The rally since the start of the year has modestly improved the S&P 500’s long term, intermediate term, and short term trend all to a bullish reading as more than 60% of stocks within the S&P 500 have rising moving averages. Also, given that its short-term momentum remains strong (see MACD section below), we are likely to see further improvement in the market’s intermediate term and long term trends.

S&P 500 Trend Strength

* Note: Numbers reflect the percentage of members with rising moving averages; 200d MA is used for long term outlook, 50d MA is used for intermediate outlook, and 20d MA is used for short term outlook.

S&P 500 Member Trend Strength

Breaking out the 500 stocks within the S&P 500 into their respective sectors shows an underlining message of accelerating global growth. Two of the top sectors showing the most bullish trends are the industrials and materials sectors. The other standout is the financial sector which is likely benefitting from a steeper yield curve as that helps boost their interest margin. Overall, we see that the bulk of the stock market is in bullish trends as most of the S&P 500 members are likewise bullish with the most cyclical sectors leading and the defensive sectors (consumer staples, utilities, and telecommunications) lagging.

Market Momentum

The Moving Average Convergence/Divergence (MACD) technical indicator is used to gauge the S&P 500’s momentum, on a daily, weekly, and monthly basis for short, intermediate, and long term momentum evaluation. As seen below, the market still has strong short term momentum as 76% of the 500 members within the S&P 500 have daily MACD BUY signals. A high reading like this was last seen after this summer's lows, and the thrust seen over the last month is now turning the tide for the market’s intermediate and long term momentum as well, as both time frames are now in bullish territory (> 60%).

As seen in the figure below, if we see the market heading higher while the daily MACD % BUYS begins to make a series of lower highs (as was the case leading up to the September 2012 peak), the market will likely be putting in its next top. However, short term momentum remains strong and we are more likely heading higher than lower at this junction.

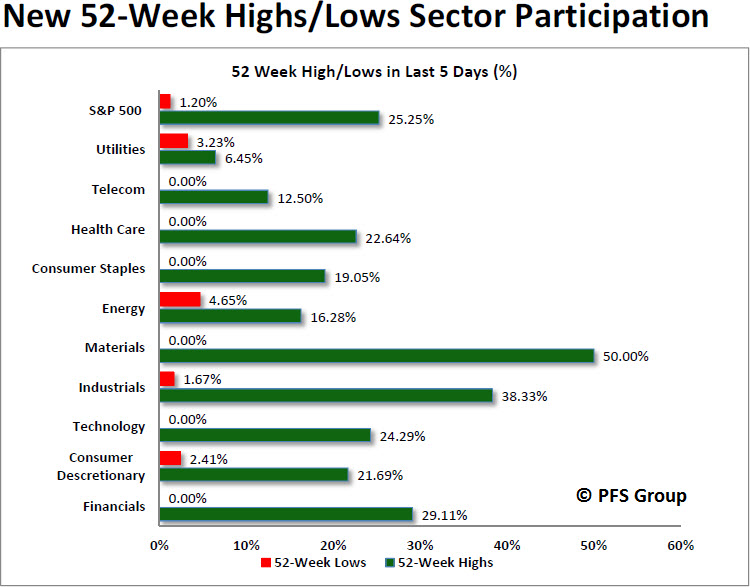

52-Week Highs and Lows Data

We have a well-represented market rally as more than one fourth of the entire S&P 500 hit a 1-year high in the last five days. What is also encouraging is that, like the trend summary above, the two leading sectors are geared towards global growth (materials, industrials) which appears to be accelerating as materials and industrials tend to underperform when global growth slows.

Summary

Over the past month there have been many calls for a coming recession and bear market but the data above does not appear to be supporting this notion. In fact, just the opposite is occurring as the most economically-sensitive groups (industrials, materials) are displaying the strongest breadth and momentum while defensive groups are lagging, not what you would expect heading into an economic contraction. When making a recession or bear market call, it is usually best to take a “weight of the evidence” approach rather than relying on any one indicator.

Currently the markets short term and intermediate term momentum remains strong and will take some time to dissipate, and thus it is likely the market’s short and intermediate trends will likely continue to improve in the days ahead.