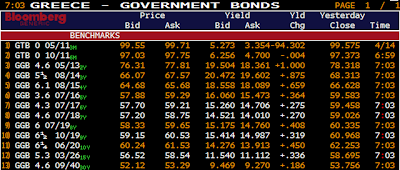

It’s been my observation over many years that when the external debt cost for a country hits 10% it is just a matter of time before the wheels come completely off and a restructuring is the next step. I saw this in Latin America many years ago. For sure, the status quo can be maintained for a bit, but the inevitable result is that the situation is unsustainable and not fixable short of a major restructuring of the country's debt. These are the conditions that brought us the Brady Plan of the Mid 80’s. The same conditions exist today for the PIGs:

A close up of the Greek 5-year. This bond is screaming for a restructuring.

So what's going to happen next? What might a restructuring of Greek debt look like? Things that are likely to result:

-There will be a range of options for holders of Greek debt.

-Principal forgiveness of at least 30% will be one option. In this case there would have to be enhancement of both principal and interest on the new debt. The exchanged bonds would be “money good” but they will still trade at a discount from other AAAs because they will be “story bonds” with limited demand and liquidity.

-Another option will be for no principal reduction (Par Swap) but an extension of maturities at a sub market interest rate.

-To have the slightest chance at acceptance and success the Par Swapped restructured obligations MUST have credit enhancement on the principal of the debt that is exchanged. The end result will be that either the IMF or the ECB (or some new Euro guaranty mechanism) will be on the hook for Greece’s future performance.

Let me make some guesses on how these new instruments would trade.

Assume that one held Greek Debt and was willing to exchange it for a new 20-year obligation. Assume the principal ‘haircut’ is 30%. The new obligation is credit enhanced so that if Greece fails to pay interest and/or principal on a timely basis the restructured creditor gets payment from a Guarantor that is equivalent to a sovereign AAA. The interest set (floater or fixed) on the new Obligation would be similar to that of the Sovereign Guarantor (AKA: ECB). The new bond will trade at a discount to its new par value, but it will trade above 90% of par (@90 = AAA+80; that should find bids).

This means that if an old Greek bond is exchanged for a new enhanced Greek bond it is worth a minimum of 63 cents. (.70 * .90). If the new enhanced bond traded at 95% the equivalent would be ~67% cents.

Now the par swap option. Assume that one is willing to exchange an existing Greek bond for a new one that has a 20-year maturity and a fixed coupon of 3%. Assume further that the interest payment will have no credit enhancement. The payment of interest will continue to be 100% Greek risk. The payment of principal in 20-years would be guaranteed by an acceptable Guarantor.

This creates a hybrid security that will trade as the sum of its parts. The principal portion has a Net Present Value of ~44 (discounted at 4.0%; Germany +75).

The interest portion will also have an NPV value. A fixed Greek obligation to pay interest at 3% would be discounted by the market by (my estimate) at 10%. The current value of the discounted interest flows is ~23.0. The sum of the two (Principal + Interest) is ~67.0.

The approaches I have used to evaluate post-restructured Greek debt are hybrids of cookie cutters. There is a long road map of what happens when a country goes bankrupt. I just apply the same rules. The guarantee feature I use is both undesirable, and necessary. The “solution” that will soon be forthcoming from the likes of the IMF will incorporate these features.

If you use my numbers/analysis you come up with a range of future values for Greek bonds of 63-67% of par. Of course one should not take these estimate too seriously. I would discount them a bit further to be on the ‘safe’ side. Another 10% over my numbers and you get the mid 50’s as a level where Greek bonds get interesting.

Guess what? We’re there already.

Am I recommending that one should jump into Greek bonds with both feet at this point? Hardly. I am suggesting that the market blowout in Greek bonds today has created the opportunity and the necessity for a restructuring. I think it will come by the end of the month.

If and when it does come, Greek bonds that are bought around 50% of par could be a money maker. What concerns me is that as soon as this restructuring is announced the ‘market’ will push Ireland and Portugal to the same end.

Those that have been advocating debt destruction as the only possible endgame of too much debt are about to see their thinking become a reality. Where the process starts is now clear. Where it will end is anything but.