The currency markets are the largest financial market in the world, and thus tracking currency movements and spotting inflection points can provide vital clues for how other asset classes will respond. Given the USD’s reserve currency status and that the bulk of global transactions are denominated in dollars, it is crucial to always keep an eye on trends in the USD, particularly for US investors. The USD appears to be in the early stages of breaking down and an intermediate-term selloff would have widespread implications. Typically, weakness in the USD leads to immediate strength in commodities and foreign equities, while also sowing the seeds for future inflation as rising commodity prices and import prices bring about rising inflationary pressures that weaken the economy down the road.

Dollar Pain Is Commodities Gain

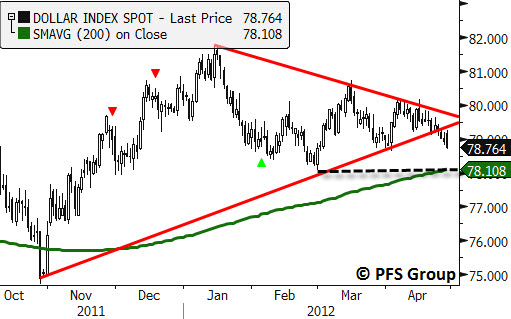

I believe the dollar is setting the stage for a decline based on the price action of the USD Index and the USD’s strength versus other currencies. Shown below is the USD Index over the last six months and a clear triangle can be seen with it breaking to the downside recently and looking set to test both the 200 day simple moving average (200d SMA) and the February low ahead. My guess is that after the USD Index hits the 200d SMA it will get a small relief rally before eventually breaking down further.

What leads me to believe that the USD is set for further weakness ahead is how it is acting on a global basis versus other world currencies. Strong moves in the market are associated with widespread breadth in which the majority of stocks are either advancing or declining. The same is true for currencies in which a strong move in a currency is usually seen by widespread weakness or strength versus other currencies rather than just a few. As shown below, all but three world currencies are up relative to the dollar today (far left column) and over the last five trading days the bulk of foreign currencies have strengthened relative. If the USD was weak relative to only a few currencies I wouldn’t expect the USD to be ready to decline significantly, but widespread weakness where the USD is weak on a global basis is often seen with strong declines.

If the USD is getting ready for an intermediate-term decline, we are likely to see strength in commodities and foreign equities. Shown below is the relationship of the Commodity Research Bureau’s Index and the Chinese Shanghai Composite with the USD Index where the latter is shown on the right axis and inverted for directional similarity. Associated with the USD Index’s recent weakness has been strength in the CRB Index as well as Chinese Equities. Further weakness in the USD is likely to lead to strength in commodity prices and foreign equities in the weeks ahead.

Coinciding with recent widespread weakness in the dollar relative to foreign currencies is widespread strength in gold bullion versus global currencies. Over the last five days (second column from the left below) gold has advanced against every currency and precious metal save the Turkish Lira and today gold is up relative to two thirds of global currencies. As shown in the table below, gold remains strong on a long-term basis where it is up against every single global currency and precious metal over the last year (far right column) and if its short-term strength continues we may see gold’s intermediate trend improve as well.

Weak Dollar Now Leads to Economic Weakness later

What I believe is perhaps the greatest market insight over the last several years was Francois Trahan of Wolfe Trahan who said that the primary factor in driving the business cycle for decades was no longer the federal funds rate, which has been zero-bound, but rather inflation. In the past a rising federal funds rate slowed bank lending and helped cool the economy while lowering the federal funds rate led to banks easing standards and helped stimulate the economy. With the federal funds rate at essentially zero for several years now it is no longer the primary driving force of the business cycle as it once was and yet we have had record volatility in the markets and economy as something else is going on. Francois correctly points out that rising inflation is like a rising federal funds rate that slows economic growth by cutting into corporate profit margins and consumer pocket books while falling inflation rates boost corporate profits and increases discretionary spending power.

With the U.S. economy highly dependent on imports and with commodities priced in dollars, the USD is a key factor in overall inflation trends. As highlighted in the section above, a falling USD is associated with rising commodity prices and import prices and so if the USD is set to decline ahead we can expect commodity prices to rise with their increase feeding into the economy 4-6 months down the road and weighing on economic growth.

While the federal funds rate used to lead overall economic activity, it is inflation now that leads economic activity and with the USD playing a pivotal role in inflation the USD Index provides a good lead time for U.S. economic activity as measured by the ISM Manufacturing Index. Shown below is the USD Index advanced six months relative to the ISM, which has had an excellent forecasting record for future trends in the ISM index. You will notice that the brief weakness in the USD Index in October of 2011 is coinciding with the ISM’s recent weakness over the last month while the USD’s strength from November to January indicates a manufacturing rebound heading into the fall. If the USD Index weakens considerably ahead that likely spells trouble for the economy just before the November elections as commodity inflation would likely be feeding into the economy.

Summary

The USD Index recently broke a triangle consolidation to the downside and this break looks like the real McCoy as the USD is displaying weakness on a global basis relative to foreign currencies. Weakness ahead by the USD will be a tailwind to commodities and foreign equities in the immediate future while acting as an economic headwind in 4-6 months as commodity inflation begins to feed into the economy. This would also coincide with the business cycle’s maturity in which late-stage cyclicals like energy, basic materials, and industrials begin to outperform as they take the reins from early cyclicals like consumer discretionary, financials, and technology to eventually lead to an economic peak in which non-cyclicals such as health care, consumer staples, and utilities outperform.