Here is a post I made to Facebook yesterday.

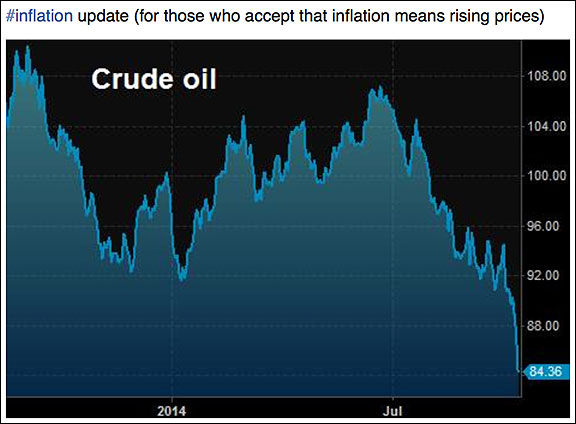

I was making two points. One, virtually all commodities are in falling trends now (except certain foods affected by the government-created drought conditions in California). Two, it has nothing to do with the money supply.

Some comments on the thread reminded me that most people accept the idea that changes in the money supply lead to changes in prices (though not necessarily evenly or instantaneously). This idea is tempting, convenient, and it seems only “common sense”. However, it is facile.

I decided to write this post to add some context. Since 2008, there has been a massive increase in the money supply. M0 has increased from about 5B to T. It is now 3.5X what it was. M1 went from .4T to .8T, or 2X. M2 went from .8T to .4, or about 1.5X.

Prices haven’t done any such thing. The Bloomberg Commodity Index fell from about 175 to 118 today. In other words, the commodity index is 0.67X what it was.

[Read: Commodity Signals Flashing Red]

How do we explain this? I have offered my theory of interest and prices. To condense 12,000 words into a sentence: rising interest rates and rising prices go together.

Here is a graph of the Bloomberg Commodity Index overlaid with the 10-year U.S. Treasury yield, going back to 1996. The correlation is imperfect, but quite visible.

I would like to share a few additional thoughts about this correlation.

At least as far back as 1897, Knut Wicksell observed it. It is interesting to note that he was a believer in the quantity theory of money, but he was honest enough to recognize when the data did not fit the theory. Here is a quote from his address before the Economic Association of Stockholm on April 14, 1898:

“Logically speaking it does not seem possible to give any other answer to our question…than the following:…the level of commodity prices must depend…on the rate of interest. A low rate of interest must lead to rising prices, and a high rate of interest to falling prices. This is in full agreement with the basic principles of the quantity theory of money… Unfortunately, we are once more faced with the same regrettable circumstance: a lack of correspondence between theory and reality [emphasis added]. If we compare…the wholesale prices in Hamburg…on the one hand and the rate of interest in Berlin…on the other, it must be admitted (if it is possible to discover any connection between them at all) that a high rate of interest is associated with high commodity prices and a low rate of interest with low commodity prices, rather than the other way around…”

Irving Fisher, a monetarist, and promoter of the Quantity Theory of Money, realized that rising prices caused high interest rates and falling prices caused low interest rates. He thought the connection worked in the other direction as well, but didn’t know why.

Gilbert E. Jackson was the first to see the bidirectional linkage between prices and interest. He studied wholesale prices and interest rates in Britain from 1782 to 1947. But he could not give a full theoretical explanation.

Antal E. Fekete was the first to propose the theory that there is normally a positive spread between the marginal time preference of the saver and the marginal productivity of the entrepreneur (also integrating the two major theories of the formation of the interest rate). The market rate of interest can move freely between those two boundaries. However, when government interferes, it can either invert this spread or it can push the market rate of interest outside the boundaries (e.g. when the central bank buys bonds). Then, it sets off a self-perpetuating trend.

I think it’s important to acknowledge that the economy is not stateless. A change in one variable—e.g. money supply—may have a different effect depending on the states of individual actors in the economy. It may even have the opposite effect one time as compared to another.

I like to use the example of a pilot pulling back on the yoke. The layman expects that this will cause the plane to climb. However, if the plane is in a spiraling descent, then it will cause the spiral to tighten, and the plane will auger into the ground if the pilot does not correct.

When you’re saturated in debt, you don’t behave the same way as when you’re unencumbered.

Interest rates have been falling for three decades, with no sign of (nor reason to expect) a reversal. Therefore we should expect a trend of falling commodity prices (consumer prices are more sensitive to labor law, taxes, regulations, and other factors).

The Gold Standard Institute Presents The Gold Standard: Both Good and Necessary, in Manhattan on Nov 1. You are cordially invited to join us for a discussion of ideas you won’t get anywhere else. The gold standard is the monetary system of the free market—of capitalism. Dr. Andy Bernstein, a rock star of the liberty movement, shows why capitalism is good. In my talk, I explain why capitalism is impossible with fiat money, and why we have not recovered from 2008, and we won’t without gold.