(This is an excerpt from the February 24, 2012 blog for Decision Point subscribers.)

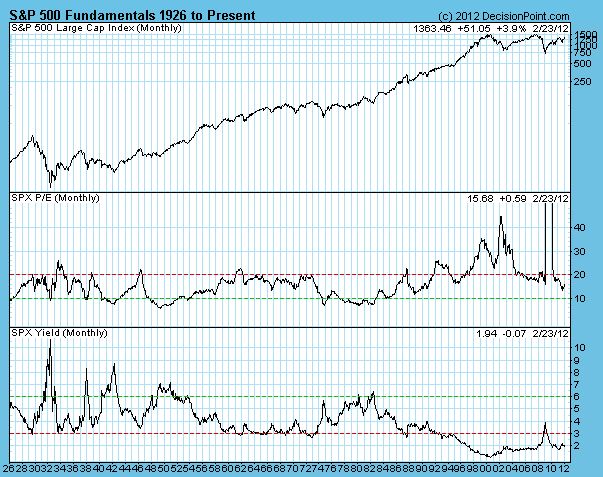

Last week my Chart Spotlight article asserted that stocks are fairly valued because the twelve-month trailing (TMT) P/E is about 15, which is midway the normal P/E range of 10 (undervalued) to 20 (overvalued). The middle panel of the chart below demonstrates this concept.

I received mail from a reader who suggested that dividends were a better measure of valuations, because dividends had to be paid with real money, a metric that is much harder to diddle than earnings. I still think that the P/E is a more consistent measure of value, because of the basic accounting principles involved; however, dividends do offer a better view of the underlying health of the market.

The bottom panel of the chart below shows the history of the S&P 500 divdend payouts beginning with 1926. We define the normal dividend range as being between 3% (overvalued) and 6% (undervalued). (We got this definition many years ago from I.Q. Trends, a service that specializes in high-quality dividend paying stocks.)

While the top of that range has been somewhat flexible, the bottom (3%) was very rigid until the 1990s, when the stock bubble began and investing became all about growth! growth! growth! Dividend stocks were for dullards who probably believed that having money coming out the wazoo could be harmful to one's health. This unfortunate shift in investor attitude, along with the Fed's easy money policy has driven dividends well below the 3% level, and one wonders if a new range is being established.

Fortunately, there is renewed interest by investors in investing for dividends, which will encourage companies to increase dividend payout. Unfortunately, with the S&P 500 yield at less than 2%, now is a lousy time for dividend investing. There are probably some good deals out there, but the downside risk to principal (the price paid for the stock) is higher than when buying near market bottoms.

Here's the ideal scenario. You buy a dividend-paying stock at an extreme price low, when the dividend yield is high. Then you hold it forever. You don't pay too much attention to the stock price -- just focus on the yield on your basis. Over the years it is highly likely that the dividend will increase, continuing to increase the return on your original investment. Dream on. The last opportunity like that occurred in 1982.

The good news is that there will probably be another once-in-a-lifetime opportunity like that in this decade. I base that assumption upon my belief that the debt crisis will drive stock prices to far lower levels than we saw in the last decade. Failing that, another bear market could present a dividend spike like we got in 2009. It wasn't close to being as good as we would like, but it wasn't too bad, considering the lousy yields available from bills and bonds.

Conclusion: Dividends are another way to value stocks, and I can't say I would necessarily disagree with anyone who asserted that stocks were overvalued based upon current dividend payouts. But I still think that the P/E is a more consistent yardstick. That said, dividend investing has been a sound methodology throughout history, and another grand opportunity like 1982 could present itself before the end of this decade. Now is the time to be examining this strategy so that the intersection of preparation and opportunity will enhance your chances at some very good luck.

Nothing herein should be construed as an offer or solicitation to buy or sell any security. Past performance does not indicate future results.