While we have been bombarded with a stream of negative news over the last few years from bankruptcies to sovereign debt crisis, some bullish commentary may prove to be a nice change. Readers who regularly follow my work know that I believe we entered a secular bear market (prolonged period of subpar stock returns) in 2000 which I believe will continue to approximately 2014-2015. While my secular bear market window is still a few years out, I believe it is time to switch from a secular bear mentality to a secular bull mentality or many great investment opportunities will pass investors by. While the general stock market (S&P 500, Down Jones Industrial Average) may not emerge from its secular bear market for a few more years, if investors sifted through the market they would realize that many stocks are breaking the shackles of their individual secular bear market chains and hitting all-time highs. These are the early signs of a budding secular bull market that have been developing since late 2008 and will continue to develop for a few more years, akin to sprouting leaves on trees as spring approaches. Unless the perma bear crowd begins to soften their hardened bearish position they will fail to jump on the opportunities that will arise after the next bear market just as they were frozen to act in late 2008 to early 2009.

Demographics – From headwind to Tailwind

One of the reasons why I think the secular bear market that began in 2000 will end around 2014-2015 (give or take a year) is due to a change in trend in relative population demographics. The ratio of the 35-49 year old group relative to the 20-34 year old group will begin to rise beginning in 2014-2015, which will be a favorable for overall spending and income trends in the U.S. Rather than hash out the reasoning behind this readers can look at two prior articles I wrote back in 2008.

- Change We Can Believe In – The Slow Decline of the U.S. Consumer (02/27/2008)

- Secular Sign Posts: The View From 30,000 Feet (10/14/2008)

As the ratio of the 35-49 to 20-34 age groups is important to overall national consumption and income trends, it also has a close link to the general trend in the stock market, and why the 2014-2015 demographic bottom may also coincide with a secular bottom in the stock market. This general trend between demographics and stock prices is shown below, which suggests the next secular bull market may begin in 2014-2015 and run to 2030.

Source: U.S. Census Bureau, Robert Shiller

Source: U.S. Census Bureau, Robert Shiller

While many think that secular bear and bull markets are characterized by price, they are also characterized by valuations, such as the price-to-earnings ratio (PE). In secular bull markets prices rise on a consistent basis as do valuations in which stock market returns not only come from earnings growth but an expansion of the PE ratio, or what investors pay for earnings. Conversely, during secular bear markets the general trend in stock prices is flat to down and the price investors are willing to pay for earnings declines in which the PE multiple contracts.

Just as relative demographics show a close correlation to stock prices they also show a close correlation to the PE ratio. Shown below are two secular bull and bear markets in the S&P 500 PE ratio and the trend in relative demographics. We can see the general increase in the S&P 500’s valuation from the 1940s to the late 1960s occurred alongside a rise in the 35-49 to 20-34 age ratio, which was also the case from the early 1980s to 2000. Similarly, the general compression in valuations from the late 1960s to the early 1980s witnessed a decline in the 35-49 to 20-34 age ratio as was the case from 2000 to the present. Thus, a bottom in the relative age demographic in 2014-2015 may also coincide with a bottom in the S&P 500’s normalized PE ratio.

