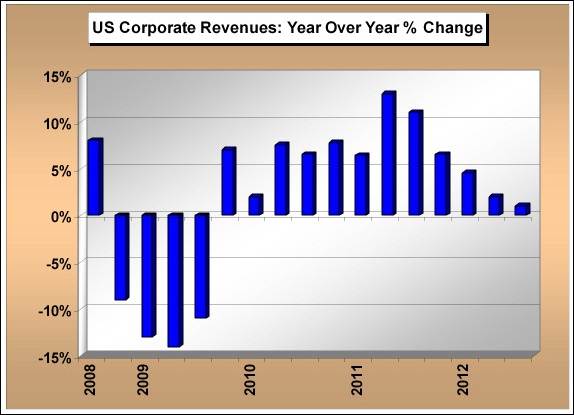

One last point about current US corporate earnings character that is very important to incorporate into forward decision making. While US economic recovery relative to historic economic cycle experience has been quite tenuous, US corporate profit margins currently rest at all time highs. The reason we see this within the context of what can be called a subpar macro economic recovery relative to prior cycles is that US corporations slashed payrolls at an unprecedented pace over the 2007-2009 period and never restaffed to prior levels. Corporations found out they simply did not need as much labor, one of their primary cost centers. This is now extremely important, since in order to maintain current levels of profit margins in what has become a slowing global macro environment, corporations will again need to cut costs. But what costs are left to cut? Although that question remains unanswered for now, it takes front and center stage as of third quarter earnings reports as 3Q saw the smallest year over year gain in US corporate revenues since 2009. Moreover, the ongoing trend in slowing year over year revenue growth is unmistakable over the last five quarters.

In a period of slowing global final demand driven in very large part by Europe and China - exemplified in the contraction in year over year S&P 500 company revenues seen above - simply maintaining levels of US corporate profitability (to say nothing of growth) mean costs must be cut. As of the current period, US corporate revenues are growing at a rate below that of headline inflation.

How this collective set of macro global economic circumstances plays out with implications for US corporate earnings specifically remains to be seen, but the current period numbers and in place multi-quarter trends tell us we need to be very watchful. What we believe is important is to focus on the correct questions as we head into year end. The mainstream media would have us believe US equity investors are solely focused on and worried about the Fiscal Cliff. Implication being that once we have some type of reconciliation, fears and jitters will subside. We suggest that although concern over Fiscal Cliff outcomes is important, equally if not more important is looking well beyond the Fiscal Cliff. Now is the time to look over the Cliff and assess the forward rhythm and tenor of the global economy, as well as how that rhythm will either positively or negatively impact the US corporate revenue and earnings growth outlook for the next two to three quarters.