There are not many AAA muni borrowers around these days. I took a look at two of them. One is small (Maine) the other large (Texas). For the life of me I can’t figure out why they are AAA. First Maine:

In 1972 the state of Maine created the Municipal Bond Bank (“MMB”). The bank borrows from the public muni market and lends the proceeds to a total of 240 municipalities for various purposes (school,water, sewer etc). MMB is rated AAA by Fitch.

MMB has a great balance sheet. $2b in assets, only $1.47b in debt. The conclusion is that there is $558mm of “equity”. That would depend on how you value all of those assets. Fitch comments on the asset quality at MMB:

Fitch estimates that participant borrowers of at least 71% of outstanding loan principal exhibit investment-grade characteristics. Fitch does not express an opinion as to the credit quality of the remaining underlying loans.

Huh? 29% ($600mm) of the book is not investment grade. Even loans that are investment grade are not liquid. There would be a big haircut to mark to market this loan book. But no need for mark to market, right?

BBB earns money off the spread on its loan book. But it is very dependant on state and federal contributions. In 08/09 MMB got $50mm in grant money from ARRA. ARRA is now gone.

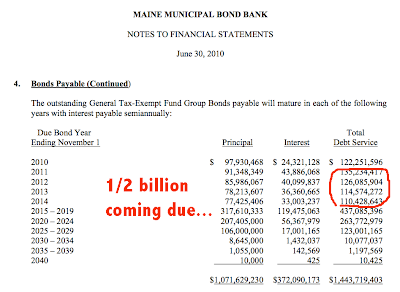

My real concern with MMB is not so much with the asset side. It is the liabilities. Consider this maturity schedule.

Under normal circumstances this bond schedule would not be an issue for a borrower with a AAA rating. My concern is that we are not operating under normal circumstances.

Please DO NOT read these thoughts and conclude that Maine’s bonds are not money good. THEY ARE. If you own them you will get your principal and interest on time. My concern is that even good borrowers are going to get crowed out. As and when this happens it will have a very significant consequence on the economy of Maine and elsewhere.

The state of Maine has an admirable AA from Fitch. But the AAA at MMB is the prize. In other words, the higher rating is a result of a CBO structure. Clever.

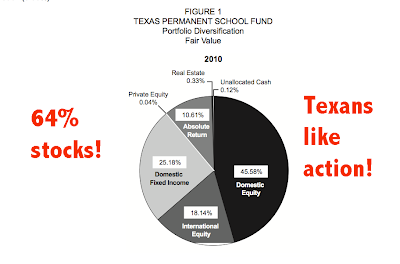

Texas does it Texas style. Want to know why this state is thriving while so many others are not? Some of the credit has to go to the Texas Permanent School Fund (“PSF”). PSF is a very interesting operation. As of the most recent report they had b of assets. How are they invested? Let’s just say that Texas loves stocks:

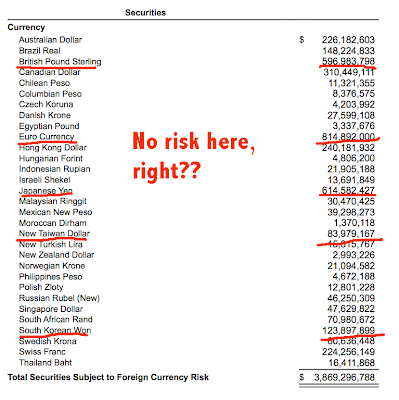

I tip my hat to the folks at the PSF. This is a pretty aggressive style. Consider their currency exposure. PSF is a global player.

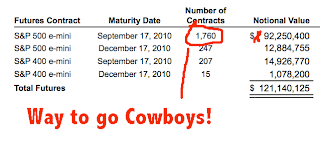

At the end of their year they had 1,700 cars on the E-mini. If they have a 0mm book of leveraged futures at Q-end I wonder how big they play during the Q?

Again, I’m not knocking the PSF. I like their style. My problem is that PSF is using the b as security for their guarantee business. The FSB has its name behind a ton of school debt. The total of principal and interest guarantees came to 4b as of 8/1/2010.

Once again let me say that Texas school bonds guaranteed by FSB are going to pay on time. FSB has deep pockets of liquidity. Texas is doing fine. My concern is that FSB has 6X leverage of total guarantees to equity. And 64% of the equity is invested in the global stock market in an aggressive manner.

Bloomberg reports that the peak to trough of FSB was a swing of 26%. Quite a ride:

The fund stopped backing municipal bonds and cut its contribution to the state last year (2009) after board-managed assets shrunk to billion in March 2009 from a peak of billion in mid-2007. It resumed bond guarantees in February, after the S&P 500 reached a 15-month high.

We have seen it in the recent past. A drop in stocks and FSB freezes up. When it does freeze, it forces munis to suspend new projects and scramble to refinance old ones.

A question given the last three years of history. How does an equity portfolio with an uncertain value create thecertainty of a AAA guarantee?