Source: U.S. Census Bureau, Standard & Poor's

Missing the Trees from the Forest

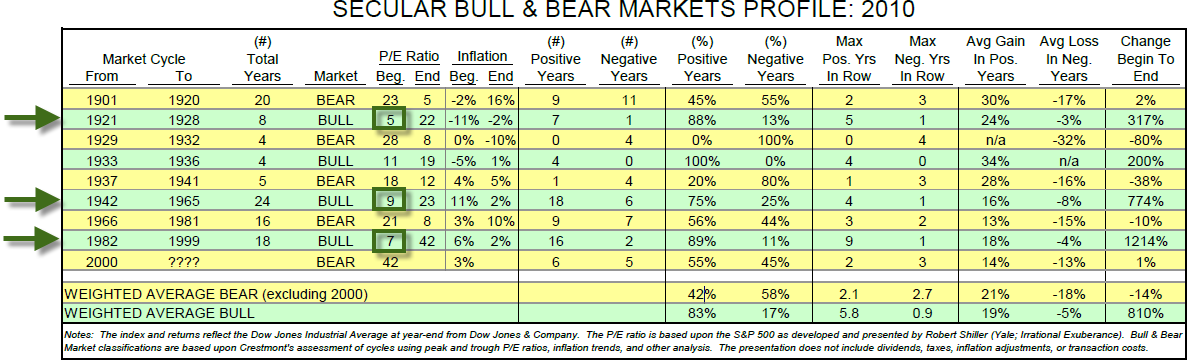

Many prominent investment bears support their argument that the 2009 low in the markets did not represent THE low for the secular bear market that began in 2000 since most secular bear market bottoms occur with single-digit PE ratios close to 6-8. This is true as seen below in the table from Crestmont Research which shows excellent data for the profiles of secular bull and bear markets. Note below the three arrows which show single-digit PE ratios for the starting point of previous secular bear market troughs (secular bull market starts).

Click here to enlarge

Source: Crestmont Research

While at the March low in 2009 the S&P 500 didn’t reach single-digit territory, it did sport a PE ratio of 10.19 which was just a stone’s throw away. That said, solely looking at the general stock market (S&P 500) will cause investors to miss the individual opportunities that arise when they take too broad of an investment view. While the perma bears were quick to point out that the S&P 500 never reached single-digit territory, there were plenty of solid blue-chip companies that did that the perma bears failed to mention. While the Dow Jones Industrial Average (DOW) reached a PE ratio of 12.19 at the March 2009 low, 24 (80%) of the 30 DOW stocks reached single-digit PE territory. Moreover, 90% of the 30 DOW stocks saw their 21-year PE low occur over the last three years, which is something you only see near secular bear market lows. I find it disingenuous to argue one’s bear thesis of pointing to a lack of single digit PE ratios for the major stock market indexes but fail to point out the abundance of individual stock single-digit PE ratios. Investors over the last three years were presented with valuations at 21-year lows for 90% of the DOW, quite the investment opportunity!

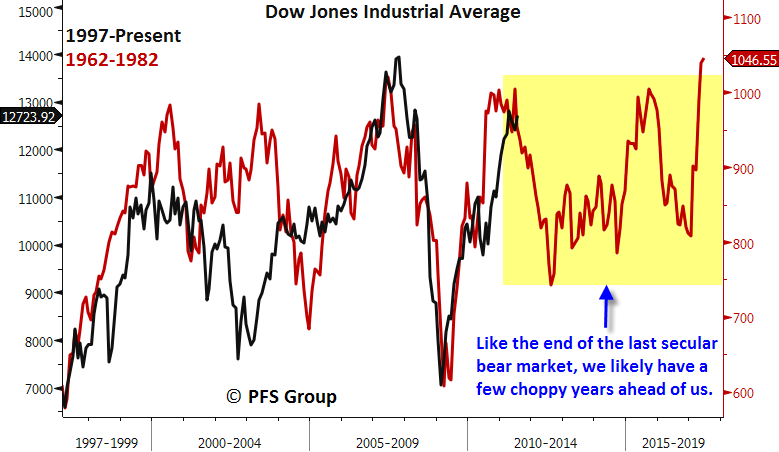

While one can argue about valuations all day long on whether or not they reached secular bear market lows, what can not be argued is price. Secular bear markets are characterized by flat to declining stock markets. If the stock market decisively breaks above its broad trading range from 2000 to the present, the market will be telling us the secular bear market is over and a new secular bull market has begun. Looking at the DOW over the past century shows the present and prior secular bear market in the red boxes. You can see that in the early 1980s the DOW broke out of its trading range and then began one of the most profitable stock market bull runs in history into 2000.

Click here to enlarge

Source: Bloomberg

As I’ve stated previously, I think we still have a few more years left in the current secular bear market where we may have some very choppy market swings into the middle of the decade similar to what the last secular bear market witnessed. While we will likely have at least one more bear market before the next secular bull market begins, I don’t expect the March 2009 lows to be exceeded on the downside in nominal terms just like the 1974 price low was never exceeded in nominal terms. Inflation-adjusted terms is a different story as it is certainly possible the March 2009 lows are taken out just as the 1974 low was taken out in real terms.

Click here to enlarge

Source: Bloomberg

Click here to enlarge

Source: Bloomberg

Using the “missing the trees from the forest” analogy, while the US stock markets may be locked in long trading ranges, stocks are already breaking out from their individual secular bear market trading ranges and some are hitting all-time highs. This highlights that being myopic by focusing solely on the market indexes will cause investors to miss the secular changes beneath the surface, with three examples from the DOW from different sectors shown below.

First up is Chevron Corp. (CVX) which is one of the two energy stocks within the DOW and has the third largest weighting at 6.44%. When looking solely at Chevron’s price over the last twenty years you would be tempted to ask, “What secular bear market?” While it’s true Chevron hit new highs with each bull market it did not escape the valuation compression seen in secular bear markets as its PE high north of 35 in 2000 compressed to a low of 5.01 in late 2008, presenting investors with a great long-term entry point.

Click here to enlarge

Source: Bloomberg

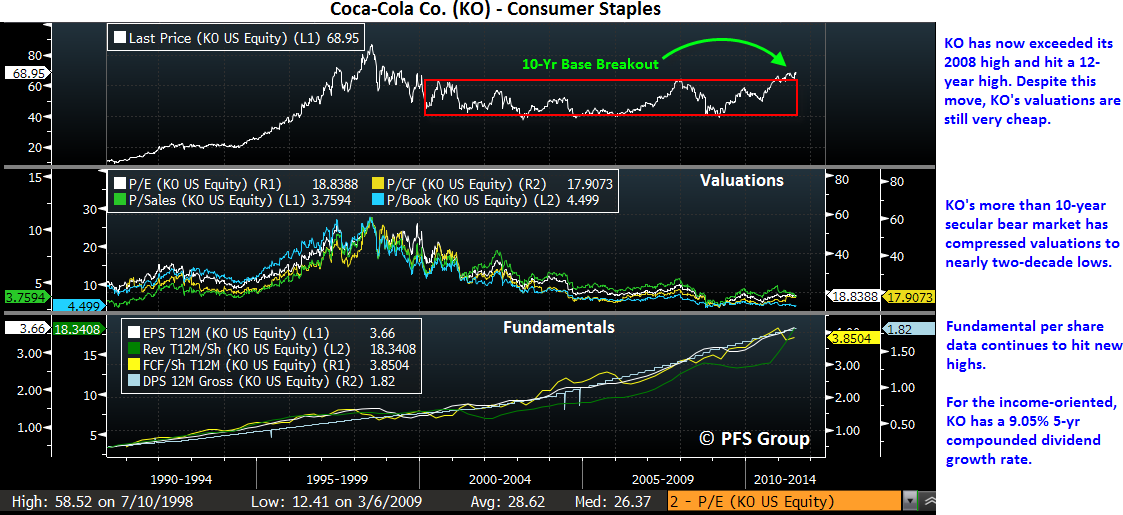

Another example of a stock that experienced a 21-year PE low in 2009 was Coca-Cola (KO). In the second panel below you can see KO’s valuation compression over the last decade which is the result of a flat stock price (top panel) while fundamentals (bottom panel) continued to improve year in and year out. Just as the S&P 500 and DOW broke out of their secular trading ranges in the early 1980s, KO is breaking out from a 10-year base and yet its valuations from a historical perspective are still attractive.

Click here to enlarge

Source: Bloomberg

Chevron illustrates a stock that has escaped the entire secular bear market, Coca-Cola is an example of a DOW stock just breaking out of its secular trading range, and Wal-Mart Stores (WMT) represents a stock still confined to its own secular bear market. Single-digit PE or not, once Wal-Mart breaks out from this long trading range the market will clearly be signaling its secular bear market is over, and it will likely be doing so starting from low valuations and record earnings-per-share, record revenue-per-share, record cash flow-per-share, and record dividends-per-share.

Click here to enlarge

Source: Bloomberg

Since all-time highs are not something characteristic of a secular bear market, it is quite telling that the present secular bear market is becoming long in the tooth given nearly a third of the DOW 30 stocks hit all-time highs this year, a statistic conveniently lost on the perm bear crowd. Just like the appearance of more and more green leaves on a tree signals the transition from winter to spring, so does the occurrence of individual stocks breaking out of their respective secular bear markets and hitting new all-time highs signals the macro secular bear market that began in 2000 is coming to an end and a new secular bull market is in the process of forming. It is this fact that I argue that investors should begin to switch from a secular BEAR market investing philosophy to a secular BULL market investing philosophy.

Next week I will cover what I feel are a few catalysts that will propel the next secular bull market, with the chief among them likely to be the handoff of investment capital from the bond market which has enjoyed nearly a three decade bull market, to the stock market.